TOMS RIVER, NJ – Township officials continue to tell residents year after year their property taxes won’t be going up, but the fact is, if you live in Toms River, your taxes have risen 16% over the past five years.

Toms River is a growing town and has seen a growth spurt over the past five years, particularly in the township’s northern section. A report today by the Asbury Park Press shows that property taxes in the township have risen by 16% in the past five years.

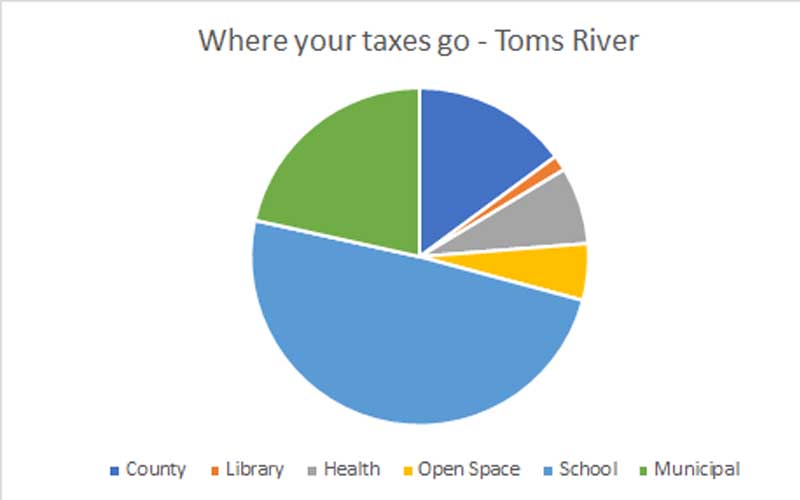

In Toms River, most of your property tax bill goes toward public school funding, followed by municipal taxes.

This year, at the municipal level, Mayor Mo Hill introduced a budget that increases spending township wide with a budget of $88.9 million, up from $88.5 million in 2022, but is promising a 0% tax rate increase.

A recent tax re-evaluation performed by the Hill administration sent property taxes soaring along the waterfront in some senior communities, some by as much as 50%.

Hill introduced his 2023 budget to the public last week, which was approved in a 5-2 vote. Councilmen Dan Rockrick and Justin Lamb voted no.

Ad: Save every day with Amazon Deals: Check out today's daily deals on Amazon.

Rodrick claimed Hill’s zero increase predicts a $4 million increase in ‘miscellaneous revenue’, and Rodrick questioned where that revenue would come from.

Last year, the township budget called for $27.4 million in miscellaneous revenue. This year, an election year, Hill is anticipating $31 million.

Rodrick accused Hill of using a tax budgeting gimmick to keep taxes flat but said the town could come up short in the end.

“So all this budget is doing is kicking the can down the road,” Rodrick said during the meeting.

Hill criticized his election opponent saying he didn’t know how two councilmen could vote no on a 0% tax increase.

Rodrick said he doesn’t see where Mo Hill will be generating an additional $4,000,000 in new revenue in 2023 and said it’s nothing more than smoke and mirrors to deceive the public during an election year.