Filing - Page 6

Somerset tax preparer admits to filing false returns causing $550K IRS loss

SOMERSET, NJ — A Somerset man has admitted to preparing fraudulent tax returns that led to more than $550,000 in losses to the Internal Revenue Service, according to court documents and statements…

South Shore Landscaper Charged with Filing False Tax Returns

BOSTON – The owner of a residential and commercial landscaping business operating in the South Shore area has been charged and has agreed to plead guilty in connection with his failure to…

April 18, 2022

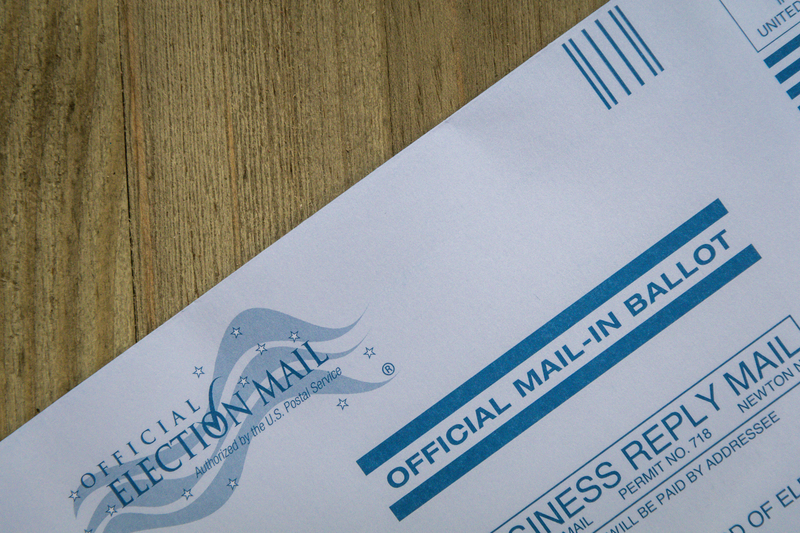

Federal Prosecutions Serve As Reminder to Comply With Tax Obligations As Filing Deadline Arrives

CHICAGO — With the arrival of Tax Day, the U.S. Attorney’s Office and IRS Criminal Investigation Division today reminded taxpayers to accurately file their returns and promptly pay any money owed. Tax…

April 18, 2022

Activision cooperating with federal insider trading probes – filing

(Reuters) – Activision Blizzard is cooperating with federal investigations into trading by friends of its chief executive shortly before the gaming company disclosed its sale to Microsoft Corp, it said in a…

April 15, 2022

Tax Preparer Sentenced to Prison for Conspiracy and Filing Fraudulent Tax Returns for Clients

WASHINGTON – A Louisiana woman was sentenced today to one year and one day in prison for conspiring to defraud the United States and helping clients file false tax returns. On Nov.…

April 14, 2022

Deutsche Bank investor Capital Group sells most of big stake – Filing

FRANKFURT – U.S. investor Capital Group sold most of its 5.2% stake in Deutsche Bank, according to a disclosure on Thursday. The filing makes official the name of the seller, which Reuters…

April 14, 2022

Bergen County Man Sentenced to Two Years in Prison for Filing Phony Tax Returns

NEWARK, N.J. – A Bergen County, New Jersey, man was sentenced today to 24 months and two days in prison for his role in a scheme to file fraudulent tax returns in…

April 12, 2022

Gloucester County Man Charged with Filing False Tax Returns

CAMDEN, N.J. – A Gloucester County, New Jersey, man was arrested by federal agents today on charges of filing false claims against the IRS, U.S. Attorney Philip R. Sellinger announced. Christian L.…

April 7, 2022

Florida Man Sentenced To Probation For Filing False Claims On U.S. Navy Contracts

HARRISBURG – The United States Attorney’s Office for the Middle District of Pennsylvania announced that Raymond Lofthouse, age 59, of Florida, was sentenced on April 6, 2022, to one month of probation…

April 7, 2022

Rhode Island Man Admits to Fraudulently Filing for COVID-Relief Unemployment Benefits

PROVIDENCE, R.I. – A Providence man who filed fraudulent online COVID-relief unemployment insurance claims in five states pled guilty today in federal court to a charge of wire fraud, announced United States…

April 1, 2022

Orange County House Flipper Found Guilty of Filing False Federal Tax Returns That Omitted More Than $2 Million of Income

SANTA ANA, California – A federal jury has found an Orange County real estate investor who successfully flipped foreclosed homes guilty of three federal criminal tax charges, the Justice Department announced…

March 31, 2022

Montgomery Tax Preparer Sentenced to 37 Months in Prison and Fined $100,000.00 for Filing False Returns

