Biden Admin Rethinks Signature Climate Policy After Major Blowback: REPORT

John Hugh DeMastri on February 3, 2023

The U.S. Securities and Exchange Commission (SEC) is planning to scale back proposed rules mandating that companies disclose climate-related data alongside traditional financial reporting, after the agency was surprised by major blowback from affected groups, The Wall Street Journal reported Friday, citing people close to the agency.

The proposed rules, announced in March 2022, would require companies to include data about both the way climate change might harm their business and the affect that their business might have on the environment via greenhouse gas emissions, according to the SEC. However, the plan was criticized by companies, investors and lawmakers for implementing onerous reporting rules, and even the pared down regulations are expected to face legal challenges, the WSJ reported.

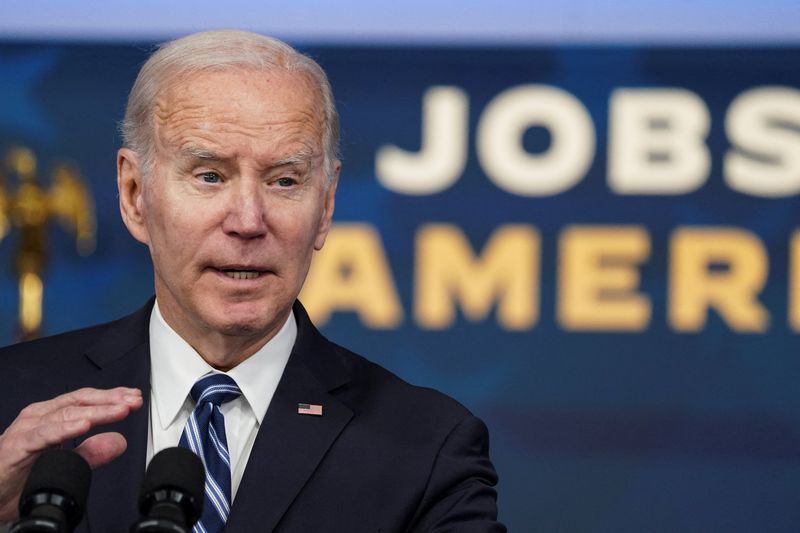

The finalized version of the rules will likely require some climate disclosures, but would raise the threshold for climate costs that companies are obligated to report, the WSJ reported. While President Joe Biden will have difficulty pushing new climate legislation now that Republicans narrowly control the House of Representatives, the proposed climate rules are considered to be one of SEC Chair Gary Gensler’s signature policies.

While some companies view the rules as little more than simple transparency targets that they already report, others have argued that the new rules would require significant investment in accounting experts that could help their companies report this data, Reuters reported. Amazon has criticized the rules for being “extremely difficult, if not impossible” to fulfill because reporting on damages done to the climate by business and vice versa are inherently subjective endeavors, the WSJ reported.

The world’s largest asset manager, BlackRock, has also pushed back on the rules, arguing that they would result in “highly inaccurate disclosures” and create “burdensome compliance costs,” the WSJ reported. BlackRock has been an outspoken advocate for making environmental, social and governance (ESG) considerations when investing, clashing frequently with Republicans, and more recently with Democrats, over its commitment to the issue.

Gensler has faced bipartisan criticism for his agency’s oversight of cryptocurrency exchange FTX, according to Fortune. FTX collapsed in November, filing bankruptcy amid allegations that founder and CEO Sam Bankman-Fried stole billions from the exchange’s clients, allegations for which he now faces a range of charges from both federal prosecutors and the SEC.

The SEC declined to comment for this story.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact [email protected].