The National Insurance Crime Bureau (NICB) today released its annualHot Wheelsreport, which identifies the 10 most stolen vehicles inthe United States. The report examines vehicle theft data submitted by law enforcement to the National Crime Information Center (NCIC) and determines the vehicle make, model, and model year most reported stolen in 2018.

Experience the interactive Multichannel News Release here:https://www.multivu.com/players/English/8429555-nicb-americas-10-most-stolen-vehicles/

Release Resources:national report|state report|infographic|2018 models

video 1(0:43 interview) |video 2(0:30 interview) |video 3(0:24 interview)

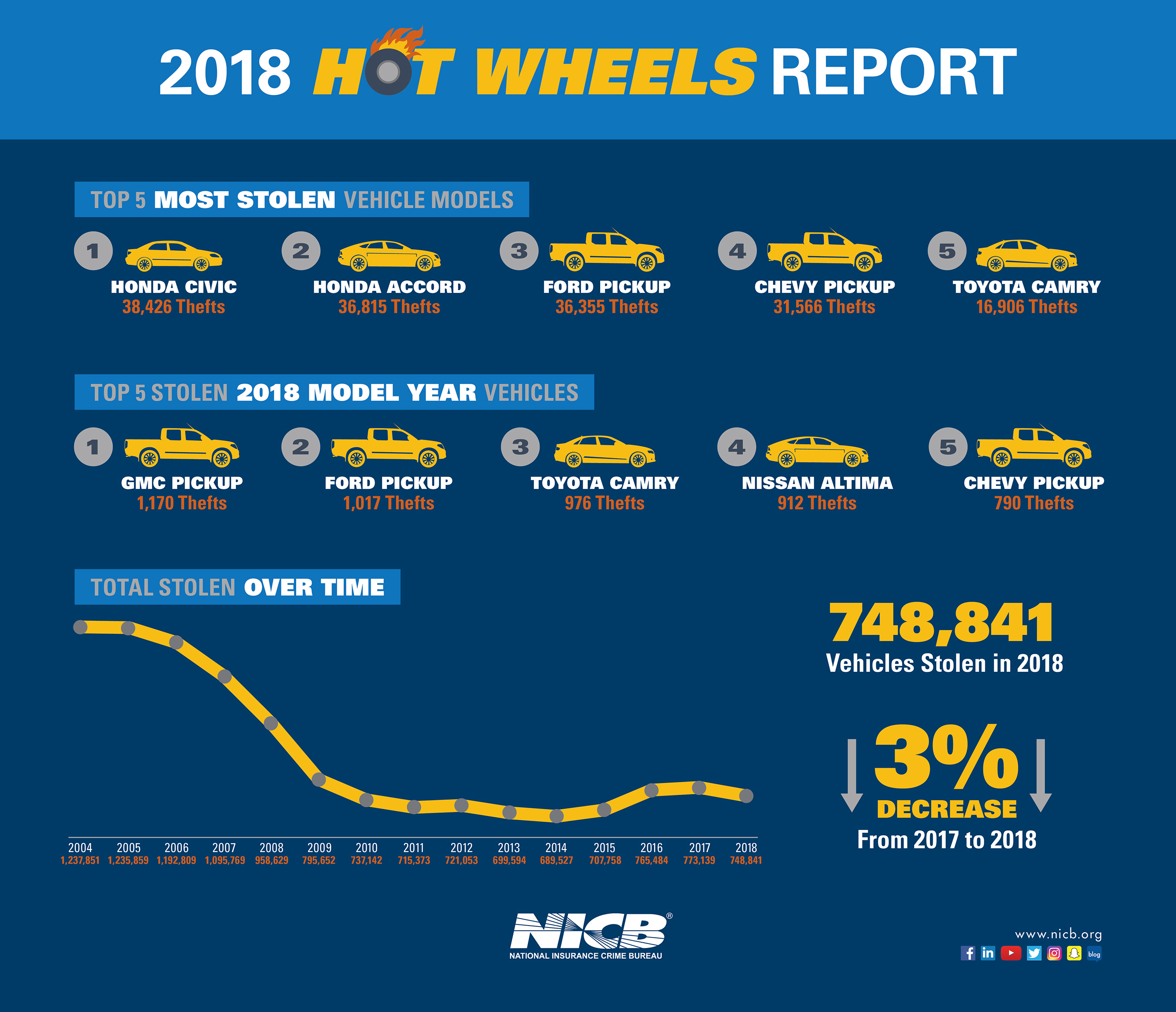

According to the FBI, in 2018, a total of 748,841 vehicles were stolen inthe United States, a 3% decline, and a return to the dominant downward trend we’ve experienced since entering the 21st century.

