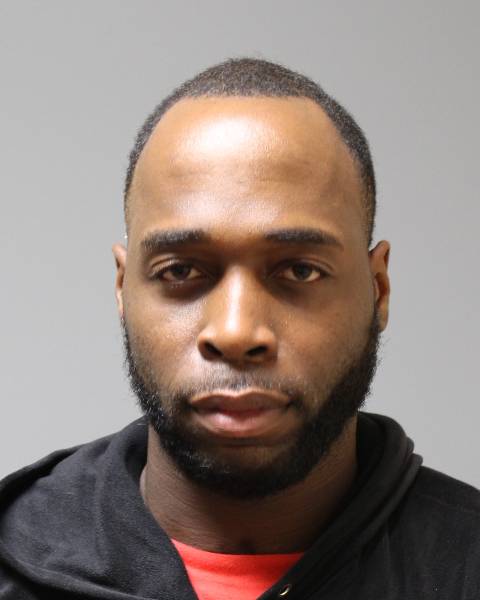

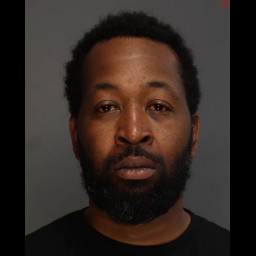

SUFFOLK COUNTY, N.Y. – Kason Parker, 35, of Albany, New York, unexpectedly pleaded guilty on Tuesday to second-degree murder charges on the first day of his trial, admitting to fatally stabbing Meghan Kiefer, 27, in 2021. District Attorney Raymond A. Tierney announced the conviction, stating that Parker is expected to be sentenced to 25 years to life in prison for his crime.

The case dates back to July 2021, when Kiefer was found dead in her apartment with multiple stab wounds. An investigation by local authorities led to Parker’s arrest, and he was charged with second-degree murder. Parker’s trial began yesterday, but after the prosecution’s opening statement, he changed his plea from not guilty to guilty.

Parker is due back in court on May 31, 2023, for sentencing, and the victim’s family is expected to make statements during the proceeding.