By Rodrigo Campos

NEW YORK (Reuters) – Emerging market equities and debt attracted the largest monthly net inflow in January in two years as better conditions allowed for blockbuster debt issuance while upbeat sentiment funneled cash toward Chinese stocks, the Institute of International Finance said on Wednesday.

The January figure of $65.7 billion net inflows outpaced the $30.9 billion for all of last year according to IIF data.

Debt securities outside of China raked in $44.6 billion, the largest monthly figure on IIF records back to 2018.

“The apparent slowdown in (developed market) interest rate hiking and a more favorable outlook have allowed some (emerging markets) to go back to issue fresh debt in the market,” said IIF economist Jonathan Fortun in a report.

The first week of the year saw a record of about $28 billion in issuance from emerging market sovereigns and companies.

“The recent rally in inflation-adjusted real yields has alleviated the burden on EM dollar credit,” Fortun wrote, adding that expectation for a decline in U.S. yields “(clears) the runway for a more positive picture for EMs.”

The dollar index fell 1.4% in January and for a fourth straight month, while the MSCI EM currency index rose 2.6% in January and over 7% over the past three months.

The U.S. Federal Reserve said in its Feb. 1 meeting it had turned a corner in the fight against rising prices, but after data on Tuesday showed inflation was slowing but remained high, the Fed is seen raising its policy rate at least twice more to the 5%-5.25% range -which could slow the cash flow to EMs.

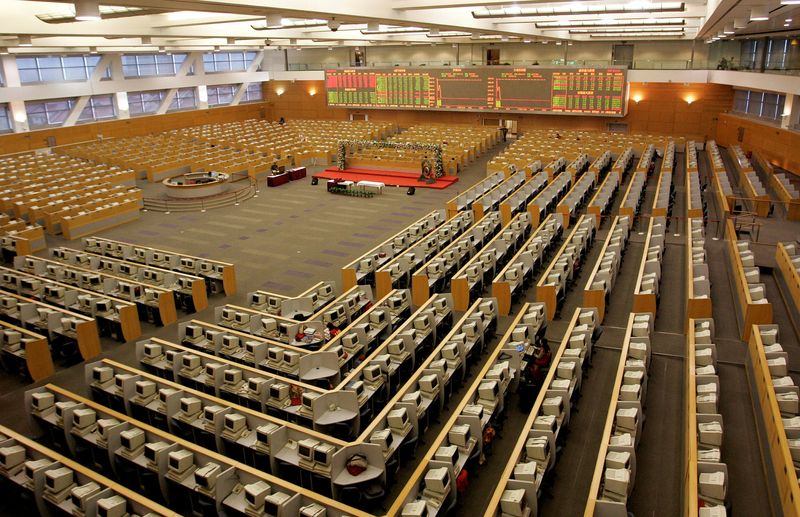

Flows to Chinese equities also posted a strong rebound last month, bringing in the largest inflow since December 2020.

“The relaxation of restrictions in China has boosted market sentiment” and allowed Chinese equities to pull in some $17.6 billion last month, the IIF report said.

Chinese debt posted a $2.5 billion outflow in January and has posted outflows in 10 of the past 12 months, the data show.

Regionally, Asia and Latin America saw the largest inflows last month with $34.4 billion and $15.9 billion respectively.

(Reporting by Rodrigo Campos, Editing by Nick Zieminski)