Included with today’s release is a list of the top 25, 2018 vehicle makes and models that were reported stolen in 2018.

For 2018, the most stolen vehicles in the nation were:

Rank | Make/Model | Model Year Most Stolen / (# Thefts) | Total Model Thefts |

1 | Honda Civic | 2000 (5,290) | 38,426 |

2 | Honda Accord | 1997 (5,029) | 36,815 |

3 | Ford Pickup (Full Size) | 2006 (3,173) | 36,355 |

4 | Chevrolet Pickup (Full Size) | 2004 (2,097) | 31,566 |

5 | Toyota Camry | 2017 (1,144) | 16,906 |

6 | Nissan Altima | 2017 (1,451) | 13,284 |

7 | Toyota Corolla | 2017 (1,034) | 12,388 |

8 | GMC Pickup (Full Size) | 2018 (1,170) | 11,708 |

9 | Dodge/Ram Pickup (Full Size) | 2001 (1,155) | 11,226 |

10 | Jeep Cherokee/Grand Cherokee | 2000 (646) | 9,818 |

The following are the top 10 2018 model year vehicles stolen during calendar year 2018:

Rank | Theft Year | Veh. Year | Make/Model | Total Thefts |

1 | 2018 | 2018 | GMC Pickup (Full Size) | 1,170 |

2 | 2018 | 2018 | Ford Pickup (Full Size) | 1,017 |

3 | 2018 | 2018 | Toyota Camry | 976 |

4 | 2018 | 2018 | Nissan Altima | 912 |

5 | 2018 | 2018 | Chevrolet Pickup (Full Size) | 790 |

6 | 2018 | 2018 | Hyundai Elantra | 775 |

7 | 2018 | 2018 | Ford Transit | 723 |

8 | 2018 | 2018 | Dodge Charger | 719 |

9 | 2018 | 2018 | Toyota Corolla | 699 |

10 | 2018 | 2018 | Chevrolet Malibu | 698 |

NICB recommends that drivers follow our four “layers of protection” to guard against vehicle theft:

Common Sense—the common sense approach to protection is the easiest and most cost-effective way to thwart would-be thieves. You should always:

- Remove your keys from the ignition

- Lock your doors/close your windows

- Park in a well-lit area

Warning Device —the second layer of protection is a visible or audible device which alerts thieves that your vehicle is protected. Popular devices include:

- Audible alarms

- Steering column collars

- Steering wheel/brake pedal lock

- Brake locks

- Wheel locks

- Theft deterrent decals

- Identification markers in or on vehicle

- VIN etching

- Micro dot marking

Immobilizing Device—the third layer of protection is a device which prevents thieves from bypassing your ignition and hot-wiring the vehicle. Some electronic devices have computer chips in ignition keys. Other devices inhibit the flow of electricity or fuel to the engine until a hidden switch or button is activated. Some examples are:

- Smart keys

- Fuse cut-offs

- Kill switches

- Starter, ignition, and fuel pump disablers

- Wireless ignition authentication

Tracking Device—the final layer of protection is a tracking device which emits a signal to police or a monitoring station when the vehicle is stolen. Tracking devices are very effective in helping authorities recover stolen vehicles. Some systems employ “telematics” which combine GPS and wireless technologies to allow remote monitoring of a vehicle. If the vehicle is moved, the system will alert the owner and the vehicle can be tracked via computer.

REPORT FRAUD:Anyone with information concerning insurance fraud or vehicle theft can report it anonymously by calling toll-free 800.TEL.NICB (800.835.6422)or submitting aformon our website.

ABOUT THE NATIONAL INSURANCE CRIME BUREAU:Headquartered inDes Plaines, Ill., the NICB is the nation’s leading not-for-profit organization exclusively dedicated to preventing, detecting and defeating insurance fraud and vehicle theft through data analytics, investigations, learning and development, government affairs and public awareness. The NICB is supported by more than 1,300 property and casualty insurance companies and self-insured organizations. NICB member companies wrote over$496 billionin insurance premiums in 2018, or more than 81 percent of the nation’s property/casualty insurance. That includes more than 92 percent ($254 billion) of the nation’s personal auto insurance. To learn more visitwww.nicb.org.