JACKSONVILLE, FL – ARLINGTON – The Jacksonville Sheriff’s Department is seeking your assistance in identifying the suspect in the photos who stole a car on August 1, 2022 at approximately 8:30am from the 1000 block of Monument Road. The car has been since recovered.

If you recognize this man and have any information regarding the identity of this suspect you are asked to contact the Jacksonville Sheriff’s Office at 904-630-0500 or email at [email protected]. To remain anonymous and receive a possible reward up to $3,000 contact Crime Stoppers at 1-866-845-TIPS.

MEXICO CITY – Mexican inflation in July likely sped up again to a near-22-year high, a Reuters poll showed on Monday, fueling bets the country’s central bank will continue to hike its key interest rate through the rest of the year.

The median forecast of 14 analysts projects that annual inflation will hit 8.13% in July, a level not seen since December 2000.

Mexico’s central bank, which targets inflation at 3% plus or minus one percentage point, has raised its benchmark interest rate by 375 basis points over its last nine monetary policy meetings, to 7.75%.

The bank’s next rate decision is scheduled for Thursday, with the market anticipating a further 75-basis-point hike. Analysts expect the interest rate to hit 9.5% by the end of the year.

Annual core inflation, which strips out some volatile food and energy prices, is forecast to reach 7.60%, also the highest since late 2000.

In July alone, prices are forecast to have risen 0.72%, according to the Reuters survey, while the median projection for the month’s core inflation is 0.58%.

Ad: Save every day with Amazon Deals: Check out today's daily deals on Amazon.

Mexico’s national statistics agency INEGI will release official inflation data for July on Tuesday.

(Reporting by Noe Torres; Additional reporting by Gabriel Burin in Buenos Aires; Editing by Bernadette Baum)

By Duncan Miriri and Karin Strohecker

NAIROBI – Millions of Kenyans will head to the polls on Tuesday to pick a new president in a fiercely contested election that pitches veteran opposition leader Raila Odinga against Deputy President William Ruto.

President Uhuru Kenyatta is not running due to term limits but is backing Odinga. Lawmakers and country officials will also be elected.

The final four opinion polls published last week put Odinga ahead with a margin of 6-8 points but Ruto has dismissed them as fake and designed to sway the electorate.

Following are key topics for investors:

WHAT IS AT STAKE FOR INVESTORS?

Ad: Save every day with Amazon Deals: Check out today's daily deals on Amazon.

One of the most advanced economies in Africa, Kenya is a commercial hub for East and Central Africa, hosting regional headquarters of global firms like Alphabet and Visa.

Its stocks, bonds and the shilling currency are some of the most traded by foreign investors on the continent.

A number of flashpoints are on investors’ radar for the election. Deadly violence erupted after recent elections with more than 1,200 people killed after the 2007 ballot.

The global backdrop looks also challenging: Kenya, an energy importer, has felt the pinch from elevated crude oil prices. Like other emerging economies, Kenya faces rising borrowing costs as the U.S. Federal Reserve and other major central banks hike interest rates to tame inflation.

Spreads of Kenya’s hard-currency debt over safe-haven U.S. Treasuries – the premium demanded by investors – have come down from over 1,400 basis points in mid-July, but are still in the danger zone of above 1,000 bps.

WHAT ARE MARKETS WATCHING OUT FOR?

Markets are closely scrutinising fiscal accounts, the balance of payments and central bank reserves. Having a current account deficit as well as a fiscal deficit, Kenya’s financial position has been a longstanding source of vulnerability.

“Fiscal consolidation is going to be paramount for the elected president,” William Blair fund manager Yvette Babb told Reuters.

Gergely Urmossy, emerging market strategist at Societe Generale, said a credible strategy could see Kenya regain full access to international capital markets, while a good relationship with the International Monetary Fund was key.

“Kenya’s next president will need to present a credible and responsible macro-financial stabilisation agenda, which addresses the wide twin deficit and promotes debt sustainability,” said Urmossy.

The IMF agreed a three-year, $2.34 billion extended fund facility and extended credit facility in April 2021. During its latest review the fund said Nairobi was on track to meet most of the program’s objectives, though urged authorities to stick to the agreed fiscal consolidation path.

Committing to structural reforms was “essential to meet the IMF’s requirements in terms of unlocking further tranches and also strengthening the market’s confidence that the new government is both willing and able to deliver,” Urmossy added.

WHAT IS THE DIFFERENCE BETWEEN ODINGA AND RUTO?

Pledges between the two key candidates differ on key policy priorities such as tackling debt issues, job creation and social spending.

Odinga has pledged to renegotiate debt terms to lengthen maturities and free up cash for social interventions and development.

That aim of rearranging debt to lengthen maturities could be targeted at domestic debt servicing, said Sthembiso E Nkalanga at JPMorgan, which has been higher than servicing of foreign debt.

Ruto pledges to reduce borrowing and stimulate small enterprises to help drive growth and generate revenues.

“Ruto recognizes the country’s debt problem, but envisions raising economic growth and broadening the tax base would suffice in restoring creditworthiness and ensuring fiscal prudence,” Nkalanga said.

Both broadly converge on the Big 4 Agenda – Kenya’s 2030 blueprint which divides the country’s future economic development into four pillars: Food security, affordable housing, manufacturing and affordable healthcare.

WHAT DO LOCAL INVESTORS THINK?

Odinga and Ruto have offered differing visions for the economy, with Odinga advocating for enhanced social protections, and Ruto promising to empower small enterprises.

Local investors are optimistic: Three quarters of all business executives who took part in the central bank’s July market perception survey said they were optimistic, compared with just a third in the same survey five years ago.

This is due to outgoing President Kenyatta making peace with arch rival Odinga in March 2018 in the wake of a divisive election contest, which led to political stability.

“We have never had a more peaceful time, days to the election. The country is calm,” said Joe Mucheru, the minister for information and communication.

However, a new schism opened between Kenyatta and his estranged deputy Ruto, who Kenyatta says is not fit to be president. Meanwhile, the government has deployed extra police in areas of the Rift Valley, Ruto’s political power base and police say they are prepared for any opportunistic looting in major cities like Kisumu during and after the election.

(Reporting by Duncan Miriri in Nairobi and Karin Strohecker in London; additional reporting by Jorgelina do Rosario in London, Editing by Ros Russell)

Russian stocks rebound as Moscow Exchange delays return of some foreign investors

(Reuters) -Russian stocks were given a reprieve and the rouble strengthened on Monday after the country’s top stock exchange decided not to allow some foreign investors to trade Russian shares for the first time since February.

Traders expect that if foreign investors return some will immediately sell shares, given the uncharted waters of an equity market now offering huge risks and insufficient transparency.

Russian stocks fell 3% on Friday after the exchange said it would let clients from “friendly” jurisdictions, or those which had not deployed sanctions against Russia, start trading after an almost six-month hiatus.

However, in a statement after Friday’s market close, the Moscow Exchange said the ruling would only apply to the derivatives market, not the main stock market.

