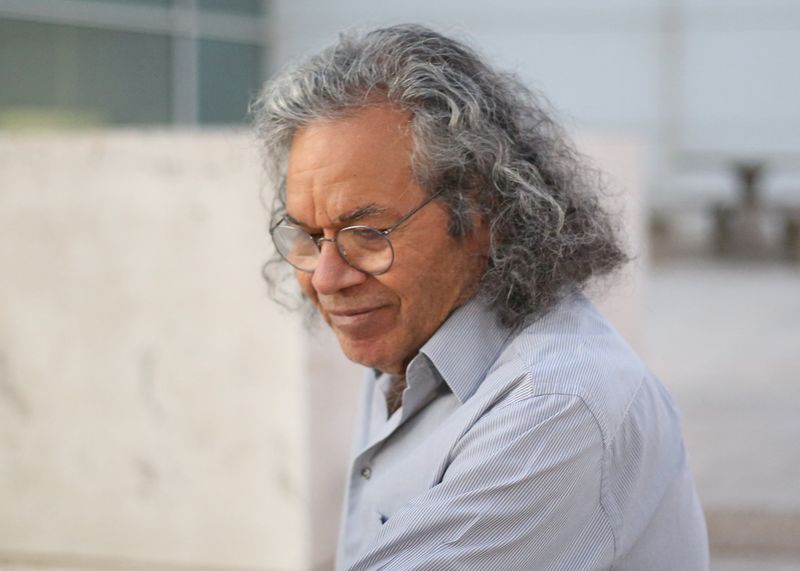

SACRAMENTO, Calif. —Glen Michael Martinka, 72, of Phoenix, Arizona, pleaded guilty today to mail fraud, U.S. Attorney Phillip A. Talbert announced.

According to court documents, beginning no later than Nov. 1, 2009, and continuing through approximately April 2012, Martinka, in his role as part owner and manager of a brokerage firm known as TSG Empire Roadrunner LLC, knowingly engaged in a false billing scheme to defraud a food company whose products the brokerage firm sold to various retailers and distributors. Martinka provided invoice numbers to his co-defendant Jeffrey Scott Davis, who, at the time, was the national sales manager for the food company. Davis then approved and submitted invoices on TSG Empire Roadrunner LLC letterhead for charges the brokerage firm was not entitled to receive. The false invoices also directed the food company to send payments to an Arizona address that Martinka controlled, rather than the brokerage firm’s headquarters where legitimately owed commissions were sent. Martinka split the fraudulently obtained money with Davis by directing checks made payable to Davis be mailed to Davis in California.

This case is the product of an investigation by the Federal Bureau of Investigation. Assistant U.S. Attorney Shelley D. Weger is prosecuting the case.

Martinka is scheduled to be sentenced by U.S. District Judge Kimberly J. Mueller on Sept. 12, 2022. Martinka faces a maximum statutory penalty of 20 years in prison and a fine of $250,000 or twice the gain or loss, and a three-year term of supervised release. The actual sentence, however, will be determined at the discretion of the court after consideration of any applicable statutory factors and the Federal Sentencing Guidelines, which take into account a number of variables.

Mail fraud and conspiracy charges remain pending against Davis. The charges are only allegations; the defendant is presumed innocent until and unless proved guilty beyond a reasonable doubt.