NEW YORK (Reuters) – JPMorgan Chase & Co bankers continued to have meetings with the sex offender Jeffrey Epstein even after the bank decided to close his accounts in 2013, the Wall Street Journal reported on Friday, citing people familiar with the matter.

The banker Justin Nelson had about a half-dozen meetings at Epstein’s townhouse between 2014 and 2017, the newspaper said.

Bank employees also met with Epstein after his accounts were closed to discuss other clients and introductions he could make to potential clients, the newspaper said, citing people familiar with the meetings.

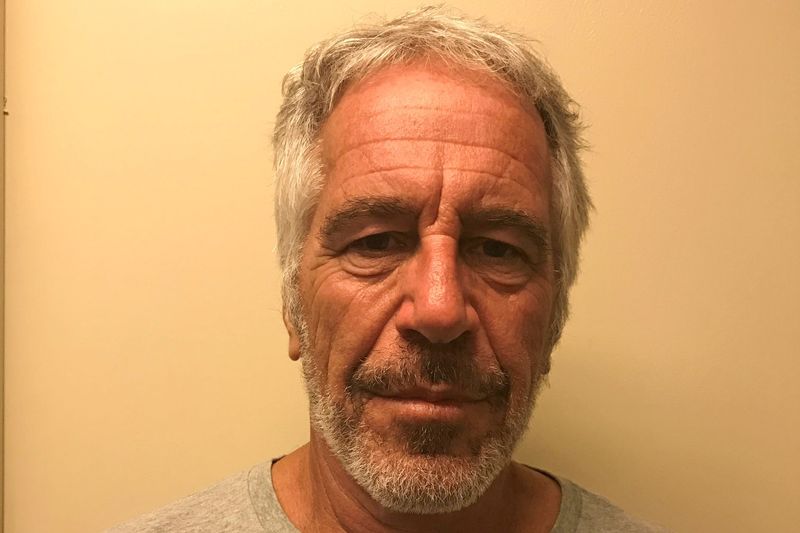

Epstein, a well-connected money manager dogged for years by allegations that he sexually abused girls and young women, killed himself in a Manhattan jail cell in August 2019 while awaiting trial on sex trafficking charges.

While still a client of JPMorgan, Epstein met in 2011 and 2013 with Mary Erdoes, who is now CEO of the bank’s asset and wealth management unit, and in 2013 with John Duffy, who ran JPMorgan’s U.S. private bank, the newspaper said.

JPMorgan has denied knowledge of Epstein’s crimes and is suing former executive Jes Staley for misleading it about Epstein’s conduct.

The interaction with Epstein was typical for a client of the private bank, a JPMorgan spokesman said after the article was published.

Erdoes’ first meeting with Epstein involved settling a lawsuit he had filed against Bear Stearns, and any of the bank’s meetings with Epstein after 2013 were requested by clients who used Epstein as an adviser, the spokesman said. JPMorgan bought Bear during the 2008 financial crisis.

Nelson declined to comment via the spokesman. Duffy and Staley’s lawyers did not reply immediately to separate requests for comment.

JPMorgan is being sued in Manhattan federal court by women who said Epstein sexually abused them, and by the government of the U.S. Virgin Islands, where Epstein owned a private island.

JPMorgan did business with Epstein as early as 1998, and managed about 55 Epstein-related accounts worth hundreds of millions of dollars.

According to court papers, compliance staff and executives on several occasions flagged the risks of keeping Epstein as a client, including his alleged use of cash to pay for girls and young women to go to his homes.

Epstein was a client for about five years after he pleaded guilty in 2008 to a Florida state prostitution charge.

(Reporting by Tatiana Bautzer in New York; Editing by Lananh Nguyen and Rosalba O’Brien)