Reversing course, the dollar-denominated RTS index was up 2.3% to 1,097 points at 1230 GMT, while the rouble-based MOEX Russian index was 2% higher at 2,095 points.

Markets had been braced for steep losses and sharp volatility and analysts said the delay over the return of foreign investors had caught out short sellers who were betting on a market slide.

Ad: Save every day with Amazon Deals: Check out today's daily deals on Amazon.

Non-residents from “friendly” countries account for only around 1% of Russian holdings, but analysts had said any relaxation of the trading ban could open a back-door for larger investors from the European Union, United States, Japan and Britain – designated “unfriendly” – to offload their holdings.

Foreigners have been locked out of the market since Feb. 25, the day after President Vladimir Putin ordered tens of thousands of troops into Ukraine.

Russia’s central bank on Monday moved to shut down the possible loophole, blocking Russian depositories and registrars from executing transactions with securities received from foreign counterparts – including from “friendly” countries – for six months.

In a later statement, the regulator threatened punishments for brokers which do not accurately report the residency status of any clients they execute orders for.

The Russian rouble also gained and by 1230 GMT was 0.6% stronger against the dollar at 60.19, having briefly dipped below 60. It gained 0.8% to trade at 61.09 against the euro.

Since the start of August the currency has fallen from multi-year highs reached earlier this year under strict capital controls.

“In the coming days, we expect the Russian currency to stay in the range of 59-62 – the downside and upside risks seem relatively balanced,” Moscow-based brokerage BCS Global Market said in a report.

(Reporting by Reuters; Editing by Susan Fenton and David Holmes)

KYIV – Ukraine has formally requested a new programme from the International Monetary Fund and hopes to receive aid under the programme from November to December, Ukrainian Prime Minister Denys Shmygal said on Monday.

“We expect to receive the corresponding assistance from the IMF already in November-December of this year,” he said in a statement on the government website.

(Reporting by Natalia Zinets; Writing by Tom Balmforth; Editing by Hugh Lawson)

DUBAI – European budget airline Wizz Air will resume flights from Abu Dhabi to Moscow from October, it said on Thursday, more than five months after the carrier suspended all services to Russia following Moscow’s invasion of Ukraine in February.

The airline’s Abu Dhabi-based joint venture, Wizz Air Abu Dhabi, will operate the daily flight from Oct. 3, with fares starting from 359 dirham ($97.74), it said in a statement.

Wizz Air, which in October 2021 announced the Abu Dhabi to Moscow flights would start in December that year, said on Feb. 27 it had suspended all flights to Russia.

Other Emirati carriers, including Emirates, have continued to operate services to Russia following the invasion of Ukraine.

Wizz Air Abu Dhabi is a joint venture between Abu Dhabi sovereign wealth fund ADQ and the European airline. It is based in Abu Dhabi and is a United Arab Emirates registered carrier.

($1 = 3.6729 UAE dirham)

(Reporting by Alexander Cornwell, Editing by Louise Heavens)

By Ceyda Caglayan

ISTANBUL – Western sanctions have given the Turkish metals sector a chance to serve as “warehouse and bridge”, the head of an industry group said, citing increased interest from Russian companies and also from EU companies seeking to sell to Russia via Turkey.

The West, including Britain and European Union countries, have imposed sanctions on Russian elites, banks and strategic industries since Russia on Feb. 24 began what it terms a “special military operation” in Ukraine.

Cetin Tecdelioglu, head of the Istanbul Ferrous and Non-Ferrous Metals Exporters’ Association (IDDMIB), said Russian demand had increased for Turkish products it could no longer source from European companies and Turkish companies had received enquiries from European businesses about supplying Russia via Turkey.

“What they (Russia) cannot buy from Germany, Italy and France, they are buying from us. Separately, a lot of EU companies are planning to sell their products to Russia via Turkey,” he told reporters on Friday.

“They want to use Turkey as a warehouse and bridge, while Russia wants supply from Turkey,” he said, adding that it was an “historic opportunity” for Turkish companies.

He did not name the companies concerned, nor specify how many, but he said they produced copper, aluminium, kitchenware and machinery.

Turkey’s ferrous and non-ferrous exports totalled 8.9 billion lira ($495.58 million) in the first seven months of 2022, according to IDDMIB data, a rise of 33% from a year ago. They accounted for 6.2% of Turkey’s exports.

Turkey’s ferrous and non-ferrous metal exports to Russia rose by 26% year-on-year to $170 million by Aug. 8, the data also show.

The rift between Moscow and the West over Russia’s invasion of Ukraine has led to concerns of a possible cut-off of Russian gas to Europe, which could force the shut-down of some European industrial production.

Tecdelioglu said that could provide another opportunity for Turkish exporters of metal products.

Turkey has criticised Russia’s invasion, sent armed drones to Ukraine and sought to facilitate peace talks between the sides. But it has not backed Western sanctions on Moscow and seeks to maintain close trade, energy and tourism ties.

Relations between the West and China have also deteriorated after U.S. House Speaker Nancy Pelosi https://www.reuters.com/world/taiwan-says-chinese-planes-ships-carry-out-attack-simulation-exercise-2022-08-06 visited Taiwan last week, which Tecdelioglu said was another potential chance for Turkey if it disrupts previous trade ties.

“We are receiving signals of some opportunities,” he said.

Turkey has not commented publicly on Pelosi’s visit, but has over recent years modified its language on Uyghur Muslims who form a significant minority in Turkey.

Turkish President Tayyip Erdogan last year told his Chinese counterpart Xi Jinping it was important to Turkey that Uyghur Muslims live in peace as “equal citizens of China” but said Turkey respects China’s national sovereignty.

($1 = 17.9589 liras)

(Writing by Ali Kucukgocmen; editing by Barbara Lewis)

By Gergely Szakacs

BUDAPEST – Budget airline Ryanair said it would appeal to the courts after Hungary fined it for passing on the cost of a special business tax, worth 800 billion forints ($2.1 billion) in total, following a consumer protection investigation.

Nationalist Prime Minister Viktor Orban’s government in May announced the special tax measure targeting “extra profits” earned by major banks, energy companies and other firms, aiming to plug budget holes created by a spending spree that helped him gain re-election in April.

“The consumer protection authority has found a breach of the law today, because the airline (Ryanair) has misled customers with its unfair business practice,” Justice Minister Judit Varga said in a Facebook post on Monday.

Ryanair said in an emailed response it would appeal against the 300 million forints ($780,000) fine which it had been levied.

“Ryanair … will immediately appeal any baseless fine raised by the Hungarian Consumer Protection Agency,” the email said. “No notice of any such fine has yet been received by Ryanair. If necessary, Ryanair will appeal this matter to the EU courts.”

The new levy on involves a tax worth 10 to 25 euros on passengers departing Hungary from July.

Ryanair had previously called on Orban’s government to scrap what it called a “misguided” tax, saying the measure would damage Hungarian tourism and the economy.

Ryanair, which has also taken issue with the tax being levied on a loss-making industry, said it would be forced to move growth capacity to countries that were working to restore traffic in the aftermath of the coronavirus pandemic.

