By Casey Hall, Martin Quin Pollard and Joe Cash

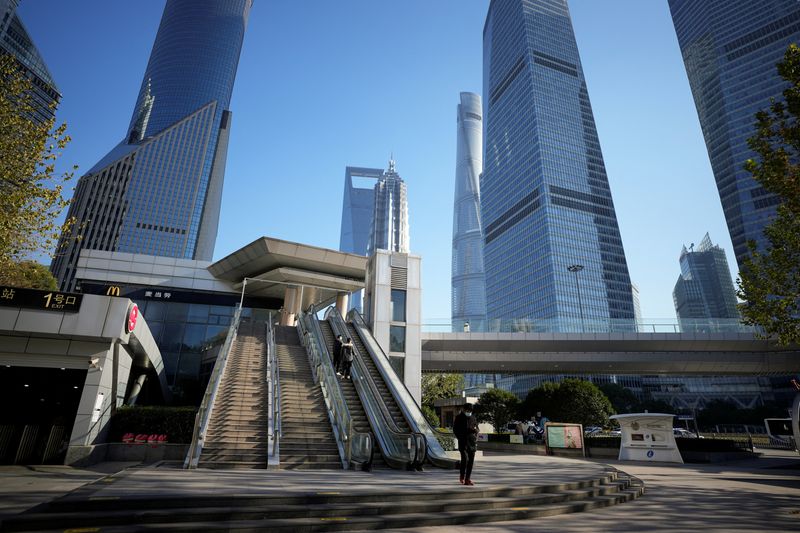

SHANGHAI/BEIJING (Reuters) – As China’s massive wave of COVID-19 infections begins its march across a country roughly the size of Europe, the ripple effect on business is accelerating.

From its original epicentre in the north, including the capital Beijing, COVID-19 infections are spreading throughout the country and cases are impeding workforces in manufacturing belts, including the Yangtze River Delta, near Shanghai.

Retail and financial services businesses have been hard hit by a shortage of staff, with manufacturers not far behind, according to an international business organisation operating in China.

“The retail and client facing sectors are in deep trouble. Obviously, they have limited staff that are available to work because of illness, so many of our large-scale retailers are not even opening their doors,” said Noah Fraser, managing director at the Canada-China Business Council.

With mass testing halted after China abruptly dropped its zero-COVID policy this month, official data no longer reliably captures new case numbers. As of Wednesday, the country has reported only 5,241 COVID-19 fatalities since the pandemic began.

Some estimates, however, predict the wave currently sweeping the country could infect up to 60% of China’s 1.4 billion-strong population.

“The case counts are starting to creep up outside of the big cities which, of course, means the virus is moving, and we’re going to see further disruption down the line,” Fraser said.

Even before COVID-19 infections began hampering companies in China, the world’s second-largest economy was already depressed by its efforts to stamp out infections, as tight movement controls and repeated lockdowns hampered consumption and production.

China’s factory output and retail sales clocked their worst readings in six months in November, prior to the lifting of the majority of COVID curbs at the start of December.

Retail sales fell 5.9% on year amid broad-based weakness in the services sector, while automobile production slumped 9.9%, swinging from an 8.6% gain in October.

LOGISTICS LOGJAM

Leading automobile chipmaker, Renesas Electronics Corp suspended production at its Beijing plant last Friday due to COVID-19 infections, but said it would re-open Tuesday.

“In a couple of cases companies have shut down either totally their plants or have reduced some of the production,” President of the European Union Chamber of Commerce in China Joerg Wuttke said.

China’s “closed loop” system, where employees are isolated from the wider world, and which had been relied on by many factories in China throughout the zero-COVID era, was beginning to fall apart as infections creep into workforces, Wuttke added.

“You have to prepare your people to shut it down before they have this fever, which basically clouds their judgment if they are at the machinery, for example.”

A senior executive at a large automotive manufacturer said keeping workers with specialist skills on the factory floor amid a surge in cases was just one of the issues they face.

“If the truck drivers have problems, then goods cannot be delivered to factories, the factories cannot move cars to the shops, and the whole industry chain is affected,” he said.

A senior manager, working in the heavy duty truck sector, said dealers he spoke to were either already infected, or caring for sick family members.

“Basically, everything has stalled and you cannot make any actual business,” he said. Both executives declined to be identified as they are not authorised to speak to media.

China’s position as a key cog in the global supply chain, as well as a major driver of sales for many global consumer goods companies, means further hits to production output and consumer demand will be felt far beyond its borders.

Shanghai’s extended lockdown in April and May caused disruption to the supply chains of multinationals including Apple, Tesla, Adidas and Estée Lauder.

For now, however, that impact is being limited in part by economic hardships elsewhere in the world denting demand for products from China.

“Reduced demand in the U.S. and Europe for consumer goods probably hides some of the impact,” said Jonathan Chitayat, the Asia boss of Shanghai-based Genimex Group, a contract manufacturer for a range of consumer products.

Working in manufacturers’ favour as an increasing percentage of the workforce are hit by infections in coming months is the Lunar New Year holiday, where many factories shut for at least a month as workers travel back to their home towns.

Even though the worst effects of the wave are still to emerge, some businesses in China remain relatively upbeat about the future, once the initial wave of infections subsides.

“Most of my clients are up to their eyeballs in debt right now, so all of them are gonna be out trying to entertain people and trying to push deals through,” said Dillon King, co-founder of an import-based food and beverage company.

“I’m optimistic for this year coming up, but definitely feeling the pain of the last few weeks for sure.”

(Reporting by Casey Hall in Shanghai, Joe Cash and Martin Quin Pollard in Beijing; Editing by Anne Marie Roantree and Jacqueline Wong)