Physician Partners of America LLC (PPOA), headquartered in Tampa, Florida, its founder, Rodolfo Gari, and its former chief medical officer, Dr. Abraham Rivera, have agreed to pay $24.5 million to resolve allegations that they violated the False Claims Act by billing federal healthcare programs for unnecessary medical testing and services, paying unlawful remuneration to its physician employees and making a false statement in connection with a loan obtained through the Small Business Administration’s (SBA) Paycheck Protection Program (PPP). Certain PPOA affiliated entities are jointly and severally liable for the settlement amount, including the Florida Pain Relief Group, the Texas Pain Relief Group, Physician Partners of America CRNA Holdings LLC, Medical Tox Labs LLC and Medical DNA Labs LLC.

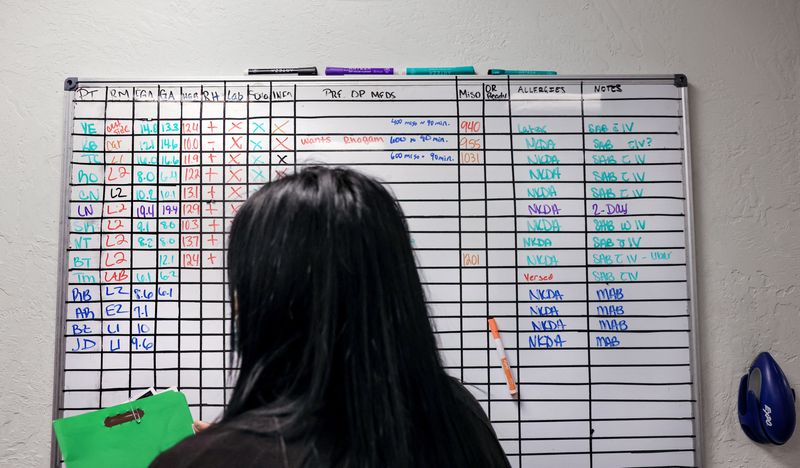

The United States alleged that PPOA caused the submission of claims for medically unnecessary urine drug testing (UDT), by requiring its physician employees to order multiple tests at the same time without determining whether any testing was reasonable and necessary, or even reviewing the results of initial testing (presumptive UDT) to determine whether additional testing (definitive UDT) was warranted. PPOA’s affiliated toxicology lab then billed federal healthcare programs for the highest-level UDT. In addition, PPOA incentivized its physician employees to order presumptive UDT by paying them 40% of the profits from such testing in violation of the Stark Law, which prohibits physicians from referring patients to receive “designated health services” payable to Medicare or Medicaid from entities with which the physician or an immediate family member has a financial relationship, unless an exception applies.

The United States further alleged that PPOA required patients to submit to genetic and psychological testing before the patients were seen by physicians, without making any determination as to whether the testing was reasonable and necessary, and then billed federal healthcare programs for the tests.

The United States further alleged that when Florida suspended all non-emergency medical procedures to reduce transmission of COVID-19 in March 2020, PPOA sought to compensate for lost revenue by requiring its physician employees to schedule unnecessary evaluation and management (E/M) appointments with patients every 14 days, instead of every month as had been PPOA’s prior practice. PPOA then instructed its physicians to bill these E/M visits using inappropriate high-level procedure codes. Moreover, the United States alleged that at the same time PPOA was engaged in this unlawful overbilling, PPOA falsely represented to the SBA that it was not engaged in unlawful activity in order to obtain a $5.9 million loan through the PPP. The settlement announced today resolves liability under the False Claims Act and the Financial Institutions Reform, Recovery and Enforcement Act (FIRREA) arising from the false claims submitted to federal healthcare programs for the E/M visits as well for PPOA’s false statement in connection with its PPP loan.

“Billing federal healthcare programs for services that providers know are unnecessary or unreasonable undermines the quality of care that patients receive and increases the costs of these taxpayer-funded programs,” said Principal Deputy Assistant Attorney General Brian M. Boynton, head of the Justice Department’s Civil Division. “The department is committed to ensuring that healthcare providers base their treatment decisions on their patients’ needs rather than their own financial interests.”

“Holding healthcare providers accountable for inflated claims and false statements helps ensure the integrity of the healthcare system as a whole,” said U.S. Attorney Roger B. Handberg for the Middle District of Florida. “Settlements like this one are an important step in that direction.”

Ad: Save every day with Amazon Deals: Check out today's daily deals on Amazon.

“Since the beginning of the pandemic, the SBA has been focused on providing relief swiftly, equitably and efficiently to millions of struggling small business owners – ensuring that relief has been distributed with the utmost integrity has been central to that mission under Administrator Guzman,” said General Counsel Peggy Delinois Hamilton for the SBA. “The SBA takes fraud seriously and will continue to make it our priority to work alongside the Office of the Inspector General to identify and address any potential fraud to ensure sound administration of relief programs.”

