By Michael S. Derby

NEW YORK (Reuters) – Comments over the weekend from a key Federal Reserve official have shed new light on how the central bank might end its ongoing effort to shrink its bond holdings, causing some market participants to revise views on the process’ endgame.

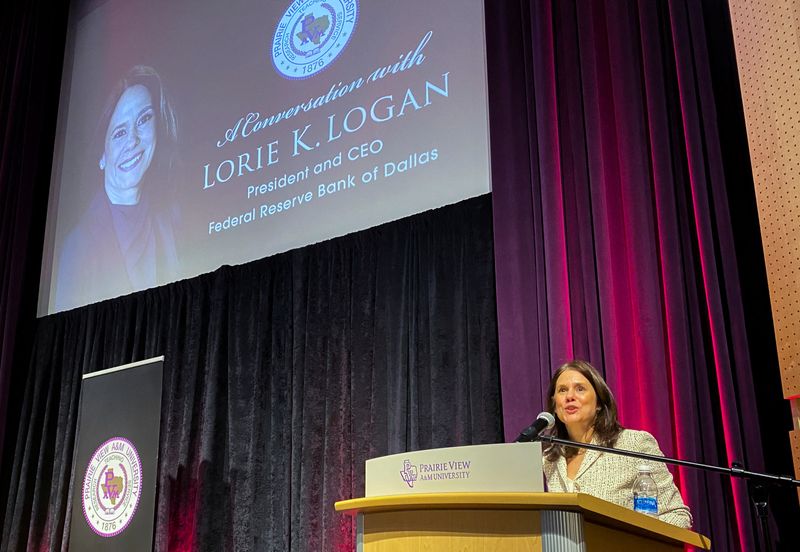

Speaking on Saturday, Dallas Fed President Lorie Logan explained how contracting liquidity in money markets may sway the outlook for what’s commonly referred to as quantitative tightening, or QT. Logan’s voice on the issue is notable because before taking over the reins of her bank in 2022, she managed the New York Fed’s massive holdings of cash and securities and implemented the monetary policy decisions of the rate-setting Federal Open Market Committee.

QT complements aggressive Fed rate rises aimed at combating high levels of inflation and involves the central bank shedding Treasury and mortgage bonds it bought to provide stimulus and stabilize markets during the early stages of the coronavirus pandemic.

The Fed doubled the size of its balance sheet between the spring of 2020 and the summer of 2022, when its holdings topped out at $9 trillion. Since 2022, the Fed has been allowing just under $100 billion per month in Treasury and mortgage bonds to mature and not be replaced, and that’s caused Fed holdings to shrink to $7.7 trillion.

The Fed wants bank liquidity at “ample” levels that avoids dislocations in money markets and affords it firm control over short-term rates. But outside of saying the process has a long way to go, Fed officials thus far offered only cursory guidance about how they’ll end QT.

The almost certain end of Fed rate rises and the prospect of rate cuts this year have put the outlook for the balance sheet at the forefront of markets’ attentions. Markets have been closely watching the rapid rundown in what’s called the Fed’s overnight reverse repo facility, or ON RPP, as a barometer for the liquidity the Fed wants to remove on the way to stopping QT.

“In my view, we should slow the pace of runoff as ON RRP balances approach a low level,” Logan said. “Normalizing the balance sheet more slowly can actually help get to a more efficient balance sheet in the long run” by making it easier for financial firms to adjust their individual liquidity levels, she said. Logan also noted that there are signs liquidity is getting tighter for banks.

SAME PLACE, DIFFERENT PACE

The process Logan describes echoes the last time the Fed shrunk its holdings, where it slowed the pace of the drawdown before bringing it to a close. Some economists now believe that while the ultimate destination for Fed holdings will be the same, it may take a touch longer to get there.

Logan’s comments indicated Fed officials “could start discussing slowing the pace of balance sheet runoff and then slow it a bit earlier,” Goldman Sachs economists said in a note. “But in that case, runoff should last a bit longer and the terminal size of the balance sheet should end up in roughly the same place, so the macroeconomic effects of starting earlier should be very minor.”

Analysts at research firm Evercore ISI said “Logan is not signaling an early end to QT” while noting market developments could still cause such a thing. Instead, they viewed her comments as providing a more fleshed-out roadmap for how the Fed will manage an end to QT.

“The Fed is paying attention to [the Secured Overnight Financing Rate] and QT evolution will be guided as much or more by price signals as quantity targets,” they wrote, adding “the timeline for agreeing internally, communicating and then executing a slowdown in the QT pace is speeding up a bit,” and it remains likely a tapering of QT will start in summer and the effort will end at the close of the year.

Evercore’s view jibes with a survey of Wall Street banks, which projected ahead of the Fed’s December policy meeting that QT will end in the fourth quarter with Fed holdings at $6.75 trillion, with bank reserves at $3.125 trillion and the Fed’s reverse repo facility holding $375 billion.

That said, Bank of America economists now project Fed officials will announce a tapering of the drawdown at the March FOMC meeting, while holding onto the view QT will end in summer.

There remain considerable devils in the details of how the Fed will shift gears, some noted, as the Fed still owns a lot of mortgages amid a desire to get its holdings back to all government bonds, so it’s possible decisions on tapering and halting may focus squarely on Treasury securities.

(Reporting by Michael S. Derby; Editing by Andrea Ricci)