MADRID -Mexican billionaire Carlos Slim’s Spanish construction firm FCC on Wednesday launched a tender offer for a 24% stake in real estate developer Metrovacesa, a FCC filing to the local stock market regulator showed.

Through the purchase, worth 284 million euros ($312.29 million), FCC would raise its stake in Metrovacesa which stands at 5.4% currently. The real estate firm is largely owned by Spanish banks Santander and BBVA.

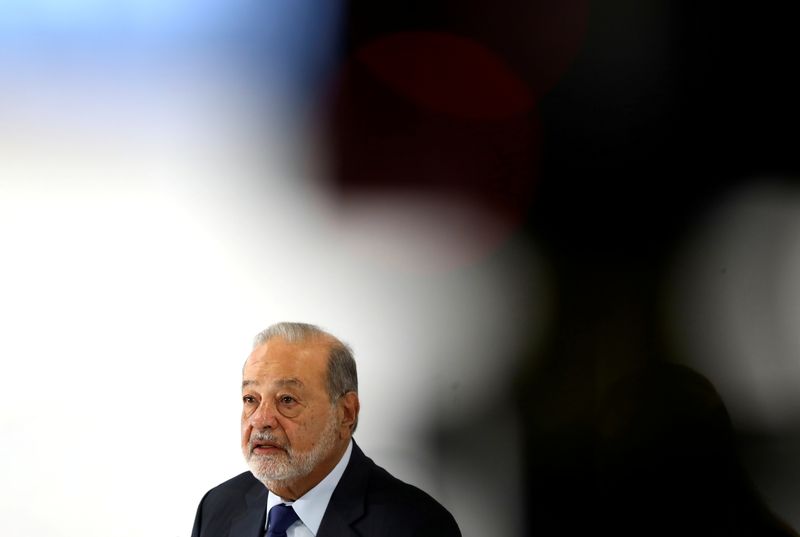

Slim, whose net worth has been estimated at $62 billion by Forbes magazine, has been betting on Spanish real estate and infrastructure after the financial crisis brought both industries to their knees.

Through his holding company Inversora de Carso, the billionaire also controls real estate developer Realia.

Metrovacesa shares jumped 16% on Wednesday morning to 7.51 euros, just below the 7.8 euros offered by FCC.

The offer price represents a 20% premium over Tuesday’s closing price, Spanish lender Bankinter said in a note to clients. Shares in Metrovacesa’s rivals may also rise on Slim’s move, Bankinter added.

Santander and BBVA, which together own about 70% of Metrovacesa according to Refinitiv Eikon data, are unlikely to sell at 7.8 euros, JBCapital analyst David Gandoy said in a report.

“Consequently, we see this partial bid as a financial investment aimed at taking advantage of the current market conditions,” he added.

“As we always do, we will analyse the offer and decide what is best for our shareholders,” a BBVA spokesperson said, adding the offer price was in line with the valuation on the bank’s books.

Santander declined to comment.

($1 = 0.9094 euros)

(Reporting by Corina Pons and Jesus Aguado, editing by Louise Heavens and Jason Neely)