JACKSON, NJ – At Tuesday night’s meeting, the Jackson Township Council announced that, amid staffing changes and after thoroughly reviewing the budget, they will be holding a hearing on the 2025 municipal budget at the next scheduled township council meeting.

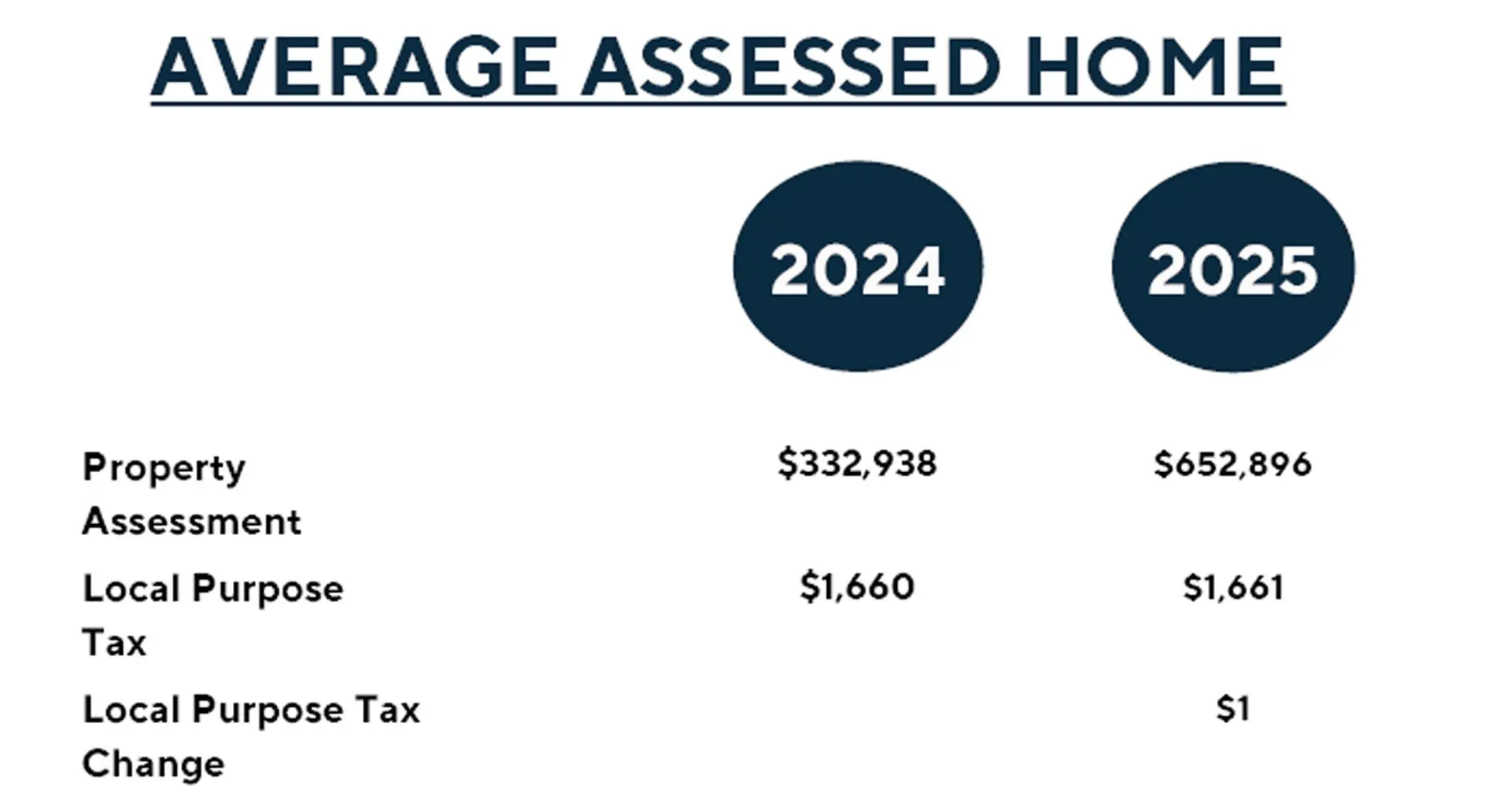

The good news is that municipal taxes are not increasing.

