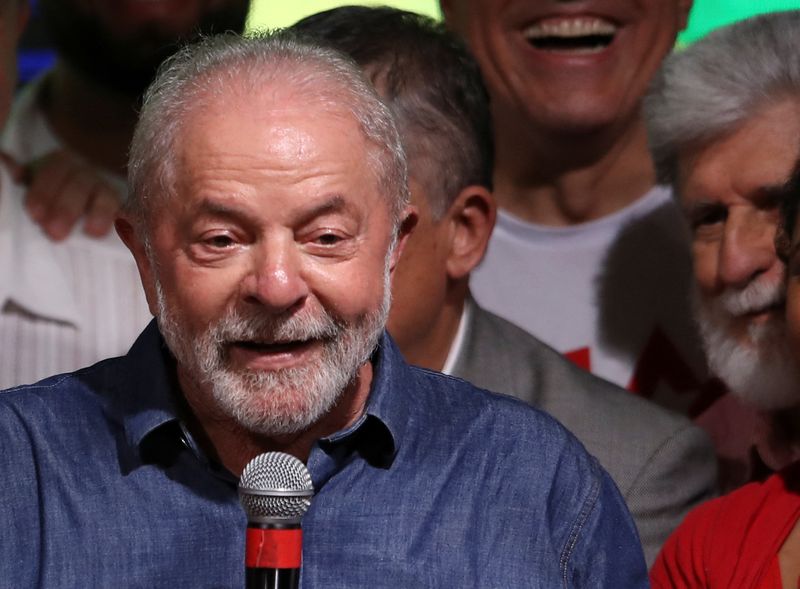

WASHINGTON (Reuters) – The election in Brazil that saw leftist Luiz Inacio Lula da Silva elected for a third term as president reinforce trust in the country’s democratic institutions, U.S. State Department spokesperson Ned Price said on Monday.

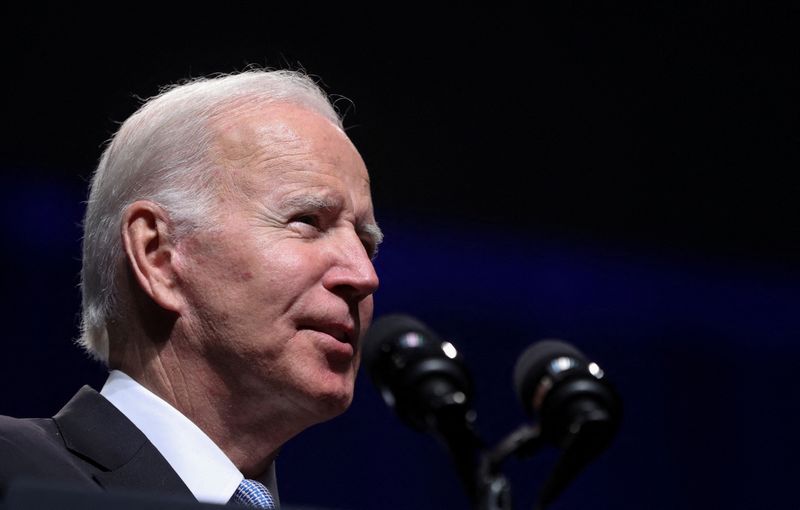

Price said figures from across Brazil’s political spectrum had expressed respect for the outcome of Sunday’s vote, when asked whether he was concerned that incumbent President Jair Bolsonaro had not commented on the results.

“The vote reinforces our trust in the strength of Brazil’s democratic institutions, which perform their constitutional roles in a free and fair election conducted with transparency,” Price said.

“A hallmark of every democracy is acceptance of the will of the people as expressed through elections, followed by a peaceful transfer of power – that’s what the world will expect and what we anticipate they will see in the coming weeks,” he added.

(Reporting by Humeyra Pamuk and Simon Lewis)