In connection with the settlement, PPOA also entered into a five-year Corporate Integrity Agreement (CIA) with the U.S. Department of Health and Human Services Office of Inspector General (HHS-OIG). Under the CIA, PPOA agreed to undertake significant compliance efforts, including: maintain a compliance department, medical director and oversight board; retain a compliance expert; provide management certifications; maintain written standards, training and education; obtain multiple annual claims reviews by an Independent Review Organization; establish a risk assessment and internal review process; and implement monitoring of testing referrals.

“When health care providers bill taxpayer-funded health care programs for medically unnecessary services, they divert government funds designed to assist business owners during this pandemic,” said Special Agent in Charge Omar Pérez Aybar of HHS-OIG. “Our agency will work with our law enforcement partners to thoroughly investigate health care fraud schemes.”

“This settlement allows OWCP to recover medical bill payments under the Federal Employees’ Compensation Act and return those funds to the Employees’ Compensation Fund,” said Director Christopher Godfrey of the Department of Labor (DOL) Office of Workers’ Compensation Programs (OWCP). “The Department of Labor’s Office of Inspector General, as well as various other agencies’ offices of inspector general (OIG), devote significant investigative resources to detecting cases of possible abuse within the FECA program, and this settlement demonstrates the commitment of the DOL and its OIG in helping to ensure that funds issued through the program are paid appropriately.”

“When actors within our health care system are focused on profit rather than patient care, it undermines the integrity of the medical decision-making process,” said Special Agent in Charge Cynthia A. Bruce of the Department of Defense Office of Inspector General, Defense Criminal Investigative Service (DCIS), Southeast Field Office. “DCIS will continue to work with our investigative partners to protect the funding entrusted to the Defense Health Agency that serves our military members and their families.”

“Veterans Affairs’ Community Care programs provide veterans and their families the ability to obtain critical healthcare services from providers within their own communities,” said Special Agent in Charge David Spilker of the Department of Veterans Affairs Office of Inspector General’s (VA OIG) Southeast Field Office. “This civil settlement reinforces the VA OIG’s commitment to safeguarding the integrity of VA’s healthcare programs and operations and preserving taxpayer funds.”

“When providers submit false claims for medically unnecessary tests, they are not only violating their patients’ trust but also compromising the integrity of the Federal Employees Health Benefits Program (FEHBP),” said Special Agent in Charge Amy K. Parker of the U.S. Office of Personnel Management, Office of the Inspector General (OPM OIG). “This settlement demonstrates the OPM OIG’s commitment to protecting patients from tests that are not medically reasonable or necessary and safeguarding the FEHBP from fraudulent claims.”

The civil settlement includes the resolution of claims brought under the qui tam or whistleblower provisions of the False Claims Act by Donald Haight, Dawn Baker, Dr. Harold Cho, Dr. Venus Dookwah-Roberts and Dr. Michael Lupi, who are current or former employees of PPOA or its affiliated entities. Under those provisions, a private party can file an action on behalf of the United States and receive a portion of any recovery. The qui tam cases are captioned United States ex rel. Haight v. Physician Partners of Am.; United States ex rel. Baker v. Physician Partners of Am LLC; United States ex rel. Lupi v. Physician Partners of Am. LLC; and United States ex rel. Dookwah-Roberts v. Physician Partners of Am. LLC.

The resolution obtained in this matter was the result of a coordinated effort between the Justice Department’s Civil Division, Commercial Litigation Branch, Fraud Section; the U.S. Attorney’s Office for the Middle District of Florida; HHS-OIG; VA OIG; DCIS; DOL OIG; and OPM OIG.

The investigation and resolution of this matter illustrates the government’s emphasis on combating healthcare fraud. One of the most powerful tools in this effort is the False Claims Act. Tips and complaints from all sources about potential fraud, waste, abuse and mismanagement can be reported to the Department of Health and Human Services at 800-HHS-TIPS (800-447-8477).

On May 17, 2021, the Attorney General established the COVID-19 Fraud Enforcement Task Force to marshal the resources of the Department of Justice in partnership with agencies across government to enhance efforts to combat and prevent pandemic-related fraud. The task force bolsters efforts to prevent fraud by, among other methods, augmenting and incorporating existing coordination mechanisms, identifying resources and techniques to uncover fraudulent actors and their schemes, and sharing and harnessing information and insights gained from prior enforcement efforts. For more information on the department’s response to the pandemic, please visit https://www.justice.gov/coronavirus. Tips and complaints from all sources about potential fraud affecting COVID-19 government relief programs can be reported by visiting the webpage of the Civil Division’s Fraud Section, which can be found here. Anyone with information about allegations of attempted fraud involving COVID-19 can also report it by calling the Department of Justice’s National Center for Disaster Fraud (NCDF) Hotline at 866-720-5721 or via the NCDF Web Complaint Form at: https://www.justice.gov/disaster-fraud/ncdf-disaster-complaint-form.

The matter was handled by Senior Trial Counsel David W. Tyler of the Civil Division and Assistant U.S. Attorney Lindsay Saxe Griffin for the Middle District of Florida.

The claims resolved by the settlement are allegations only and there has been no determination of liability.