Council President Jennifer Kuhn and Council Vice President Mordechai Burnstein acknowledged that the township’s hiring of a new Chief Financial Officer and Business Administrator has led to unexpected delays, along with the council’s desire to read through the entire budget with a fine-toothed comb, which has taken some time, but all parties are moving forward, together on introducing and passing the municipal budget.

In the end, the wait was worth it for taxpayers.

Council President Jennifer Kuhn presented the public with a timeline of events to help residents better understand the process involved, and the problems that arose during this year’s budget cycle.

- January 27th – The council received the budget from the mayor’s office.

- February – The council met and spoke with Mayor Reina several times to discuss the budget and items within the budget.

- In March, former Business Administrator Terrance Wall resigned. At one public meeting, he ripped up a contract to hire a new Chief Financial Officer, delaying the process.

- A new CFO was hired by the township on March 27th, who started on April 28th

- A new business administrator, Lavon Phillips, was hired on June 26th.

- The council began working with Mr. Phillips, the new CFO, and the Mayor’s office closely to advance the budget process.

- Throughout the summer, all parties worked diligently and together to audit the budget and find more savings for the township.

- The township council and mayor’s office, together, presented full transparency during the process which led to the delay in the budget adoption process.

Mayor Michael Reina noted in an email that he was “Looking forward to finally having a council engaged in the budget process.”

The good news is, taxes will remain stable this year, and the township council found an extra $1.4 million of previously funded money that fell through the cracks and has allocated that money to reinvest into its senior center, police department, and public parks, to help further maintain a stable tax rate for residents.

“This budget keeps taxes flat and allows us to continue to improve our recreation services, parks and police department,” said Kuhn, who also serves on the newly created recreation advisory committee. “I look forward to meeting with the committee to continue improving these services and repairing and replacing aging infrastructure across the township.”

The Jackson Township Police Department continues to hire new police officers at a record level. This year, the department was also able to upgrade its police cruiser fleet, while lowering the cost per vehicle over years past.

Employee Changes Delayed Budget Process

Kuhn said the new CFO’s hiring was placed on the agenda in March but did not officially begin until April 28. A key meeting with the auditor, the CFO, and an interim CFO took place on May 2, when the council identified the $1.4 million.

Council Vice President Mordechai Burnstein opened the discussion by thanking the mayor’s staff and pushing back against suggestions that the council had acted without the administration’s input.

“This council has been working closely together as one council, and with the mayor’s office to present the best budget for the township and for the people of Jackson,” Burnstein said. “Anyone who says otherwise is simply lying, and has no idea how this process works.”

The negotiations between the council and the administration were tough this year, and compromises were made by both branches of government. The mayor thanked the council for being the first governing body to engage in the budget process actively.

Councilman Giuseppe Palmeri met with the CFO and auditor to thoroughly examine the budget.

“Together, we went line by line through the budget to ensure it was a comprehensive and smart fiscal plan for the township,” Palmeri said. “While the process took longer than in previous years, this is the first time in a decade that a sitting council took the due diligence to go line by line.”

“We’re proud of the budget,” Kuhn said. “All sides made compromises that will benefit the township.”

Burnstein agreed that the sign of a good negotiation is that each side compromised and, in the end, the adminstration and council were united in the decisions made in the final budget presentation.

Both leaders emphasized that the council and administration continue to work together and are eager to introduce the budget formally at the next meeting.

