By Khalid Abdelaziz

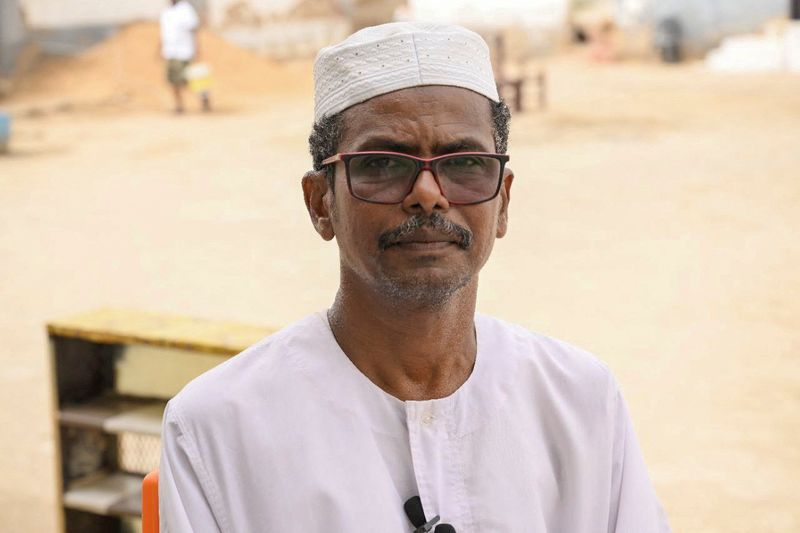

PORT SUDAN (Reuters) – Elsafi Mahdi was separated from his wife and three younger children on June 1 near Sudan’s border with Egypt. He does not know when he’ll see them again.

Like many families fleeing the war in the capital Khartoum, Mahdi, a prominent music teacher and conductor, left home without a visa required for entry to Egypt.

His elder sons aged 19 and 17 needed their passports renewed, a task that became impossible as the conflict paralysed central government offices.

Mahdi and the two elder boys turned back to Port Sudan on the Red Sea coast, while the rest of the family headed north to Cairo.

“I’m so close to my young children, they did not accept the idea,” said Mahdi, whose family decided to leave Bahri, part of Sudan’s wider capital, after hearing heavy air strikes from their home.

“I was telling them that I will join them in two or three days in Egypt, but I knew it was not easy and that it would take a very long time.”

More than 2.5 million people have been uprooted by the conflict between Sudan’s army and the paramilitary Rapid Support Forces (RSF) that erupted on April 15, including an estimated 600,000 who have crossed into neighbouring states.

Over 250,000 have crossed into Egypt, which on June 10 began requiring that all Sudanese obtain entry visas.

Previously, only men aged 16-50 needed visas, meaning that many women, children and elderly crossed while men stayed behind in the northern Sudanese town of Wadi Halfa waiting for days or weeks to apply for visas at the Egyptian consulate.

On June 13, the United Nations said about 12,000 displaced families were staying in Wadi Halfa. Witnesses say some of those who reached the town have recently retreated to larger towns and cities in northern Sudan, hoping for a change in rules that would allow easier access for refugees.

LIVING IN TENTS

Women and elderly displaced people have been held up by the new visa rules. Saadia Abdullah, an 80-year-old with chronic health problems, said she left Khartoum before they were imposed.

“They cannot prevent us from entering Egypt. I am ill, and there is no treatment in Sudan,” she told Reuters by phone from Wadi Halfa last week, before travelling nearly 900km to Kassala city in eastern Sudan to wait for another chance to cross.

Egypt says it brought in the new visa rules in response to “illegal activities”. The foreign ministry did not respond to a request for comment on what such activities were and how they related to women, children and the elderly.

The United Nations has appealed to Sudan’s neighbours to keep their borders open.

The U.N. World Food Programme said this week it had opened a humanitarian corridor to deliver food from southern Egypt to Wadi Halfa.

Some of those still camping out in Wadi Halfa are hoping to catch up with family in Egypt, including Nader Ismail, a 48-year-old who said he had been there with his eldest son for six weeks.

“We live in tents and in difficult conditions with the temperature rising,” said Ismail. “My only hope is to get a visa so we can live as a single family again.”

Suheir Siddig Ali, Mahdi’s wife, said at the time she crossed into Egypt with her three younger children after a long and difficult journey that it was the only country open to them.

Now, she said, all they can do is wait until the rest of the family can join them.

“We talk to them daily on the phone,” she said. “But it is not easy.”

(Reporting by Khalid Abdelaziz in Dubai, Ibrahim Mohamed Ishak in Port Sudan, and Sherif Fahmy in Cairo; Writing by Aidan Lewis; Editing by Hugh Lawson)