By Allison Lampert and Aditi Shah

PARIS/NEW DELHI (Reuters) – Standing at a small booth among a row of other Japanese aerospace suppliers at the Paris Airshow, Yoko Konno is excited at the prospect of new orders for her company, but frowns at long delays to get titanium and the rising cost of chemicals.

“It is challenging but it is a chance to get more business,” said Konno, a section manager at Japan’s Asahi Kinzoku Kogyo, Inc, which produces components and does chrome plating.

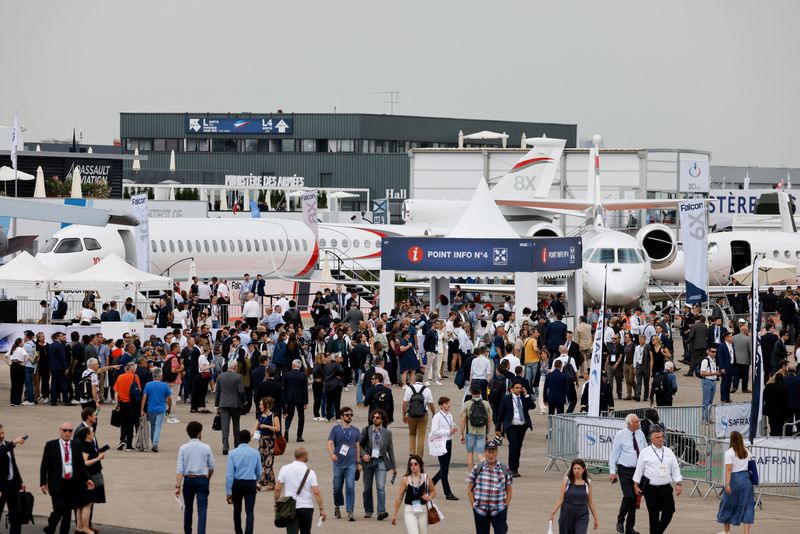

Far from the fighter-jet displays and blockbuster plane orders that grabbed headlines at the world’s largest air show this week, it’s the small and medium-sized suppliers dotting the sprawling exhibition halls that are garnering big attention from senior aerospace officials.

While bosses at Airbus and Raytheon Technologies see improvements, labor shortages and delays are expected to remain a key concern for planemakers and large suppliers for more than a year.

“There are issues and lack of capacity almost everywhere,” said Anne Brachet, executive vice president of Air France-KLM’s engineering and maintenance division.

The show is a test of the supply chain’s resilience, with some small and medium suppliers both hurting from higher costs and seeing opportunities as large players look for more sources to make parts and components to reduce risk.

Others are wary of making investments in new production without assurances that clients will stick around.

“It’s chaos, but everyone’s in the same boat,” said Liam Wiezak, business development manager at Britain’s Sigma Aero about the supply chain.

It’s raising concerns whether jetmakers Airbus and Boeing will be able to hit ambitious goals to ramp up output in order to meet delivery targets, particularly after the show saw orders for almost 1,000 jets from just two Indian carriers.

“Headlines may be dominated by news of record new orders but this is all but irrelevant in the short-medium term,” said Louis Knight, analyst at research firm Third Bridge.

“The bottlenecks, lead times, sourcing challenges and labor shortages continue to plague the industry, so – regardless of order intake – deliveries remain in full focus.”

Sigma Aero is seeing higher demand for the pipes, ducts and machines it produces for engines and airframes, but the time needed to buy certain raw materials has more than tripled, Wiezak said on the sidelines of the show.

MATERIALS, LABOR

Following the war in Ukraine, planemakers are trying to find alternatives to Russia’s VSMPO-Avisma, a key titanium producer to the aerospace industry, which is pushing up demand and creating long waits to buy from other providers.

“Now all the people who used to buy from Russia are shopping in our store,” said Nik Delic, president of New England Airfoil Products (NEAP) in Connecticut, which purchases U.S.-made titanium.

VSMPO, for example, is the sole source of particular high-strength titanium landing gear, despite increasing production from American, Chinese and Japanese mills, Knight said.

“While its market share may be reduced, it is very hard for the likes of Airbus, Boeing, and (engine maker) Safran to remove the dependency.”

Purchasing new machines would increase capacity to meet higher demand for the company’s airfoils used in engine compressors, but Delic wants a long-term commitment from buyers.

“I have 100 people whose livelihood depends on the success of the company.”

In certain cases, it takes longer to get parts or materials due to some suppliers exiting aerospace during the pandemic.

DCM Group in Canada’s Quebec produces parts welded from sheet metal which mostly need protective coatings.

But that segment of the industry is under stress because some companies have closed their doors since COVID-19, said Guillaume Gasparri, executive vice president, business development, for DCM.

Like parts and materials, a shortfall of labor is a key problem for suppliers who can’t offer comparable salaries to the large planemakers.

Patrice Arnoux, director of RecAero, said the manufacturer of parts and components had its own training program that takes just over a year to produce workers for the company and others in France’s aerospace hub around Toulouse.

Most of the 30 participants this year are unemployed.

“The needs are enormous,” he said, adding RecAero was looking for 30 workers. “If we are looking for 30 people, imagine Airbus and Safran.”

Some small and medium-sized suppliers in India see opportunities from the jet buying spree of their local airlines.

Ankit Patel, founder and director of Ankit Fasteners with about 450 employees, was already looking to double capacity in the next three or four years.

“There is a euphoria around India,” said Patel, whose company supplies fasteners like screws and bolts to Airbus and Boeing. “Now’s the time to capitalise, to say yes, we have capacity on the ground, Airbus and Boeing, look at us we can deliver.”

(Reporting by Allison Lampert in Paris and Aditi Shah in New Delhi; Editing by Mark Potter)