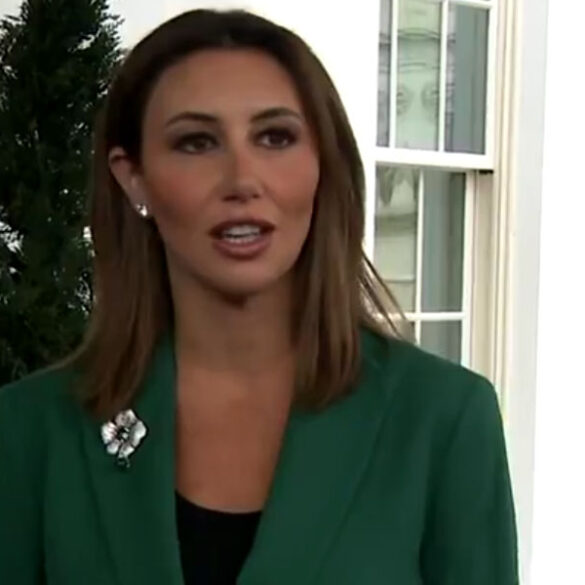

DOJ defends Alina Habba’s appointment as New Jersey U.S. attorney in court challenges

Philadelphia, PA

The Department of Justice returned to court to uphold Alina Habba’s appointment as acting U.S. attorney for New Jersey. Criminal defendants argue her appointment was unlawful, claiming it disqualifies her from prosecuting them.

A panel from the 3rd U.S. Circuit Court of Appeals, composed of Judges L. Felipe Restrepo, D. Michael Fisher, and D. Brooks Smith, questioned the legality of Habba’s appointment. They explored the intersection of federal statutes regarding the appointment of U.S. attorneys, which must be confirmed by the Senate.

Defendants Julien Giraud Jr., Julien Giraud III, and Cesar Pina contended that Judge Matthew Brann of the Middle District of Pennsylvania correctly determined that Habba was not lawfully serving. The DOJ countered that Brann’s decision would impede the government’s ability to fill thousands of important positions.

Judge Brann did not dismiss the indictment against the defendants but noted that the executive branch operated through novel legal methods in appointing Habba. The DOJ cited 5 U.S. Code § 3345 and the Federal Vacancies Reform Act as the basis for her role as acting U.S. attorney.

Habba, once a personal attorney for Donald Trump, was first named interim U.S. attorney in March. Her temporary appointment allowed for a 120-day tenure, which had to conclude with Senate confirmation or a federal court appointment.

Throughout her interim period, Habba’s nomination remained pending in the Senate, leading to federal judges appointing Desiree Grace as U.S. attorney. Following Trump’s decision to withdraw Habba’s nomination, she resigned from the interim position and was named the first assistant.

Attorney General Pam Bondi reacted by dismissing Grace, asserting that rogue judges disrupted Trump’s powers. Habba subsequently secured a position as a “Special Attorney to the United States Attorney General.”

During arguments on Monday, Henry Whitaker from the DOJ defended Habba’s appointment, stating it was within statute. However, he acknowledged that the circumstances surrounding her appointment were unique.

The panel probed whether the sequence of events surrounding Habba’s appointment posed serious constitutional implications. Judge Smith remarked that the case involved fundamental issues surrounding the appointment of U.S. attorneys and Separation of Powers.

Whitaker maintained that Habba could fulfill her role without being subject to time limits as a special attorney. He argued the statutes were being applied properly, though he recognized that specific precedents were lacking.

Lawyer Abbe Lowell, representing the defendants, criticized the legal framework surrounding Habba’s appointment. He claimed it allowed an individual to operate indefinitely without Senate confirmation.

The court heard claims from amicus James Pearce, representing the Association of Criminal Defense Lawyers in New Jersey. Pearce stressed that endorsing this legal maneuver could lead to a shadow government of delegated U.S. attorneys.

Whitaker contended that precedents exist for delegated authority under federal law. He noted that challenges to Habba’s appointment were unprecedented and had emerged from unique circumstances.

The implications of this ruling could significantly impact future appointments of acting U.S. attorneys across the country. The case highlights ongoing tensions between judicial authority and executive power in appointing key government officials.