By Lindsay Dunsmuir

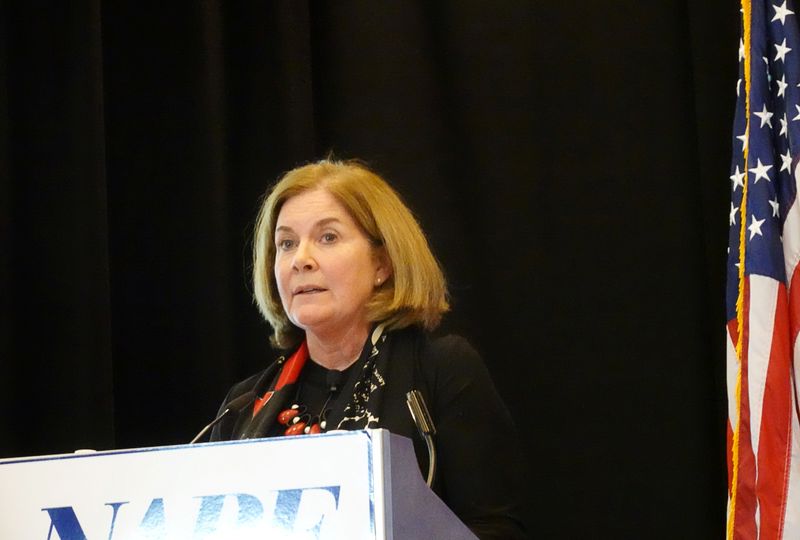

(Reuters) – The Federal Reserve should more slowly and steadily raise interest rates to allow time for its policy actions to seep through the economy and minimize market volatility, Kansas City Fed President Esther George said on Friday.

“I have been in the camp of steadier and slower to begin to see how those effects from the lag will unfold,” George said during an event organized by S&P Global Ratings. “The full effect on the real economy is likely still playing out.”

She added that while she supports ongoing rates increases, including the possibly that rates will need to go higher and stay longer at their peak than previously thought, they need to be paced in a balanced way.

“These large moves in the policy rate are likely to increase uncertainty around future policy actions…to the extent we can minimize this policy uncertainty during a time of heightened market volatility I think is particularly important,” George added.

The U.S. central bank has raised interest rates at the fastest pace since the 1980s as it seeks to puncture inflation running at a 40-year high, with its key policy rate having risen from near zero in March to a current target range of 3.00 to 3.25%.

At least another 75 basis point move is expected at the conclusion of the Fed’s next policy meeting on Nov. 1-2 with further tightening in the pipeline as policymakers cool demand across the economy.

So far there are few major signs the current level of interest rates is doing enough to quash an inflation rate running more than three times the Fed’s 2% goal.

A hotter-than-expected key inflation reading on Thursday caused already fearful investors to price in more interest rate hikes than the Fed has itself projected, amid mounting concern only a recession will bring supply and demand into better balance.

(Reporting by Lindsay Dunsmuir; Editing by Chizu Nomiyama)