HOWELL TOWNSHIP, NJ – A house fire at 13 Woodstown Drive prompted a rapid response from the Howell Township Police Department at approximately 3:35 PM today.

Upon arrival, officers reported the residence was fully engulfed in flames. Thankfully, all occupants evacuated safely without injuries.

Firefighting units from Adelphia Fire, Squankum Fire, Southard Fire, Jackson Station 55, and Freehold Township Independent Fire worked together to extinguish the fire. Support was also provided by Howell Township Police EMS and Howell Township First Aid.

Currently, the Howell Township Fire Bureau and the Monmouth County Fire Marshal are investigating the cause of the fire. No injuries were reported among the responding emergency personnel.

- No Risk to Water Supply After Dead Geese with Suspected Avian Flu Found at Monmouth County Reservior

MIDDLETOWN, NJ — New Jersey environmental officials are monitoring an active outbreak of Highly Pathogenic Avian Influenza (HPAI), also known as H5N1, following reports of sick and dead birds at multiple locations across the state, including Monmouth and Gloucester counties.

The New Jersey Department of Environmental Protection (NJDEP) confirmed that avian influenza has been circulating in wild birds throughout all 21 counties and continues to be tracked by NJDEP Fish & Wildlife in coordination with federal partners.

At the Swimming River Reservoir in Monmouth County, more than 100 Canada geese have reportedly died in what officials suspect is part of the broader H5N1 outbreak.

In Gloucester County, hazmat crews responded Tuesday morning to Alcyon Lake in Pitman after reports of dozens of sick and dead geese. Gloucester County Office of Emergency Management officials estimated between 50 and 75 dead birds at that site, though no final count has been released.

DEP: Outbreak Primarily an Animal Health Issue

In a public advisory, NJDEP Fish & Wildlife said the ongoing outbreak is primarily an animal health issue and currently poses a low risk to the general public. The U.S. Centers for Disease Control and Prevention has similarly stated that the current strain circulating in wild birds presents limited risk to human health.

Officials noted that while HPAI can infect humans in rare circumstances, transmission typically involves prolonged, unprotected contact with infected birds.

Typical symptoms observed in birds include:

- Diarrhea

- Nasal discharge

- Coughing or sneezing

- Neurological symptoms such as incoordination

- Sudden death without visible warning signs

Residents who encounter groups of five or more sick or dead birds are urged to report findings through the state’s Wild Bird Disease Reporting Form.

Drinking Water Supply Not Impacted

Concerns have also been raised about the Swimming River Reservoir, which supplies treated drinking water to approximately 300,000 residents in eastern Monmouth County, including Middletown, Red Bank, Holmdel, and Colts Neck.

New Jersey American Water, which manages the reservoir, operates continuous monitoring and conventional water treatment systems that include disinfection processes effective at neutralizing influenza viruses.

State officials say there is no documented risk to the public drinking water supply.

Public health authorities emphasize that municipal treatment processes are designed to remove or inactivate viruses and other pathogens. There is no evidence that avian influenza spreads through properly treated drinking water.

Precautions for Residents

Officials advise residents to:

- Avoid direct contact with sick or dead birds

- Keep pets away from wildlife carcasses

- Report clusters of bird deaths to NJ Fish & Wildlife

- Consume only properly cooked poultry and pasteurized dairy products

State officials also confirmed that as of today, no human cases linked to this outbreak have been reported in New Jersey.

- Over 100 Canadanian geese found dead at Monmouth reservoir amid suspected bird flu outbreak

MIDDLETOWN, NJ – Wildlife officials are investigating a mass die-off of more than 100 Canada geese at the Swimming River Reservoir in Monmouth County, believed to be linked to an outbreak of highly pathogenic avian influenza (H5N1) spreading across New Jersey.

Residents near the reservoir began reporting dead and dying geese over the past week, with drone footage showing visibly sick birds spinning in circles and tilting their heads — neurological symptoms consistent with the bird flu strain that has devastated waterfowl populations nationwide. Officials have since confirmed similar cases in other counties, including Mercer, where a recent outbreak in Allentown tested positive for the same virus.

The New Jersey Department of Environmental Protection and U.S. Department of Agriculture are monitoring the situation closely. Authorities say at least two bald eagles in the area are also believed to have died from the virus.