Orban’s taxes on “extra” profits at banks, insurers, large retail chains, the energy industry, telecoms companies and airlines is reminiscent of the tax regime he used to fix the budget after he swept to power in 2010.

Companies have so far proved reluctant to challenge the tax measure, but Ryanair’s rival carrier Wizz Air has said it will take a long time for the airline industry to return to revenue and profitability levels seen before the COVID-19 pandemic. It said the tax would hamper the recovery of the tourism sector.

($1 = 384.88 forints)

(Reporting by Gergely Szakacs; Additional reporting by Anita Komuves; Editing by Bradley Perrett and David Holmes)

(Reuters) – Pandemic-related disruption to global supply chains and the knock-on effects of Russia’s war in Ukraine are combining to push prices of energy, commodities and basic items higher.

Below is a list of some of the actions taken by governments aimed at offering relief to hard-hit consumers and companies:

AMERICAS:

* The U.S Senate on Sunday approved the “Inflation Reduction Act of 2022”, a $430 billion plan which among other things lowers the cost of prescription drugs, raises some corporate taxes, and introduces consumer tax credit measures to encourage energy efficiency.

* Brazil’s President Jair Bolsonaro and lawmakers have been pressuring state-owned energy giant Petrobras to further cut petrol prices. The company in July twice announced separate price reductions cumulatively totalling 9%, bringing prices to their lowest levels since March.

EUROPE:

* Germany plans to introduce a gas price levy on all consumers from Oct. 1. The government in July announced 15-billion euro state bailout of Uniper, the country’s largest importer of Russian gas. It had also introduced a tax cut on petrol and diesel, while slashing public transport costs.

* France’s parliament on Aug. 3 adopted a 20 billion euro inflation-relief package, lifting pensions and some welfare payments, and allowing companies to pay employees higher tax-free bonus payments, in a bid to boost household purchasing power.

* Italy on Aug. 4 approved an aid package worth about 17 billion euros. The legislation aims to cut electricity and gas bills and adds to about 35 billion euros already spent since January to soften the impact of power, gas and petrol costs.

* Poland in July introduced the so-called “payment holidays” relief scheme for individuals holding mortgages in Polish zlotys, allowing them to skip payments for eight months over a two-year period.

ASIA:

* India in May imposed restrictions on exports of food items including wheat and sugar, which account for nearly 40% of the consumer price index, and cut taxes on imports of edible oil.

* Japan deployed a $103 billion relief package in April to cushion the economic blow from rising raw material costs, which consisted of subsidies to curb gasoline prices and cash payouts to low-income households with children. Prime Minister Fumio Kishida has signalled there may be additional steps if rises in living costs persist.

MIDDLE EAST AND AFRICA:

* Saudi Arabia and the United Arab Emirates in early July announced boosts to their spending on social welfare. The UAE doubled financial support to low-income Emirati families, while Saudi Arabia’s King Salman ordered the allocation of 20 billion riyals ($5.32 billion).

* Turkey in early July increased its minimum wage by about 30%, adding to the 50% rise seen at the end of last year.

($1 = 3.7575 riyals)

(Compiled by Olivier Sorgho, Leika Kihara, Manoj Kumar and Alessandra Prentice; Editing by Alison Williams)

By Eduardo Baptista

BEIJING – From a Chinese soy sauce maker to an Asia-focused asset manager, companies in China are rushing to distance themselves from geopolitical tensions over Taiwan following last week’s visit to the island by a high-profile U.S. official.

China claims self-ruled Taiwan as its territory, and the visit by U.S. House of Representatives Speaker Nancy Pelosi to Taipei last week – in defiance of Beijing’s warnings – has sparked a wave of Chinese nationalism and huge military drills.

Chinese social media users have targeted companies and celebrities they see as unpatriotic or supportive of Taiwan’s independence with strong criticism – such as candy brand Snickers, whose owner apologised last week for a product launch that was seen as suggesting Taiwan is a country.

On Saturday, Foshan Haitian Flavoring and Food Co Ltd, China’s largest soy sauce maker by sales, issued a lengthy apology, saying it had fired an unidentified employee who attracted social media attention with a private post that celebrated Pelosi’s visit.

“The inappropriate content published seriously goes against Haitian’s culture, does not match with Haitian’s values, and has hurt the feelings of the Chinese people, producing a negative societal influence,” the company said on its Weibo account, promising it would manage its employees better.

Another business, Asia-focused asset manager Matthews International Capital Management, issued a clarification on Monday after it was described by Beijing-backed Hong Kong newspaper Ta Kung Pao as being founded by Pelosi’s husband, saying such allegations were “factually incorrect”.

It said on its website that it was founded by Paul Matthews, not Paul Pelosi, and also did not have any current ownership or business ties with William Hambrecht, who is a friend and political supporter of Pelosi, contrary to media reports.

“We take the recent misreporting and false statements about our firm very seriously and are working with media outlets to take prompt corrective action,” Matthews, whose main owners include Paul Matthews, Mark Headley, Mizuho Financial Group Inc and Royal Bank of Canada, said on Monday.

In a separate case, Taiwanese chip maker United Microelectronics Corp (UMC), distanced itself from its founder Robert Tsao, who last week pledged to donate NT$3 billion (US$100 million) to help Taiwan bolster its defences, after his comments were pilloried by Chinese social media users.

In a statement, UMC said: “Mr Tsao retired from UMC more than 10 years ago. He has nothing to do with UMC.”

Chinese state media have issued warnings, saying that companies should consider their access to the world’s second largest economy with respect to the Taiwan situation and Pelosi, who has, along with her immediate family, been sanctioned by China after her visit.

“It can be expected that if any ties of interest with China can be found in the business activities of Pelosi and her immediate family members, they will definitely be cut off,” state-backed Global Times newspaper said in an editorial over the weekend.

China’s military announced fresh military drills on Monday in the seas and airspace around Taiwan – a day after the scheduled end of its largest ever exercises, confirming the fears of some security analysts and diplomats that Beijing would continue to maintain pressure on Taiwan’s defences.

(Reporting by Eduardo Baptista, Samuel Shen, Sarah Wu; Editing by Brenda Goh and Mark Potter)

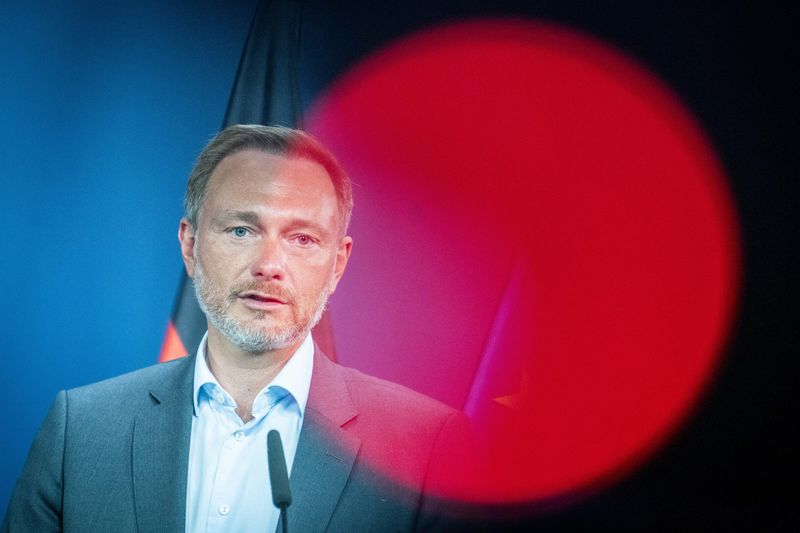

BERLIN – German Finance Minister Christian Lindner plans a 10.1 billion euro ($10.29 billion) relief package to help taxpayers in 2023 which he is set to present next week, the Spiegel news weekly reported.

