By Julie Ingwersen

CHICAGO (Reuters) -U.S. wheat futures jumped 6%, hitting a two-week high, and corn rose 1.6% on Monday as Russia’s withdrawal from a Black Sea export agreement raised concerns over global supplies.

Soybeans followed the trend, with the most-active January contract setting a one-month top.

Chicago Board of Trade December wheat settled up 53 cents at $8.82-1/4 per bushel after reaching $8.93-1/4, the contract’s highest since Oct. 14.

Benchmark CBOT wheat futures hit a record high of $13.63-1/2 a bushel in March.

CBOT December corn ended up 10-3/4 cents at $6.91-1/2 a bushel and January soybeans finished up 19-1/4 cents at $14.19-1/2 a bushel.

Ad: Save every day with Amazon Deals: Check out today's daily deals on Amazon.

“The grain and oilseed markets rose sharply overnight, led by wheat, as food shortage fears rise again after Russia pulls out of the Black Sea trade agreement,” StoneX chief commodities economist Arlan Suderman said in a client note.

Moscow suspended its participation in the Black Sea deal on Saturday in response to what it called a major Ukrainian drone attack on its fleet in Russia-annexed Crimea.

Ships carrying grain sailed from Ukrainian ports on Monday, suggesting Moscow had stopped short of reimposing a blockade.

But shipments could be interrupted again, not least if insurers stop underwriting them. Lloyd’s of London insurer Ascot is suspending writing cover for new shipments using the Ukrainian grains corridor in the Black Sea until it has more clarity about the situation there, a senior official said.

Russia’s moves overshadowed market pressure from a firmer dollar, which tends to make U.S. grains less competitive globally, and hedge-related pressure from the ongoing Midwest harvest.

After the close of the CBOT, the U.S. Department of Agriculture rated 28% of the newly-seeded U.S. winter wheat crop in good to excellent condition, below analyst expectations and the lowest for this time of year in USDA records dating to 1987.

The USDA said the U.S. soybean harvest was 88% complete, ahead of the five-year average of 78%, and the corn harvest was 76% complete, ahead of the five-year average of 64%.

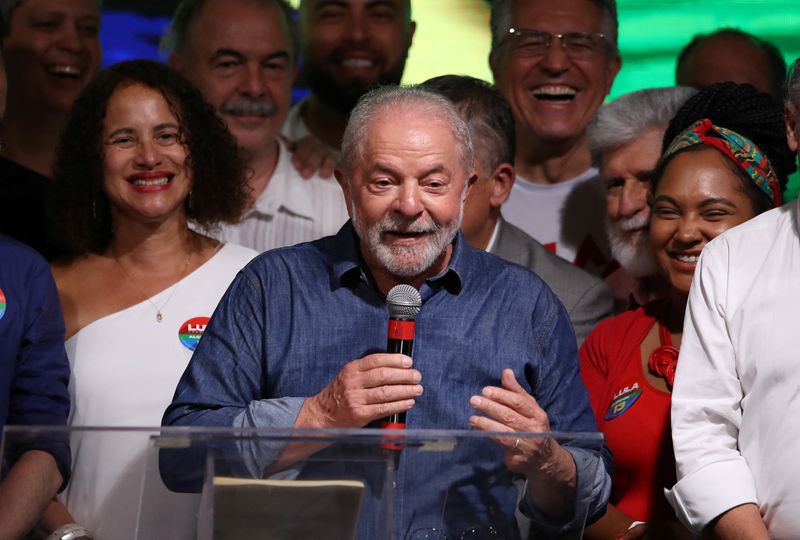

In South America, roadblocks in at least 12 Brazilian states by truckers who support outgoing President Jair Bolsonaro could affect agricultural exports in one of the world’s top food producers, according to the head of a key state farm lobby.

(Additional reporting by Naveen Thukral in Singapore and Sybille de La Hamaide in Paris; editing by David Evans and Leslie Adler)