Officials warn residents to avoid contact with sick birds

Health officials stress that the current outbreak poses little to no risk to humans and does not affect the region’s drinking water supply. Still, the public is urged not to touch or handle any dead or sick birds and to keep pets away from the shoreline and affected parks.

Some township parks and reservoirs have been temporarily closed as cleanup and testing continue. Wildlife crews are collecting carcasses for analysis to confirm the scope of the infection.

Key points:

- More than 100 dead or dying geese found at the Swimming River Reservoir in Middletown.

- Officials suspect highly pathogenic avian influenza (H5N1) as the cause.

- Residents warned to avoid handling sick or dead birds and keep pets away.

Bird flu continues to spread across New Jersey

The H5N1 avian influenza strain has been detected in several wild bird populations across the state in recent months, raising concerns about its impact on native species, particularly raptors that feed on infected waterfowl. The virus, which spreads rapidly among migratory birds, has led to similar die-offs in neighboring states and remains under federal surveillance.

State officials say they will continue tracking wildlife health data and coordinating with federal partners to contain the outbreak. For now, residents are urged to report unusual bird deaths to the New Jersey Division of Fish and Wildlife.

Read more about related topics:

Wildlife authorities are urging vigilance as the avian flu continues to spread across New Jersey.

- Cold Stone Creamery launches two sweet new flavors for spring

FREEHOLD, NJ – Spring is officially in full bloom at Cold Stone Creamery, and ice cream lovers across New Jersey can celebrate the season with two fresh new flavors now available for a limited time at locations in Freehold and Brick.

The popular dessert chain has introduced the Lemon Berry Batter Creation and the Berry Best S’More Creation, both available through May 12, 2026. These limited-edition treats bring bright, fruity flavors to Cold Stone’s signature hand-mixed ice cream lineup, designed to capture the fun and freshness of spring.

The Lemon Berry Batter features Lemon Cake Batter™ Ice Cream blended with Lemon OREO Cookies, Lemon Pie Filling, and Strawberries. For fans of classic campfire desserts, the Berry Best S’More combines Strawberry Marshmallow Ice Cream with Fudge, Marshmallow Cream, and Graham Cracker Pie Crust.

House fire displaces family in howell - photo authorized for use by and/or licensed by shore news network Seasonal treats bring a taste of spring to New Jersey

“Spring is a time for bright flavors and a little indulgence,” said Courtney Maxedon, Vice President of Marketing and Digital Strategy at Kahala Brands™, parent company of Cold Stone Creamery. “These seasonal treats give our guests a delicious way to celebrate the season.”

Both Cold Stone Creamery creations will be available nationwide, but New Jersey fans can enjoy them now at the chain’s local shops in Freehold and Brick. Each flavor is handcrafted fresh in-store daily using Cold Stone’s signature granite-stone mixing technique.

- Lemon Berry Batter and Berry Best S’More available through May 12

- Featured at Cold Stone Creamery shops in Freehold and Brick

- New limited-time ice creams inspired by lemon, berry, and marshmallow flavors

For more details, visit ColdStoneCreamery.com and check out local listings for upcoming promotions in Freehold and Brick.

Sweet spring flavors delight Cold Stone fans statewide

- Burglary blitz hits senior complex as suspect posed as contractor

Man charged in Tinton Falls burglary scheme targeting seniors at Sea Brook Village

Tinton Falls, NJ – A two-month investigation led to the arrest of a Lakehurst man accused of posing as a handyman to enter apartments at Sea Brook Village, where police say he stole jewelry and other items valued at roughly $30,000.

Investigators identified Parry L. DuPont, 54, as the suspect in a series of incidents between December and February. Police reported that DuPont disguised himself as a contracted handyman to gain access to residences on the Essex Road property. Once inside, he allegedly stole jewelry and miscellaneous belongings from residents.

DuPont was taken into custody, processed, and transported to the Monmouth County Correctional Institution. He is charged with five counts of third-degree burglary and theft by unlawful taking.

Detectives are continuing to review the case. Anyone with information is asked to contact Det. Cpl. James Sapia at 732-542-3400 ext. 464 or email jsapia@tfpolice.org. Police emphasized that DuPont is presumed innocent unless proven guilty in court.