For 2024, further relief is planned with a volume of around 4 billion euros, the report said.

The package is set to include an increase in the amount people can earn tax-free and an increase in child benefit.

($1 = 0.9817 euros)

(Writing by Rachel More; Editing by Paul Carrel)

Exclusive-Russian weapons in Ukraine powered by hundreds of Western parts – RUSI

By Andrew MacAskill

LONDON – More than 450 foreign-made components have been found in Russian weapons recovered in Ukraine, evidence that Moscow acquired critical technology from companies in the United States, Europe and Asia in the years before the invasion, according to a new report by Royal United Services Institute defence think tank.

Since the start of the war five months ago, the Ukrainian military has captured or recovered from the battlefield intact or partially damaged Russian weapons. When disassembled, 27 of these weapons and military systems, ranging from cruise missiles to air defence systems, were found to rely predominantly on Western components, according to the research shared with Reuters.

It is the most detailed published assessment to date of the part played by Western components in Russia’s war against Ukraine.

About two-thirds of the components were manufactured by U.S.-based companies, RUSI found, based on the weapons recovered from Ukraine. Products manufactured by the U.S.-based Analog Devices and Texas Instruments accounted for nearly a quarter of all the Western components in the weapons.

Other components came from companies in countries including Japan, South Korea, Britain, Germany, Switzerland, and the Netherlands.

“Russian weapons that are critically dependent upon Western electronics have resulted in the deaths of thousands of Ukrainians,” Jack Watling, a land warfare specialist at RUSI, told Reuters.

While many of the foreign components are found in everyday household goods such as microwaves that are not subject to export controls, RUSI said a strengthening of export restrictions and enforcement could make it harder for Russia to replenish its arsenal of weapons such as cruise missiles.

In one case, a Russian 9M727 cruise missile, one of the country’s most advanced weapons that can manoeuvre at low altitude to evade radar and can strike targets hundreds of miles away, contained 31 foreign components. The parts were made by companies that included U.S-based Texas Instruments Inc and Advanced Micro Devices Inc , as well as Cypress Semiconductor, which is now owned by Infineon AG , a German company, the RUSI investigation found.

In another case, a Russian Kh-101 cruise missile, which has been used to strike Ukrainian cities, including the capital Kyiv, also had 31 foreign components with parts manufactured by companies including U.S.-based Intel Corporation and AMD-owned Xilinx.

In response to questions about how their chips ended up in Russian weapons, the companies said they comply with trade sanctions and they have stopped selling components to Russia.

Analog Devices said the company closed their business in Russia and instructed distributors to halt shipments to the country.

Texas Instruments said it follows all laws in the countries where they operate and the parts found in the Russian weapons were designed for commercial products. Intel said it “does not support or tolerate our products being used to violate human rights.”

Infineon said it was “deeply concerned” if its products are being used for purposes which they were not designed for. AMD said it strictly follows all global export control laws.

Many of the foreign components only cost a few dollars and Russian companies would have been able to buy them before the start of the Ukraine invasion online through domestic or international distributors because they could be used in non-military applications.

However, more than 80 Western-manufactured microchips were subject to U.S. export controls since at least 2014 meaning they would have required a licence to be shipped to Russia, RUSI said. The companies exporting the parts had a responsibility to carry out due diligence to ensure they were not being sent to the Russian military or for a military end-use, according to RUSI.

The investigation’s findings show how Russia’s military remains reliant on foreign microchips for everything from tactical radios to drones and precision long-range munitions, and that Western governments were slow to limit Russia’s access to these technologies particularly after President Vladimir Putin’s invasion of Crimea in 2014.

Russia’s war with Ukraine, which began on Feb. 24, has killed thousands of people, displaced millions more and laid waste to several cities. Russia’s superior firepower, including its use of cruise and ballistic missiles, has helped its forces grind through eastern Ukraine and occupy around a fifth of the country.

Russian troops have fired more than 3,650 missiles and guided rockets in the first five months of the war, according to the Staff of the National Security and Defense Council. These include the 9M727 and Kh-101 missiles. Russian missiles have been used to hit targets including railway lines to disrupt Western supply lines, military infrastructure and civilian targets such as shopping centres and hospitals. Russia said it has only fired at military targets. Russian authorities didn’t provide further comment for this story.

In the aftermath of the invasion of Ukraine, the United States announced sweeping sanctions to try to weaken Russia’s economy and its military. This included a ban on many sensitive microchips being sold to Russia. Countries in Europe, as well as Japan, Taiwan, and South Korea – all key chipmaking countries – have announced similar restrictions. Russia characterises the conflict as a special military operation meant to disarm Ukraine. Moscow has cast the sanctions as a hostile act and has denied targeting civilians.

Russia is currently working to find new routes to secure access to Western microchips, according to RUSI. Many components are sold through distributors operating in Asia, such as Hong Kong, which acts as a gateway for electronics making their way to the Russian military or companies acting on its behalf, RUSI found.

Russia’s government did not respond to a request for comment.

The U.S. government said in March that Russian firms were front companies that have been buying up electronics for Russia’s military. Russian customs records show that in March last year one company imported $600,000 worth of electronics manufactured by Texas Instruments through a Hong Kong distributor, RUSI said. Seven months later, the same company imported another $1.1 million worth of microelectronics made by Xilinx, RUSI said.

Texas Instruments and AMD-owned Xilinx did not respond to a request for comment about the customs data.

Russia’s military could be permanently weakened if Western governments strengthen export controls, manage to shut down the country’s clandestine procurement networks and prevent sensitive components being manufactured in states that support Russia, RUSI said.

((reporting by Andrew MacAskill; edited by Janet McBride))

By David Shepardson

WASHINGTON – Two members of the U.S. House of Representatives are launching a bipartisan effort to help revive legislative efforts to boost self-driving vehicles.

Representatives Robert Latta, a Republican, and Debbie Dingell, a Democrat, told Reuters in a joint interview they are unveiling the bipartisan Congressional Autonomous Vehicle Caucus to help educate fellow lawmakers on the importance of self-driving vehicles as they work to revive legislation.

“We’re working hard to find that common ground to get something that we can pass,” Dingell said, adding the United States must update motor vehicle safety standards written decades ago assuming human drivers are in control and “cannot afford to have a patchwork of laws either across 50 states.”

