By Trevor Hunnicutt and Jeff Mason

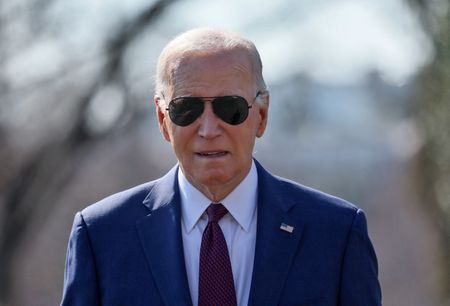

CULVER CITY, California/WASHINGTON (Reuters) -President Joe Biden said on Wednesday his administration is cancelling $1.2 billion worth of student loans for nearly 153,000 people who are eligible under a program used to make good on his promises to increase loan forgiveness.

Biden, a Democrat, last year pledged to find other avenues for tackling debt relief after the Supreme Court in June blocked his broader plan to cancel $430 billion in student loan debt.

Left-leaning progressive and young voters, whose support Biden needs to win re-election in November, have been vocal in advocating for student loan forgiveness on a wide scale. Republicans largely oppose such actions.

“While a college degree is a ticket to a better life, that ticket is too expensive,” Biden said during a trip to California that has been focused primarily on fundraising for his re-election campaign.

Biden said the latest round of debt relief would be “a huge help to graduates of community college and borrowers with smaller loans, putting them back on track faster for debt forgiveness than ever before.”

The administration has now canceled some $138 billion in student debt for nearly 3.9 million people through executive actions, the White House said.

The latest announcement applies to people enrolled in a repayment program known as Saving on a Valuable Education (SAVE) and covers those who borrowed $12,000 or less who have been repaying the money for at least 10 years.

The SAVE plan, according to the White House, takes into account a debt holder’s income and family size when setting monthly payments and makes sure balances cannot grow from unpaid interest if the borrowers are making regular payments.

Recipients of the relief will receive an e-mail from Biden.

“I hope this relief gives you a little more breathing room,” Biden writes in the note, provided by the White House. “I’ve heard from countless people who have told me that relieving the burden of their student loan debt will allow them to support themselves and their families, buy their first home, start a small business, and move forward with life plans they’ve put on hold.”

(Reporting by Jeff Mason and Trevor Hunnicutt; Editing by Miral Fahmy and Alistair Bell)