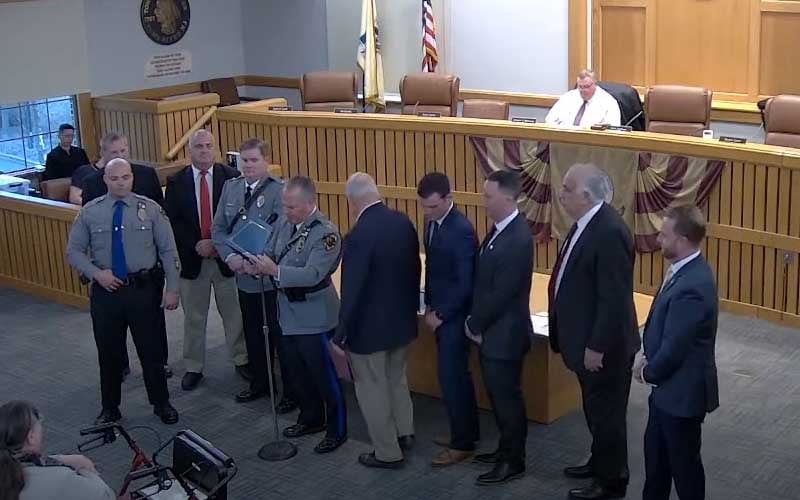

TOMS RIVER, NJ – Toms River Police Officer Michael Foye received a life-saving award from Police Chief Mitch Little Wednesday night for his actions on Saturday, March 16, 2019.

“Officer Foye rendered critical life-saving support in the form of CPR,” Chief Mitch Little said Wednesday. “Officer Foye is commended for his immediate response the give the infant the best chance of survival.”

On that day, at 5:45 PM Toms River police were dispatched to Vermont Avenue for an infant not breathing.

“Dispatch advised that a Hatzolah member was on scene stating that it was a 4-month-old baby boy who did not have a pulse, was not breathing and C.P.R. was in progress,” Toms River Police Department Spokeswoman Jillian Messina said in a statement. “Toms River Police Officers arrived on scene and in the events that followed, the professionalism, respect and teamwork demonstrated by all was undeniable. As a team, the dispatchers directed the call, Hatzolah and Officer Michael Foy performed CPR in the home, during the trot to the ambulance, and inside that ambulance to the hospital.”

According to an account of the incident, the police department reported the Medic on site acted as a team leader as he entered the rig.

Related: It is what it is, Toms River Council President says after seniors hit with 40% tax hike

“Lakewood and Toms River Police Officers shut down traffic lights as police units lead the ambulance to Monmouth Medical Center,” the department said. “At the hospital, support, genuine concern, respect, and compassion were shown to the family and the first responders were given respect and praise for their part in saving the child’s life. The baby was revived and airlifted to CHOP.”

“In a time of high stress and determination, everyone came together for that infant boy and did all they could do to save his life,” Chief Mitch Little said at the time. “What is seemingly “just their job” is so much more. We’d like to thank the family of this little boy for recognizing our team who was on call that day, they all came to say thank you and brought a beautiful lunch as a token of appreciation. When we all come together, miracles can happen.”