Last month, the National Highway Traffic Safety Administration said General Motors and Ford Motor had asked for exemptions to deploy up to 2,500 self-driving vehicles annually without human controls like steering wheels and brake pedals, the maximum allowed under current law.

“We both come from automobile states,” Latta said. “It’s important we keep our competitiveness in the United States — that we are using U.S. technology, that it is not coming from China… It’s got to be done here in the United States.”

Latta acknowledged self-driving car legislation might not pass until the next two-year Congress that will open in 2023. “It’s important that we get members involved from all over the country,” Latta said. “This is something that is going to affect everybody.”

U.S. lawmakers have been divided for years over how to amend regulations to encompass self-driving cars, including the scope of consumer and legal protections.

In 2017, the House of Representatives passed legislation to speed the adoption of self-driving cars and bar states from setting performance standards, but the bill never passed the U.S. Senate.

The lawmakers noted U.S. traffic deaths jumped 10.5% in 2021 to 42,915, marking the highest number killed on American roads in a single-year since 2005 and said autonomous vehicles have the potential to save thousands of lives and reduce congestion.

Senators Gary Peters and John Thune have also been working on autonomous vehicle legislation. They previously proposed giving NHTSA the power to initially exempt 15,000 self-driving vehicles per manufacturer from current federal motor vehicle safety standards, a figure that would rise to 80,000 within three years.

(Reporting by David Shepardson; Editing by Edwina Gibbs)

By Federico Maccioni and Angelo Amante

ROME -The leader of Italy’s centrist Azione party said on Sunday it would leave a centre-left election alliance it formed with the Democratic Party (PD) last week, dealing a blow to the coalition’s odds ahead of a Sept. 25 ballot.

The Green leftist federation and centrist party Impegno Civico had only the day before agreed to join the PD-led bloc, a move that was seen as strengthening a centre-left already lagging behind conservative rivals.

Polls show that a conservative alliance is poised to win next month’s election, with the far-right Brothers of Italy set to be the largest single party. Italy’s election law favours parties that form broad alliances.

Azione leader Carlo Calenda said he had told PD leaders his party would leave the accord, citing the presence of parties who voted against former Prime Minister Mario Draghi’s government as one of the reasons.

The September vote was called following the collapse of the Draghi’s unity government last month, after three main partners snubbed a confidence vote he had called to try to end divisions. Draghi resigned but has stayed on as acting premier.

“This has been the most painful decision of my life,” Calenda told state-owned television channel Rai Tre.

PD leader Enrico Letta tweeted: “I listened to Carlo Calenda. From all the things he said, it looks to me as if the only possible ally for Calenda is Calenda (himself).”

Azione had agreed to team up with the PD, the largest party on the centre-left, in an effort to make up ground on the conservatives. He pledged to stick to Draghi’s foreign policy of supporting Ukraine and to meet targets required to access billions of euros in funding from the European Union.

The centrist party and its +Europa ally are polling at around 5-7% in surveys. Earlier on Sunday, +Europa expressed its strong approval of the pact with the PD and it remained unclear what the small group would do after Calenda’s move.

(Reporting by Federico Maccioni and Angelo Amante, editing by Raissa Kasolowsky and Mark Heinrich)

By Rich McKay

BRUNSWICK, Ga. – Carla Arbery has a T-shirt summing up what’s changed in her coastal Georgia community since the murder of nephew Ahmaud Arbery by three white men in 2020.

Phrases on her shirt list action sparked by the fatal shooting of the young Black jogger: The abolishment of a state citizens-arrest provision that the three white killers claimed justified the shooting. The removal and indictment of the local district attorney. And new leadership in the police department.

“His life did matter,” said Carla Arbery, 52. “I don’t want people to ever forget it. Or forget him.”

As Black residents of Georgia say they will press for more change, the last major milestone in the Arbery case is set to play out on Monday. Travis McMichael, 36, his father, Gregory McMichael, 66, and a neighbor, William “Roddie” Bryan, 52, face sentencing for their February convictions for federal hate crimes and other charges in the Arbery killing. Each faces life in prison.

Last year the men were also convicted in state court of murder and other crimes and were sentenced to life in prison. They have appealed those convictions.

A 25-year-old onetime high school football star, Arbery worked for a truck-washing company and his father’s landscaping business. He was shot on Feb. 23, 2020, while jogging in Satilla Shores, a subdivision outside Brunswick.

Mostly white Satilla Shores, just two miles from Arbery’s home, contrasts with the county seat of Brunswick – a city of 16,000 people, mostly minorities, and among the poorest in the state.

The McMichaels claimed they thought Arbery was a burglar and began pursuing him. Bryan joined in, telling police that he thought the jogger must be up to something if the McMichaels were chasing him.

The men cornered Arbery with their trucks before the younger McMichael fatally shot him. About two months later, Bryan’s cell phone video of the attack went viral after being leaked by a defense lawyer.

Charges weren’t issued until 73 days after the murder, when the Georgia Bureau of Investigation had taken over the case from local authorities. Charges had not been brought by the local district attorney at the time, Jackie Johnson, who is white–and for whom the elder McMichael had worked as an investigator after leaving the Glynn County police department.

NEW PROSECUTOR, NEW POLICE CHIEF

Arbery’s family worked to get Johnson voted from office in November 2020. Johnson has since been indicted on charges of violating her oath of office and hindering law enforcement. She has denied the charges and filed a motion to dismiss them. Reuters was unable to reach her or her lawyer for comment.

After the Arbery case drew global attention, Georgia’s citizen’s arrest law was largely abolished by a law Gov. Brian Kemp signed last May. A few months later, Kemp signed a new hate crimes law. Glynn County fired its white police chief.

Glynn County Commissioner Allen Booker, who is a family friend of the Arberys, said the case was among the reasons the commission sacked the police chief in the county of 85,000. The department was rife with broader troubles, too, he said, including a culture of “good ol’ boy” cronyism.

“Change is here,” said Booker, the only Black member among the seven county commissioners.

The former chief, John Powell, has disputed claims of misconduct on the force during his watch and has denied charges of violating oaths of office brought against him in Glynn County Superior Court. His attorney was not available for comment.

The new chief is Jacques Battiste, a former special agent for the Federal Bureau of Investigation and onetime New Orleans police officer. He is the county’s first Black police head. Battiste was unavailable for an interview, a county spokesperson said.

Three Georgia law enforcement officers have filed a suit against Glynn County and the members of the commission. The suit claims that the political environment following Arbery’s death led the commission to overlook them for the job of chief in favor of hiring a Black officer.

Booker declined to comment on the suit, as did a spokesperson for the county commission. Last year, Booker was quoted in the Brunswick News as saying that to “choose somebody other than something the Black community would be comfortable with, I think it’s the wrong way to go.”

Protests over Arbery’s death drew national civil rights activists to this region of scenic shorelines and old oaks draped with Spanish moss. The murder also prompted new local activism.

Rabbi Rachael Bregman, who is white, co-founded a group called Glynn Clergy of Equity. It has hosted dinners to bring together people of different races and faiths. “We’ve found a new willingness for people, white and not-white, Black, to have a conversation about racial equity, gender equity, all of it,” she said.

