By Akash Sriram and Divya Rajagopal

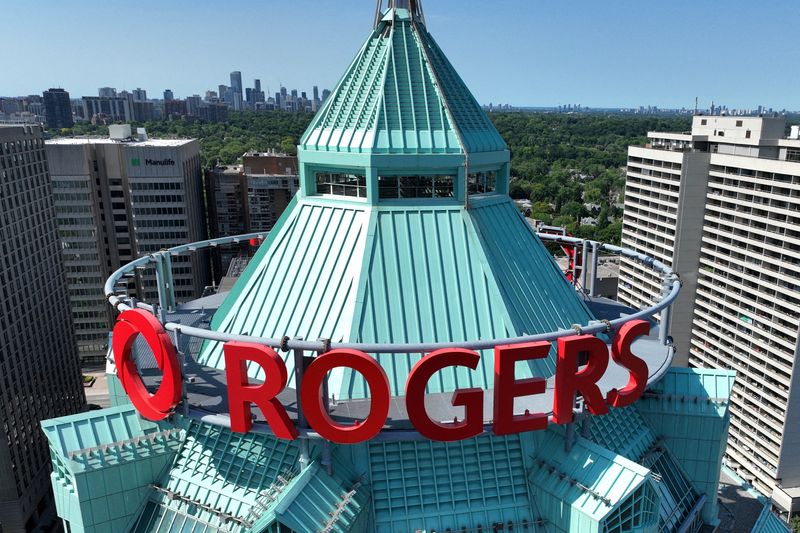

(Reuters) – Rogers Communications Inc extended the deadline to close its C$20 billion ($15.6 billion) buyout of rival Shaw Communications to December and said it would take a hit due to an outage that impacted millions of customers earlier this month.

The company will look at bank financing or raise funds through capital markets to fund the deal if the closure extends beyond Dec. 31 as it has a mandatory redemption provision on its senior notes worth C$12.01 billion plus accrued interest if the transaction does not close by end of December.

William Densmore, senior director, Corporates at Fitch Ratings said every 1% increase in the average cost of the new newly issued debt due to refinancing would add around C$130 million in interest cost.

The purchase of Shaw has been in the crosshairs of Canada’s antitrust agency, which said last week it needs more time to examine the concession offered to allay competition concerns over the deal.

Rogers said on Wednesday it has an option to further delay to deal to end-January after Dec. 31 deadline.

The Canadian telecom giant has come under increased pressure since the outage on July 8 that paralyzed the country’s banking and emergency services for nearly 19 hours.

The company expects to record C$150 million in costs in the third quarter as it credits customers with the equivalent of five days service, lower than the C$175 million estimates from J.P. Morgan and TD Securities.

For the three months ended June 30, the company reported a profit and revenue that were better than market expectations, thanks to a jump in wireless subscribers and strong demand for its internet services.

Rogers added 122,000 monthly bill paying wireless subscribers in the second quarter, compared with 66,000 net additions in the previous three months, as its efforts to expand 5G coverage helped attract more customers.

Its cable unit – which includes internet, phone and cloud-based services – posted a 3% rise in revenue.

Total revenue rose to C$3.87 billion, compared with the C$3.8 billion expected by analysts, according to Refinitiv IBES data. Adjusted net income was 86 Canadian cents per share, higher than estimates of 85 Canadian cents.

Rogers shares were up 1% by afternoon, in-line with the gains in the benchmark Toronto share index.

($1 = 1.2852 Canadian dollars)

(Reporting by Akash Sriram in Bengaluru; Editing by Aditya Soni and Marguerita Choy)