By Pablo Mayo Cerqueiro and Amy-Jo Crowley

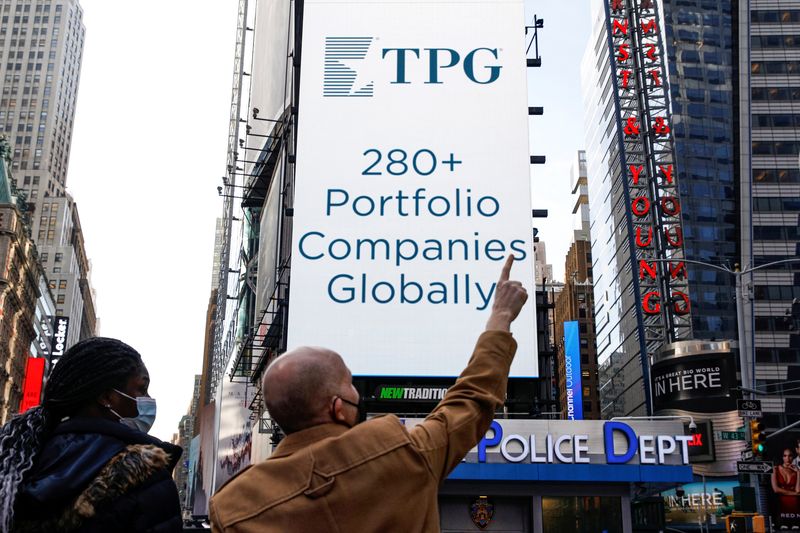

LONDON (Reuters) – Buyout houses including Blackstone Inc. and TPG Inc. are evaluating competing bids for a U.S. fund administrator, in a deal that may value the company at as much as $1.7 billion, two people familiar with the matter told Reuters.

Boston, Massachusetts-based Standish Management, a service provider to the buyout industry, has been working with advisers at Morgan Stanley to bring in a private equity backer, said the people, who spoke on condition of anonymity.

Blackstone and TPG are reviewing whether to proceed with firm offers after an initial round of bids, the people said. Rival deal house Thomas H. Lee Partners (THL) has also shown interest in the company, one of them added.

Spokespeople for Standish, Morgan Stanley, Blackstone, TPG and THL declined to comment.

Standish, which is controlled by a group of employees, provides outsourced operations-type services like accounting and reporting to investment funds.

Led by CEO and chair Robert Raynard, the company oversees around $450 billion of client assets, with private capital as its core focus, according to its website.

The business is expected to post earnings before interest, tax, depreciation and amortization (EBITDA) of around $70 million for 2023, the people said.

Private equity firms see fund administrators not just as contractors but as an investment case, thanks to their predictable income and ability to grow via debt-fueled acquisitions.

Most large players are now in private equity hands, such as Bermuda-based Apex Group and U.S.-based Gen II, making sizeable independent companies like Standish scarce.

Those coveted assets have previously been bought and sold at hefty multiples of more than 20 times their EBITDA.

However, a slowdown in private equity fundraising amid economic uncertainty could weigh on buyers’ minds, one of the people said.

(Reporting by Pablo Mayo Cerqueiro and Amy-Jo Crowley in London; Editing by Elisa Martinuzzi and Chizu Nomiyama)