Elijah “Bobby” Henderson, 46, a Black electrical engineer, co-founded a group called A Better Glynn. It promoted the successful candidate who ran against Johnson for district attorney. Henderson has pledged to help people restore their voting rights after criminal convictions. Some of those people were convicted on years-old traffic violations after being unable to pay their fines, he said.

“The big thing we need to change is the culture that helped the cover-up of Ahmaud’s murder,” Henderson said. “Black people are still disenfranchised.”

(Reporting by Rich McKay in Brunswick, Georgia; editing by Donna Bryson and Michael Williams.)

BANGKOK – Crypto exchange Zipmex will release Ethereum and Bitcoin tokens from this week, a spokesperson said on Monday, allowing 60% of its customers to retrieve their digital assets after a suspension of withdrawals from its Z Wallet product.

The Singapore-based Zipmex, which also operates in Thailand, Australia and Indonesia, in July halted withdrawals from Z Wallet, which it said had $53 million worth of cryptocurrencies exposed to Babel Finance and Celsius.

Ethereum will be released on Thursday and Bitcoin on Aug. 16, the company said. Last week it allowed digital coins XRP, ADA and SOL to be withdrawn.

Zipmex late last month said it was in talks with investors for potential funding.

The Thai Securities Exchange Commission on Saturday said it was collecting further information on affected customers and was working with customer representatives on the issue.

(Reporting by Chayut Setboonsarng; Editing by Martin Petty)

BANGKOK – Thailand plans to raise its mininum wage for the first time in more than two years, by 5% to 8% to help workers cope with the impact of the pandemic, according to the national wage committee and the labour minister.

The national wage committee expects to recommend the hike in the daily minimum wage when it meets later this month, committee member Phijit Deesui told Reuters on Monday.

The daily minimum wage would be increased to between 329 baht and 353 baht ($9.19-$9.86), pending cabinet approval.

The government wants the wage increase to start later this year, rather than early next year, Labour Minister Suchart Chomklin told Reuters.

“I want this to happen as soon as possible because people have a lot of trouble with living costs and we haven’t adjusted the wage for a long time,” he said.

The minimum wage was last hiked in January 2020, by 1.6%-1.8%.

The new figures would put Thailand’s monthly minimum wage – at 9,870 to 10,590 baht – among the highest in Southeast Asia.

In Vietnam, a regional manufacturing base, the government’s minimum wage range is between 3.25 million dong ($138.96) and 4.68 million dong ($138.96-$200.10) per month.

($1 = 35.79 baht)

($1 = 23,388 dong)

(Reporting by Kitphong Thaichareon and Satawasin Sta[censored]charnchai; Writing by Orathai Sriring; Editing by Kanupriya Kapoor)

ATHENS – Greece’s annual consumer inflation slowed to 11.6% in July from 12.1% the previous month, but remained close to its highest level in nearly three decades, data showed on Monday.

Surging costs for energy, housing, transportation and foods were the main factors underpinning the figures, statistics service ELSTAT said. Month-on-month consumer inflation fell 1.8%.

Greece’s annual EU-harmonised inflation also decelerated to 11.3% in July from 11.6% in June, but again kept near highs that continued to squeeze disposable incomes.

EU-harmonised inflation is an index of components that is used across the EU to measure inflation in a consistent way.

Natural gas prices soared 178.9% on an annual basis, while electricity prices were up 55.8% and those for heating oil up 65.1%, ELSTAT said.

The cost of housing rose 30.9% year-on-year in July while transportation prices were up 20.6%, with foods and non-alcoholic beverages 13% more expensive, the data showed.

(Reporting by George Georgiopoulos; Editing by Andrew Heavens)

(Reuters) – Russia’s central bank announced steps on Monday aimed at preventing investors from “unfriendly” countries from taking advantage of plans to allow those from “friendly” nations to resume trading on the Moscow stock market.

The Moscow Exchange said on Friday it would allow clients from “friendly” jurisdictions – or those that have not imposed sanctions against Russia over its actions in Ukraine – to start trading after an almost six-month hiatus.

But it later said this would apply only to the derivatives market, not the main stock market, and did not say when the wider access would be permitted.

Analysts said the delay was partly due to concerns that investors from the European Union, United States and Britain – which are currently banned from trading in Moscow – might be able to use the resumption of trading by “friendly” nations as a back-door to offload any Russian stocks they still hold.

The central bank said on Monday it was blocking Russian depositories and registrars from executing transactions with securities received from foreign counterparts – including from “friendly” countries – for six months.

The regulator said it had seen brokers offering the option to purchase securities from non-residents in foreign jurisdictions and then transfer the assets to a Russian depository – a move which it described as risky and with “no guarantee of obtaining the expected financial result”.

Western sanctions have severely restricted Russians’ access to global stock markets, while countermeasures from Moscow have also blocked most foreigners from buying and selling Russian shares.

(Reporting by Reuters; Editing by Mark Potter)

Exclusive-Bolsonaro election concerns stall U.S. Javelin missiles sale to Brazil-sources

By Matt Spetalnick, Gabriel Stargardter, Patricia Zengerle and Mike Stone

WASHINGTON/RIO DE JANEIRO – A Brazilian military request to buy Javelin anti-tank missiles worth as much as $100 million has been stalled in Washington for months due to U.S. lawmakers’ concerns about far-right President Jair Bolsonaro, including his attacks on Brazil’s electoral system, multiple U.S. sources told Reuters.

Brazil’s bid to acquire some 220 Javelins was originally made when former President Donald Trump, a Bolsonaro ally, was in the White House. The State Department gave its blessing to the proposal late last year, despite objections from some lower-ranking U.S. officials, according to two people familiar with the matter.

But the confidential deal, which has not been previously reported, has since become mired in procedural limbo amid mounting concerns among Democratic lawmakers over Bolsonaro’s Trump-like questioning of voting integrity ahead of Brazil’s Oct. 2 election, the sources said.

Brazil’s request for the cutting-edge U.S.-made missiles, which have won fame for their effective use by Ukrainian forces against Russian armor, has been delayed by a Democratic-led effort to send a message to Bolsonaro and his military.

“It’s being slow-walked on Capitol Hill and isn’t going anywhere anytime soon” because of misgivings about Bolsonaro, said a source who has followed the proposed deal.

The holdup underlines the impact Bolsonaro’s undemocratic rhetoric is already having on Latin America’s biggest country. It also gives a glimpse of how Brazil could become more isolated internationally if Bolsonaro were to follow Trump’s example and refuse to accept any election loss to his leftist rival, former President Luiz Inacio Lula da Silva.

President Joe Biden’s administration, scarred by Trump supporters’ Jan. 6, 2021, storming of the Capitol, has become increasingly anxious about Bolsonaro’s authoritarian comments, sending delegations to Brasilia to urge caution.

Defense Secretary Lloyd Austin brought a message of respect for democracy to Brazil in a meeting of regional defense ministers in July. That followed a visit last year by CIA director William Burns in which he told Bolsonaro’s aides he should stop undermining confidence in the country’s electoral process.

