Damian Williams, the United States Attorney for the Southern District of New York, announced that defendant ARIFUL HAQUE pleaded guilty today to participating in a conspiracy that exploited victims, including elderly victims, by remotely accessing their computers and convincing victims to pay for computer support services they did not need, and which were never actually provided. HAQUE registered a purported technical support company, which defrauded more than 100 victims. HAQUE pleaded guilty to conspiracy to commit wire fraud before U.S. District Judge Paul A. Crotty, to whom his case is assigned.

U.S. Attorney Damian Williams said: “As he admitted today, Ariful Haque participated in a conspiracy that caused pop-up windows to appear on victims’ computers—pop-up windows that claimed, falsely, that a virus had infected the victim’s computer. Through this and other misrepresentations, this fraud scheme deceived scores of victims, including some of society’s most vulnerable members, into paying hundreds of thousands of dollars to the perpetrators. Thanks to our partners at Homeland Security Investigations, Haque now awaits sentencing for his crime.”

According to the allegations contained in the Superseding Information, court filings, and statements made during plea proceedings:

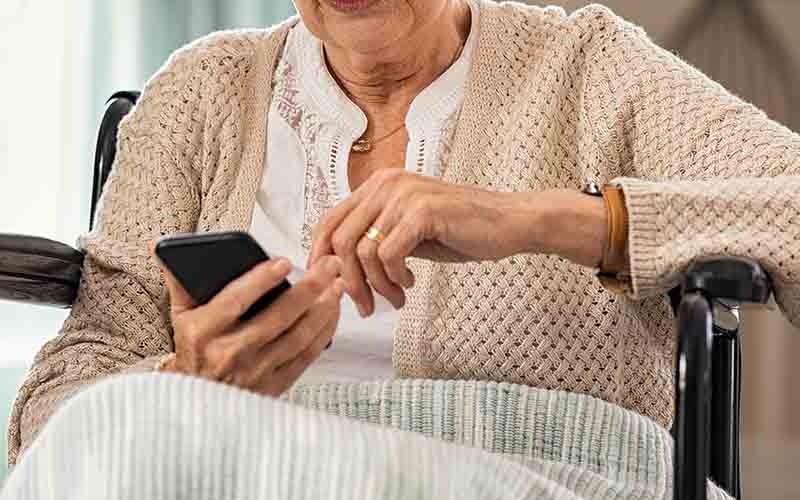

From approximately November 2017 through June 2019, HAQUE was a member of a criminal fraud ring (the “Fraud Ring”) based in the United States and India that committed a technical support fraud scheme that exploited score of victims located across the United States and Canada, including in the Southern District of New York. The Fraud Ring’s primary objective was to trick victims into believing that their computers were infected with malware, in order to deceive them into paying hundreds or thousands of dollars for phony computer repair services.

The scheme generally worked as follows. First, the Fraud Ring caused pop-up windows to appear on victims’ computers. The pop-up windows claimed, falsely, that a virus had infected the victim’s computer. The pop-up window directed the victim to call a particular telephone number to obtain technical support. In at least some instances, the pop-up window threatened victims that, if they restarted or shut down their computer, it could “cause serious damage to the system,” including “complete data loss.” In an attempt to give the false appearance of legitimacy, in some instances the pop-up window included, without authorization, the corporate logo of a well-known, legitimate technology company. In fact, no virus had infected victims’ computers, and the technical support phone numbers were not associated with the legitimate technology company. Rather, these representations were false and were designed to trick victims into paying the Fraud Ring to “fix” a problem that did not exist. And while the purported “virus” was a hoax, the pop-up window itself did cause various victims’ computers to completely “freeze,” thereby preventing these victims from accessing the data and files in their computer—which caused some victims to call the phone number listed on the pop-up window. In exchange for victims’ payment of several hundred or thousand dollars (depending on the precise “service” victims purchased), the purported technician remotely accessed the victim’s computer and ran an anti-virus tool, which is free and available on the Internet. The Fraud Ring also re-victimized various victims, after they had made payments to purportedly “fix” their tech problems.

The Fraud Ring operated through at least 15 fraudulent entities. In November 2017, HAQUE registered one of these fraudulent entities in New York State. HAQUE’s entity defrauded more than approximately 100 victims as part of this scheme. As part of his involvement in the scheme, HAQUE opened U.S. bank accounts to receive funds from victims, and HAQUE repeatedly provided a co-conspirator in India (“CC-1”) with authentication codes so that CC-1 could wire funds out of these bank accounts. HAQUE, a former bank branch manager in New York City, also made suggestions to CC-1 about which victim checks should, and should not, be deposited, noting in messages that it was “Not a good idea to deposit” certain specified checks. HAQUE also assisted another co-conspirator (“CC-2”), who had registered a different fraudulent entity that was part of the Fraud Ring, as well. In total, as he admitted in his plea agreement, HAQUE is responsible for losses exceeding $600,000.

* * *

HAQUE, 36, of Queens, New York, pled guilty to one count of conspiracy to commit wire fraud, which carries a maximum penalty of five years in prison. The statutory maximum sentence is prescribed by Congress and is provided here for informational purposes only, as HAQUE’s sentence will be determined by the judge. HAQUE’s sentencing is scheduled for May 4, 2022 at 12:00 p.m. before Judge Crotty.

Mr. Williams praised the New York Office of U.S. Immigration and Customs Enforcement’s Homeland Security Investigations (“HSI”)’s El Dorado Task Force, Cyber Intrusion/Cyber Fraud Group for its outstanding work on the investigation. Mr. Williams also thanked the New York City Police Department for its assistance on this case.

This matter is being handled by the Office’s Complex Frauds and Cybercrime Unit. Assistant United States Attorneys Michael D. Neff and Jilan J. Kamal are in charge of the prosecution.

Click here for information on the investigation into the Mount Vernon Police Department

This Office was one of the districts affected by the SolarWinds intrusion.

Please click here for further information.

Public Service Announcement on Sexual Assault in Public Housing

Giving back to the community through a variety of venues & initiatives.

Making sure that victims of federal crimes are treated with compassion, fairness and respect.

One St. Andrews Plaza – New York, NY 10007