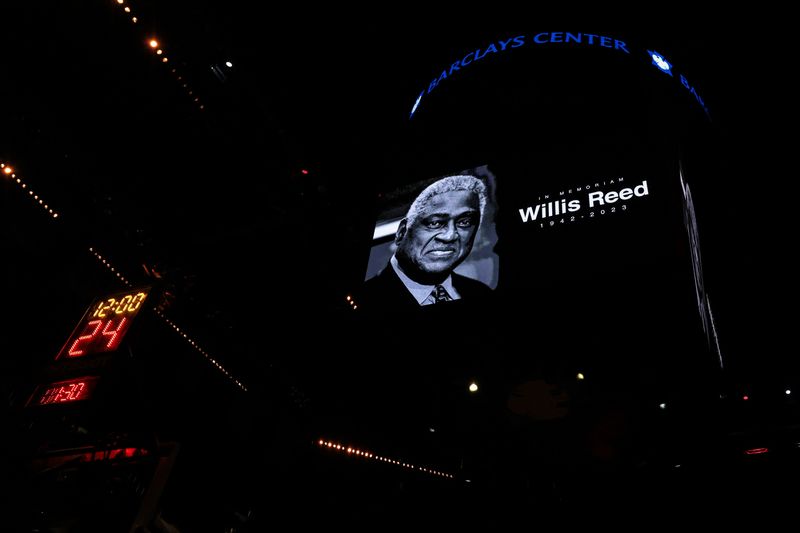

NEW YORK (Reuters) -Hall of Famer Willis Reed, the beloved former New York Knicks player who won two championships, has died at the age of 80, the National Basketball Retired Players Association said on Tuesday.

The seven-time All-Star spent his decade-long career with the Knicks, where he famously took the court in Game 7 of the 1970 NBA Finals against the Los Angeles Lakers despite suffering a leg injury earlier.

He barely played but the heroic effort whipped the crowd at Madison Square Garden into a frenzy, as he inspired his team mates to a 113-99 victory and vaulted himself into the pantheon of New York City sports greats.

“As we mourn, we will always strive to uphold the standards he left behind,” the Knicks said in a statement. “The unmatched leadership, sacrifice and work ethic that personified him as a champion among champions.

“His is a legacy that will live forever.”

Reed became the first to earn regular-season MVP, Finals MVP and All-Star MVP honors in one season in 1970, before leading the Knicks to their second championship in 1973.

Ad: Save every day with Amazon Deals: Check out today's daily deals on Amazon.

Beloved by fans and known affectionately as “the Captain”, he retired in 1974, having averaged 18.7 points and 12.9 rebounds per game, and was the first player for the Knicks to have his jersey retired by the team.

“My earliest and fondest memories of NBA basketball are of watching Willis, who embodied the winning spirit that defined the New York Knicks’ championship teams in the early 1970s,” NBA Commissioner Adam Silver said in a statement.

“He played the game with remarkable passion and determination, and his inspiring comeback in Game 7 of the 1970 NBA Finals remains one of the most iconic moments in all of sports.”

Reed returned to the Knicks to coach the team in the 1977-78 season. He later coached the then-New Jersey Nets.

(Reporting by Amy Tennery in New YorkEditing by Toby Davis)