Open Space Funds Protecting Land From Development

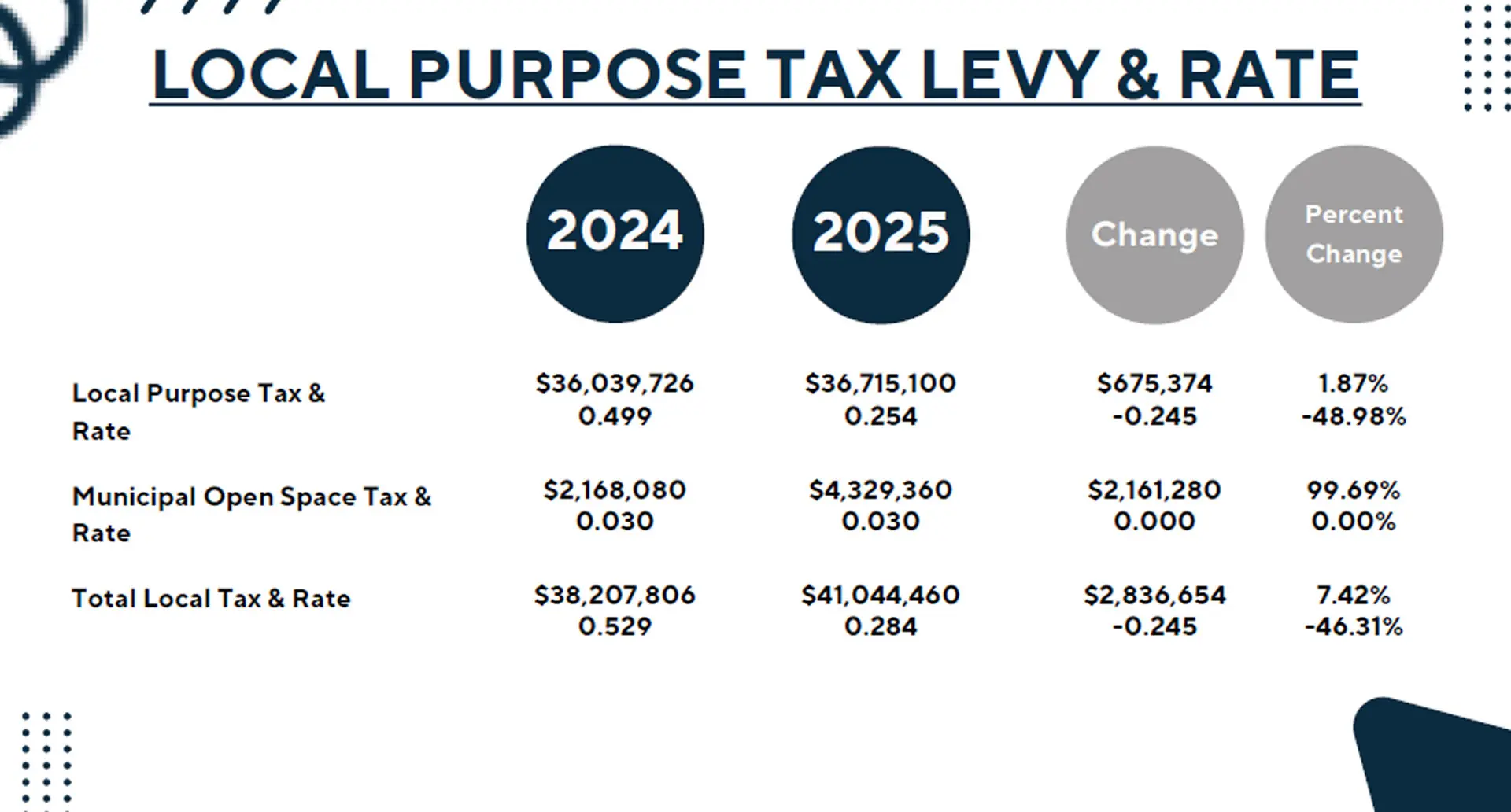

While the budget remains flat in spending compared to last year’s budget, residents will see an increase in open space revenue due to the 2001 and 2004 Open Space Tax referendums, which the voters of Jackson approved.

In 2001, Jackson voters petitioned for a 1.5 cents per $100 assessed value Open Space Tax through a ballot referendum vote. In 2004, residents returned to the ballot box to approve a 3-cent per $100 assessed value Open Space Tax. This tax cannot be changed by the mayor’s office or council, only through an election ballot referendum.

“The purpose of the twenty-year-old Open Space Tax is to set aside money to purchase land and to protect it from development. That’s what we are doing. We have been working to identify properties we can purchase to save from development and preserve as open space for generations to come,” Kuhn said. “It is our primary tool being used to permanently protect our open spaces from development. We will have some big news on new purchases this year across the township.”

The council also noted that while the municipal tax rate was held firm, county, school board, and fire districts tax rates are determined by those entities and are beyond the scope and jursidiction of the township council. For information about those budgets and taxes, residents are advised to contact the appropriate taxing authorities.