Montgomery, Ala. – Today, United States Attorney Sandra J. Stewart and Special Agent in Charge James E. Dorsey with IRS Criminal Investigation, Atlanta Field Office, announced that a Montgomery tax…

March 30, 2022

Hammond Tax Preparer Charged With Filing False IRS Returns and Making False Statements to IRS and to Department of Education

NEW ORLEANS – KENISHA R. CALLAHAN, age 44, and a resident of Ponchatoula, Louisiana, was charged by bill of information on March 25, 2022, by the U.S. Attorney for filing a false…

March 29, 2022

U.S. Capitol riot defendant in talks to settle case – filing

By Sarah N. Lynch WASHINGTON – A man accused of attacking at least three police officers with a chemical irritant during the riot at the Capitol last year asked a judge on…

March 28, 2022

Delaware Accountant Charged for Filing Fraudulent Returns

WILMINGTON, DE – A Dover accountant has been charged by a grand jury for filing and preparing false and fraudulent tax returns. According to a statement released by David C. Weiss, U.S.…

March 25, 2022

Syracuse Tax Preparer Sentenced to Prison for Filing False Tax Returns for Herself and Others

SYRACUSE, NEW YORK – Phoenix Phan, age 63, of Syracuse, was sentenced yesterday to 18 months’ imprisonment and one year of supervised release for filing a false tax return for herself and…

March 23, 2022

Former State Legislator, Justice of the Peace, Sentenced to Prison for Filing False Tax Return

TUCSON, Ariz. – Keith Allan Bee, 56, of San Tan Valley, Arizona, was sentenced yesterday by U.S. District Judge James A. Soto to six months in prison for filing a false tax…

March 17, 2022

Nurse Pleads Guilty To Filing False Tax Returns

Fort Myers, Florida –United States Attorney Roger B. Handberg announces that Jennifer Hansen has pleaded guilty to three counts of filing false tax returns. Hansen faces a maximum penalty of three years…

March 15, 2022

Strongsville Man Sentenced to Prison for Embezzling $375k from Employer and Filing False Tax Returns

Acting U.S. Attorney Michelle M. Baeppler announced that Angelo Kanaris, 42, of Strongsville, Ohio, was sentenced on Monday, March 14, 2022, by U.S. District Judge Christopher A. Boyko to six months in…

March 15, 2022

Newark city councilman admits to taking bribes and kickbacks, filing false tax return

NEWARK, NJ – The United States Department of Justice today announced a Newark city councilman has admitted to taking bribes, accepting kickbacks and filing a false tax return. U.S. Attorney Philip R.…

March 15, 2022

Blairsville Bookkeeper Sentenced to Prison for Embezzling from Her Employer and Filing False Tax Returns

PITTSBURGH, PA- A resident of Blairsville, PA was sentenced in federal court for Mail Fraud and Filing a False Income Tax Return, United States Attorney Cindy K. Chung announced today. Sandra Jo…

March 10, 2022

Woman Facing Federal Charges for Filing and Receiving Social Security Benefits Under Two Social Security Numbers

Baltimore, Maryland – A federal grand jury has returned an indictment charging Dinorah De Denis, age 72, of Frederick, Maryland, for the federal charges of theft of government property and social security…

March 3, 2022

Former El Cajon Tax Preparers Admit to Filing Hundreds of False Tax Returns

Assistant U. S. Attorneys Joseph J.M. Orabona (619) 546-7951 and Jennifer E. McCollough (619) 546-8773 NEWS RELEASE SUMMARY – March 2, 2022 SAN DIEGO – Two former tax preparers based in El…

March 2, 2022

Beachwood woman sentenced to 17 years in prison for stealing the identities of more than a dozen people and filing false tax returns

A Beachwood woman was sentenced to more than 17 years in prison for stealing the identities of more than a dozen people and filing false tax returns. Aesha Johnson, 42, was convicted…

March 1, 2022

Former State Attorney Pleads Guilty To Bribery And Extortion As Part Of Conspiracy With Defense Attorney, As Well As Wire Fraud And Filing False Tax Returns

Jacksonville, Florida – United States Attorney Roger B. Handberg announces that Jeffrey Siegmeister (53, Live Oak) has pleaded guilty to four felonies pursuant to a plea agreement. Specifically, he pleaded guilty to…

February 24, 2022

RGV tax preparer indicted for filing false returns

McALLEN, Texas – A local tax preparer is set to make her initial appearance in federal court on charges of filing false tax returns on behalf of taxpayers, announced U.S. Attorney Jennifer…

February 24, 2022

Breaking News

Ocean County Landfill Operator Sees Six Accident Cases Tossed by Judge

September 26, 2025

New Jersey cops seize illegal e-bike after 12-year-old flees traffic stop

September 26, 2025