——

Key Points- Lakehurst man charged in burglary scheme at Sea Brook Village

- Police say suspect posed as handyman to access apartments

- Stolen property valued at approximately $30,000

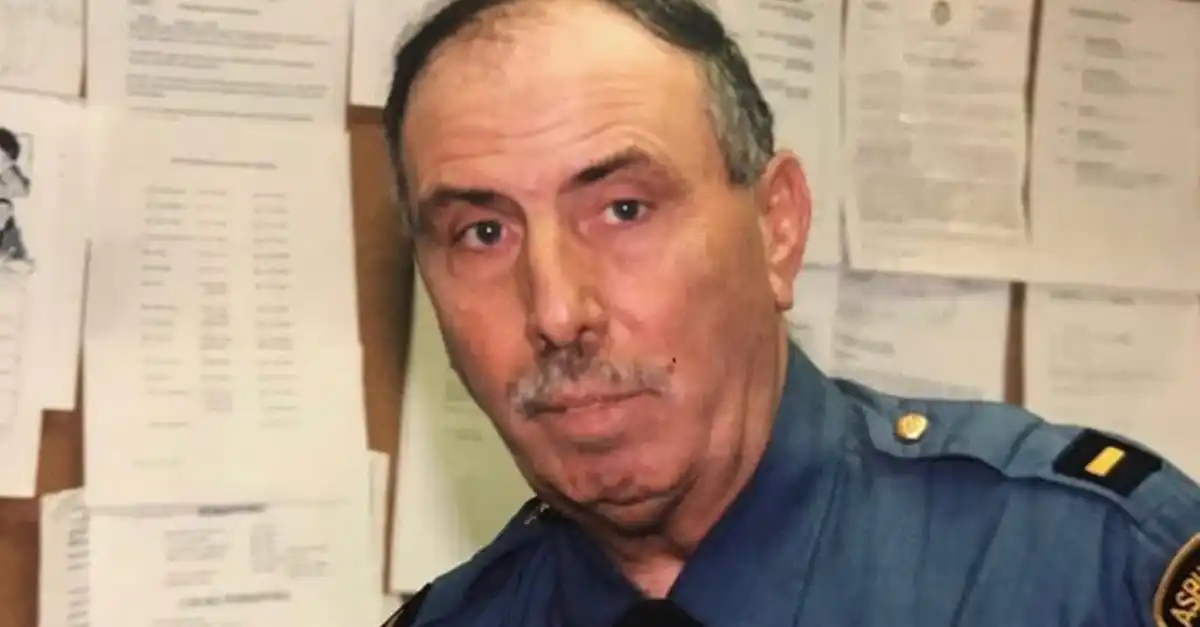

- Beloved retired Asbury Park police captain Dominick Fazio dies at 78

ASBURY PARK, NJ – The Asbury Park community is mourning the loss of retired Detective Captain Dominick Fazio, a beloved figure who dedicated more than three decades of his life to the city and its residents. The Asbury Park Police Department announced his passing on social media Tuesday, calling him an “integral member” of the force and a man remembered for his deep love of the city’s people and its youth.

Fazio began his career with the department in 1968, working his way through the ranks as Patrolman, Detective, Sergeant, and Lieutenant before retiring in 2001 as Captain of the Detective Bureau. During his tenure, he played a pivotal role in community policing and helped strengthen trust between law enforcement and residents — a legacy that continues to influence the city’s police culture today.

A proud member of the Benevolent Order of Elks and the Sons of Italy, Fazio’s community involvement extended far beyond his police badge. He also served as President of the Asbury Park Board of Education, where colleagues said he was passionate about ensuring students had opportunities to succeed.

“Dominick cared about every kid who walked through our schools,” said a former board member. “He never stopped working to make Asbury Park a better place for them.”

Fazio’s colleagues remembered him as a mentor to younger officers and a fixture at local events, often seen chatting with residents or volunteering for community programs. The department credited him with shaping its modern community relations approach, bridging the gap between law enforcement and citizens during challenging times.

A pillar of community and service

Friends described Fazio as the heart of Asbury Park, someone who never hesitated to help a neighbor or lend a hand to a fellow officer. His leadership, they said, reflected the city’s resilient spirit — loyal, hardworking, and deeply connected to the people.

- Joined the Asbury Park Police Department in 1968 and retired in 2001

- Served as Captain of the Detective Bureau and led community outreach efforts

- Also held leadership roles with civic and educational organizations

Funeral arrangements for Detective Captain Fazio are expected to be announced later this week. The police department has requested that residents keep his family and loved ones in their thoughts during this difficult time.