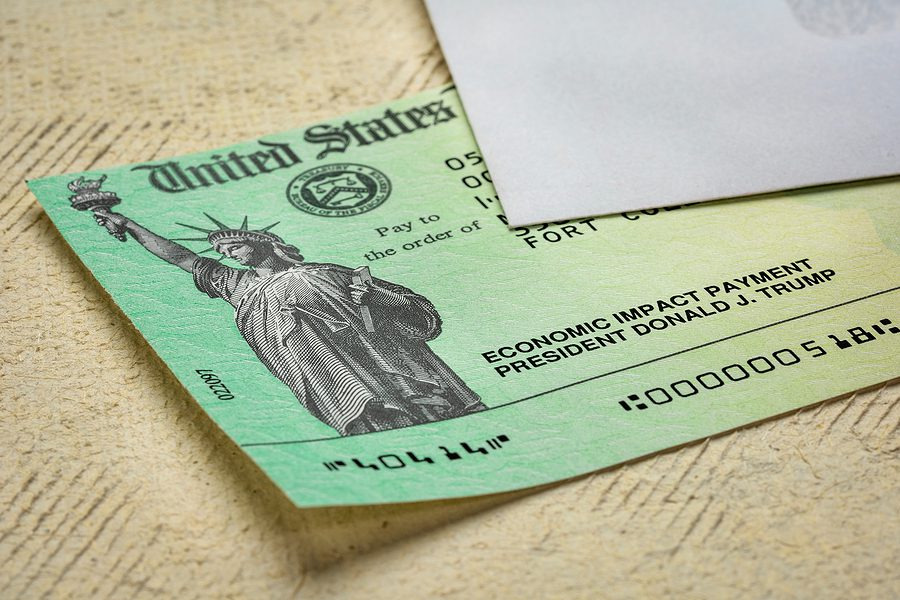

LOS ANGELES – A Santa Clarita Valley man was sentenced today to 51 months in federal prison for scheming to fraudulently obtain approximately $1.8 million in COVID-19 relief guaranteed by the Small Business Administration (SBA) through the Economic Injury Disaster Loan (EIDL) program and the Paycheck Protection Program (PPP).

The case is the result of a probe by Homeland Security Investigations (HSI) Los Angeles’ El Camino Real Financial Crimes Task Force and the Treasury Inspector General for Tax Administration.

Hassan Kanyike, 30, of Santa Clarita, was sentenced by U.S. District Judge Virginia A. Phillips, who also ordered him to pay a $20,000 fine and $1,302,550 in restitution to the SBA and four victim lenders. Kanyike pleaded guilty on March 29 to one count of wire fraud.

From April 2020 to June 2020, Kanyike submitted six fraudulent PPP loan applications and two fraudulent EIDL applications. The applications sought funds to purportedly pay the salaries of employees whom he claimed worked for two of his businesses. Kanyike successfully obtained approximately $1 million through four PPP loans, and another $300,000 through two EIDL loans.

In support of the fraudulent PPP loan applications, Kanyike submitted fake federal tax filings and payroll reports for a used-car business, the Van Nuys-based Falcon Motors. For example, in one loan application, Kanyike falsely claimed the business had 26 employees and an average monthly payroll of $168,000, and he submitted a fabricated IRS tax form claiming Falcon Motors had paid $2,022,300 to employees in 2019.

In reality, Falcon Motors had no employees on payroll. Kanyike further admitted that he obtained additional Employer Identification Numbers from the IRS in April and May 2020 so he could apply for multiple loans for the same used-car business. Kanyike then used a substantial portion of the PPP loan proceeds for his own personal benefit.

Kanyike schemed to fraudulently obtain eight loans totaling approximately $1.8 million, of which six loans worth a total of $1,302,550 were approved.

At the time of his arrest in December 2020, Kanyike had transferred approximately $762,000 to Uganda, his country of citizenship, from one of the business accounts that had received the loan proceeds, in violation of the terms of the PPP and EIDL program.

This case was prosecuted by the U.S. Attorney for the Central District of California’s Major Frauds Section and the Department of Justice Criminal Division’s Fraud Section.

HSI is the principal investigative arm of the U.S. Department of Homeland Security (DHS), responsible for investigating transnational crime and threats, specifically those criminal organizations that exploit the global infrastructure through which international trade, travel and finance move.

HSI’s Operation Stolen Promise combines HSI’s expertise in global trade, financial fraud, international operations and cyber-crime. The initiative focuses investigative efforts on financial fraud schemes, the importation of prohibited and fraudulent pharmaceuticals and medical supplies, websites defrauding consumers or facilitating illegal activity and any other illicit criminal activities associated with the virus that compromise legitimate trade, financial systems or endanger the public.

HSI encourages the public to report suspected illicit criminal activity or fraudulent schemes related to the COVID-19 pandemic, via email at Covid19Fraud@dhs.gov.