TRENTON, NJ – On Tuesday, Governor Phil Murphy released his revised budget proposal for Fiscal Year 2021 that will see $1 billion in new taxes, but he says he doing it to create fairer New Jersey in the COVID-19 rebuilding era.

Republican State Senator Kristin Corrado said Murphy’s plan is not taking New Jersey where it needs to go.

“The budget announced today is proof Governor Murphy is taking New Jersey in the wrong direction,” Corrado said. ““Main Street restaurants and small businesses across the state remain closed by order of the Governor while competitors across the state lines are open for business, serving New Jersey customers and sucking money out of our state.”

For the traditional 12-month fiscal year, decreased revenue collections left the state facing a $5.7 billion shortfall over what was projected during the Governor’s Budget Message in February. The Governor’s proposed budget relies on a series of solutions to help close this gap and protect many shared priorities, which translates to more taxes for residents.

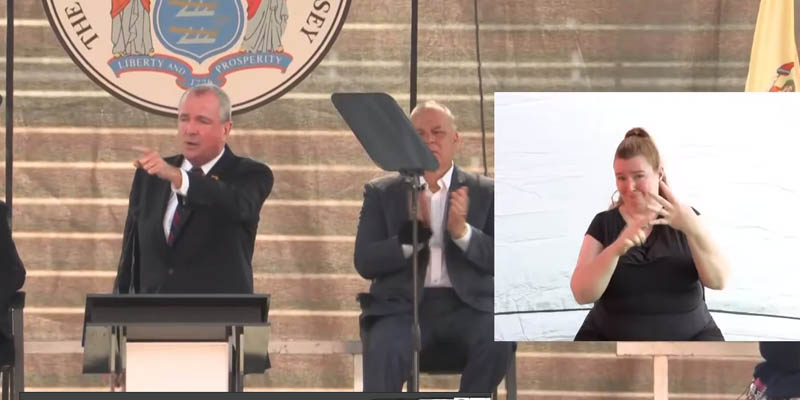

“This budget proposal is not simply about getting New Jersey back to where it used to be, but moving forward to where we need to be by building a new economy that grows our middle class and works for every single family, while asking the wealthiest among us to pay their fair share in taxes,” said Governor Murphy.

Notably, the budget includes a new proposal – advanced at the federal level by Senator Cory Booker and prominent economists – to launch a statewide Baby Bonds initiative, which will provide a $1,000 deposit for the approximately 72,000 babies born in 2021 into families whose income is less than 500 percent of the Federal Poverty Level, or $131,000 for a family of four. When these residents turn 18, they can withdraw these funds to help them pursue higher education, buy a home, start a business, or pursue other wealth-generating activities. This will assist three of four children born in New Jersey.

In addition, the budget invests $60 million into the Clean Water and Drinking Water programs to ensure safe and modern water infrastructure statewide, and increases the Earned Income Tax Credit (EITC) to 40 percent while proposing to expand EITC eligibility to assist tens of thousands more young adults.

The budget also includes a nearly $4.9 billion contribution to bolster the state pension system, which equals 80 percent of the Actuarially Determined Contribution (ADC) and represents the largest percentage of the ADC contributed in 25 years. Additionally, it includes a robust $2.2 billion surplus, which represents 5.59 percent of appropriations over the 12-month period. The Governor is committed to maintaining this surplus to address the very real possibility of another shutdown due to a resurgence of the novel coronavirus.

“The governor has called for higher income taxes, higher business taxes and billions in borrowing, while making no serious spending cuts. That’s unacceptable. Everyone recognizes that the pandemic has created fiscal challenges and unprecedented uncertainties, but the Governor continues to single-handedly dig us into a deeper hole that is leading to a greater generational fiscal mess,” said New Jersey State Senator Anthony Bucco. ““New Jersey cannot and should not be raising taxes with the fourth highest unemployment rate in America and one of the largest debt burdens of any state. This is why it’s so critical to have a check-and-balance on Democrat tax-and-spend policies that year after year make it increasingly difficult to afford to live here.”

“The governor has called for higher income taxes, higher business taxes and billions in borrowing, while making no serious spending cuts. That’s unacceptable. Everyone recognizes that the pandemic has created fiscal challenges and unprecedented uncertainties, but the Governor continues to single-handedly dig us into a deeper hole that is leading to a greater generational fiscal mess,” Bucco added. “New Jersey cannot and should not be raising taxes with the fourth highest unemployment rate in America and one of the largest debt burdens of any state. This is why it’s so critical to have a check-and-balance on Democrat tax-and-spend policies that year after year make it increasingly difficult to afford to live here.”

Murphy launches millionaires’ tax, limo tax, business tax and a boat tax. He also announced a $1,000 baby bond, a plan proposed federally by failed U.S. Presidential candidate Cory Booker. Under that plan, any baby born to families making a combined income of less than $130,000 would have an account created for that child to pay for college, hoping the $1,000 will have accumulated into a much larger amount in 18 years.