Bolsonaro, who trails Lula in the polls, has ignored them. Instead, he has continued to question the credibility of Brazil’s electronic voting system and claimed fraud in recent elections without providing evidence.

‘BRAZIL DOESN’T NEED THEM’

The potential post-election role of Brazil’s armed forces, which oversaw a military dictatorship for two decades following a 1964 coup, is an open question. Bolsonaro has called for the military, Latin America’s largest, to undertake its own parallel vote count, saying “the army is on our side.”

Washington is also concerned by environmental backsliding under Bolsonaro, as well as his friendly relationship with Russian President Vladimir Putin, whose Ukraine invasion he has refused to condemn.

Manufactured by defense giants Lockheed Martin Corp and Raytheon Technologies Corp, the Javelin has become one of the world’s best-known weapons due to its success against Russian tanks in the Ukraine war.

Brazil faces no similar threats, prompting questions about why it would need such firepower, sources said. Brazil’s military mainly focuses on securing its borders, among the world’s longest, and international peacekeeping missions.

“Brazil doesn’t need them,” said a former congressional aide who worked on weapons issues.

Another source said the State Department’s support for the sale showed it wanted to satisfy Brazil’s weapons wish-list to help nurture relations with one of Washington’s most important allied militaries in the region.

Bolsonaro’s office directed requests for comment to the defense ministry, which did not respond to a list of questions.

The State Department did not respond to a request for comment.

The request came in 2020 at a time of warming ties between the United States and Brazil under Trump and Bolsonaro, two blustery nationalists. In 2019, Trump designated Brazil a major non-NATO ally, allowing it greater access to U.S.-made weaponry.

The deal sailed through the Trump-era bureaucracy and was inherited by Biden, a Democrat less friendly toward Bolsonaro than his Republican predecessor.

Still, Biden’s State Department gave the deal a preliminary nod after what one person familiar with the matter described as only cursory discussions, overlooking concerns of U.S. diplomats in Brazil and lower-level officials in Washington.

“There are those within State working levels who have expressed reservations about this sale given Bolsonaro’s actions and rhetoric and certain past actions of Brazil’s military and security services,” said a U.S. government source. “Such concerns are not shared among Defense Department officials nor State leadership.”

The State Department then sent the proposed sale for an “informal” review by the two Democratic chairs and two Republican ranking members of Congress’ foreign relations committees. Congressional sources say it has not advanced due to the concerns of lawmakers, including Senator Bob Menendez and Representative Gregory Meeks, Biden’s fellow Democrats.

They have peppered the State Department with questions, ranging from Bolsonaro’s human rights record to whether Brazil needs such weapons, according to one congressional source, suggesting they at least want to delay it until after Brazil’s elections.

“We do not comment on arms cases under current review,” said a spokesperson for the committee, adding: “Chairman Meeks takes a range of considerations into account when reviewing such transfers, such as the broader range of diplomatic and security dynamics as well as human rights concerns.”

There have been no indications that the two senior Republicans also reviewing the Brazilian request, Senator Jim Risch and Representative Michael McCaul, have expressed any reservations, sources said.

The State Department has acknowledged to the lawmakers that the Javelins do not safeguard against any specific threat Brazil faces, a U.S. official said. But State has argued that Brazil’s bid to upgrade its anti-armor capacity is legitimate, and it seeks a reasonable number of missiles, the official added.

FORMIDABLE OBSTACLES

Despite tensions between Biden and Bolsonaro, Washington has remained open to selling weapons to Brasilia.

“The view is that Brazil has the right to procure military equipment as it sees fit and in accordance with our laws,” a senior Biden administration official told Reuters.

Even if the sale does move to the next phase – a full congressional review – it would still face formidable obstacles.

Democratic Senator Tim Kaine, who chairs the Western Hemisphere subcommittee, said he would want to examine any sale closely. Selling weapons to Brazil, he told Reuters, is “not something that I just would immediately feel like we should do.”

Demand for Javelins has soared since the start of the Ukraine war. So even if the deal is approved, it could take years for Brazil to receive the missiles due to a backlog of orders, with priority given to other U.S. partners.

If the request is denied, sources said Brazil has other options – chiefly the HJ-12, China’s cheaper version of the Javelin.

(Reporting By Matt Spetalnick, Gabriel Stargardter, Patricia Zengerle and Mike Stone; Writing by Matt Spetalnick; Editing by Brad Haynes, Mary Milliken and Daniel Wallis)

BUDAPEST – Ryanair is ready to appeal against what it said is a “baseless” fine from the Hungarian consumer protection agency, the airline said in an emailed response on Monday.

“Ryanair … will immediately appeal any baseless fine raised by the Hungarian Consumer Protection Agency. No notice of any such fine has yet been received by Ryanair. If necessary, Ryanair will appeal this matter to the EU courts,” the airline said.

(Reporting by Gergely Szakacs; Editing by David Goodman)

By Timothy Aeppel

(Reuters) – Business investment appears to be an early victim of red-hot U.S. inflation and rising interest rates.

Nonresidential fixed investment, which is how the Commerce Department lumps together things like spending by businesses on new buildings and renovations of existing ones, slipped 0.1% on an annualized basis in the second quarter. This acted as a drag on gross domestic product, the broadest measure of U.S. economic output. It also ended a seven-quarter run of outsized additions to GDP that on average were more than double the category’s historic contributions to growth.

The cutbacks hit every industry except mining and drilling.

Economists are watching closely to see how inflation hits different parts of the economy. Consumer spending has softened in the face of higher prices but still added to growth in the second quarter.

Business investment stalled in the second quarter: https://graphics.reuters.com/USA-ECONOMY/INVESTMENT/jnvwenwewvw/chart.png

And even as companies curtailed adding new buildings and other expansions, they kept hiring. U.S. job growth accelerated in July, and the U.S. job market has now recovered to the level it was before the pandemic. Meanwhile the stress on global supply chains eased last month to its lowest level since January 2021, according to the New York Federal Reserve.

The pullback in business spending “is more of a pause than a sign of structural weakness,” said Andrew Hunt, who heads the Center for Real Estate at Marquette University in Milwaukee.

Hunt said a surge in rents and construction costs earlier this year – part of a wave of price increases that have pushed inflation to a four-decade high – caused some businesses to postpone adding new space. But the pullback will be temporary, he predicts. He noted that demand for space is so high and available space in such short supply that vacancy rates are below 5% and in some markets there is essentially no space available.

“People said, ‘Let’s see if the Fed does what they said they were going to do – and see how things stabilize as we move into the fall.'”

The Fed has lifted interest rates at each of its meetings beginning in March, including back-to-back outsized increases of three-quarters of a percentage point at its last two policy gatherings. Far-larger-than-expected payrolls gains for July, data for which was issued on Friday, puts a third hike of that size squarely in play for the next Fed meeting in September.

CBRE Group Inc., which tracks industrial property trends, also views the pullback on business spending as temporary – and concentrated only in some pockets of the industrial sector. The real estate company noted in a recent report there was a record-breaking 626.6 million square feet of new industrial construction underway nationally in the second quarter – nearly a third of which was already leased.

“Last year was the biggest industrial leasing year ever – over 1 billion feet in the U.S.,” said John Morris, president of the logistics business for the Americas at CBRE.

“This year looks like it won’t be quite as big,” he said, noting they project 850 million square feet will be leased. That would still mark the second-biggest year in their records.

Morris said the slowdown appears concentrated in smaller companies, rather than the big-name e-commerce and retail firms that gain the most attention for their investments in giant warehouses. Leasing of the biggest warehouses – those over 700,000 square feet – is up 25% in the first half of this year, compared to 2021, said Morris, while leasing of warehouses of 50,000 square feet or less is off 21%.

“If you think about who typically is leasing those (smaller) buildings,” it is more likely to be smaller companies, he said, adding that those firms may be more sensitive to costs like rising rents.

Craig Meyer, president of industrial for the Americas at Jones Lang LaSalle Inc., said surging costs have curbed investments in industrial space. But he remains optimistic.

“We talk to all our brokers about what will happen to the end of year. And all of their pipelines seem to be solid,” he said.

(Reporting by Timothy Aeppel; Editing by Dan Burns and Chizu Nomiyama)

By Jorgelina do Rosario and Karin Strohecker

LONDON – Ukraine’s creditors vote this week on a government proposal to defer payments on the war-torn country’s international bonds for 24 months as Kyiv hopes to swerve a $20 billion messy default.

Bondholders have until 5 p.m. New York time (2100 GMT) on Tuesday to decide whether to back or vote down the proposal by Ukraine’s government, which faces a $5 billion monthly financing gap and liquidity pressures following Russia’s invasion on Feb. 24. Time is precious: the country has a $1 billion bond maturing on Sept. 1.

Creditors will likely wait until relatively close to the deadline to vote, said a person familiar with Ukraine’s thinking. Investors are expected to support the debt standstill, the person added.

When announcing its proposal, Ukraine’s finance minister Sergii Marchenko said it had “explicit indications of support” from some of the world’s biggest investment funds including BlackRock, Fidelity, Amia Capital and Gemsstock.

Creditors of Ukravtodor and Ukrenergo, two state-owned firms that have government guarantees on their debt, also have until Aug. 9 to vote on a plan similar to the sovereign.

IS THIS A DEFAULT?

The two-year moratorium on external debt payments would allow Ukraine to avoid a contractual or legal default, as any amendment on the bonds’ terms would have the creditors’ backing, Rodrigo Olivares-Caminal, professor of banking and finance law, at Queen Mary University of London, told Reuters.

However, creditors could ask whether a default insurance known as credit default swaps (CDS) should kick in, as a deferral of payments might be considered a credit event by the International Swaps and Derivatives Association (ISDA).

Investors are sitting on about $221 million of insurance on Ukraine’s debt, according to Depository Trust & Clearing Corporation (DTCC) data on the CDS.

Credit rating agencies might also classify this as a “selective default” or “default”.

“A contractual default, a credit event and a credit rating default are three different albeit related concepts,” Olivares-Caminal said. “Incurring any of the three doesn’t mean that the other two will trigger.”

While investors are expected to back the freeze it is unclear whether the country may still need a debt restructuring in the medium term.

“It is just a pause button – we do not know what shape Ukraine will be in a few months or a few years down the line,” said Luiz Peixoto, emerging markets economist at BNP Paribas in London. “Investors are already preparing for a debt restructuring.”

The dollar-denominated bonds trade at deeply distressed, some as low as 17 cents in the dollar.

Battered by the war, which Russia calls a “special military operation”, Ukraine faces a 35%-45% economic contraction in 2022, according to estimates from the government and analysts, and is heavily reliant on foreign financing from its Western partners.

Ukraine aims to strike a deal for a $15 billion-$20 billion programme with the International Monetary Fund before the end of the year.

Ukraine restructured its debt in 2015 after an economic crisis linked to a Russia-backed insurgency in its industrial east. The deal left it with a large number of payments due annually between 2019 and 2027, and it returned to international markets in 2017 with a $3 billion hard-currency debt issuance.

For the foreign debt freeze plan to be successful, the so-called consent solicitation requires the support of investors holding two-thirds across the 13 Eurobonds maturing from 2022 to 2033, and at least 50% of the holders of each note.

The government launched a separate proposal on its $2.6 billion of outstanding GDP warrants, a derivative security that triggers payments linked to its economic growth.

In late July, Ukraine’s state-energy firm Naftogaz became the first Ukrainian government entity to default since the start of the Russian invasion. Naftogaz’s bonds are not guaranteed by the sovereign.

(This story corrects first name in paragraph 12 to Luiz ..not.. Luis)

(Reporting by Jorgelina do Rosario and Karin Strohecker; Editing by Susan Fenton)

Indian Oil Corp unit to open 50 fuel stations in Sri Lanka to help alleviate crisis

By Uditha Jayasinghe

COLOMBO – Sri Lanka has given approval for India’s Lanka Indian Oil Corporation (LIOC) to open 50 new fuel stations, a company official said on Monday, as part of efforts to reduce severe shortages that have crippled the island nation.

Sri Lanka is caught in its worst financial crisis in more than 70 years as a shortage of foreign exchange has left it struggling to pay for essential imports of food, medicine and, critically, fuel.

LIOC, the smaller player in the island’s fuel supply duopoly, already has 216 fuel stations and will invest about 2 billion rupees ($5.5 million) on the expansion, its Managing Director Manoj Gupta told Reuters.

LIOC is a subsidiary of India’s Indian Oil Corporation and is listed on the Colombo Stock Exchange.

“We have been trying for some time to get this approval and we are more than willing to come forward and play a larger role to support and work with Sri Lanka to resolve its challenges,” Gupta said.

The country’s largest fuel retailer, state-run Ceylon Petroleum Corporation (CPC), operates around 1,190 fuel stations.

LIOC’s retail expansion follows a separate agreement signed in December to gain control of 75 oil tanks in a strategically important storage facility near Sri Lanka’s eastern port of Trincomalee.

The company has also stepped up supplies to CPC in the last two months after Sri Lanka ran short of dollars to pay for shipments, forcing consumers to wait in long queues, sometimes for days.

India has poured about $4 billion into its southern neighbour this year to prop up the economy, including swaps and multiple credit lines to purchase fuel, food and fertilizer.

Sri Lanka is also in discussions with the International Monetary Fund (IMF) for a possible $3 billion bailout package, besides seeking assistance from China and Japan.

(Reporting by Uditha Jayasinghe, Editing by Devjyot Ghoshal and Susan Fenton)

NEW YORK, NY – A 13-year-old Brooklyn boy was robbed at gunpoint in July and now police have released photos of his attackers in hopes the public can help them identify the suspects.

According to the New York City Police Department, on July 12th, three men approached a 13-year-old boy inside 725 Nostrand Avenue in Brooklyn at around 3:45 pm.

One of the suspects pulled a gun and removed the victim’s headphones and committed a robbery. The three suspects fled the scene before police arrived and the boy was uninjured but shaken.