With the increase in looting, smash and grabs, and shoplifting across America, the IRS is reminding thieves and burglars that they must legally report their ill-gotten gains on their tax returns.

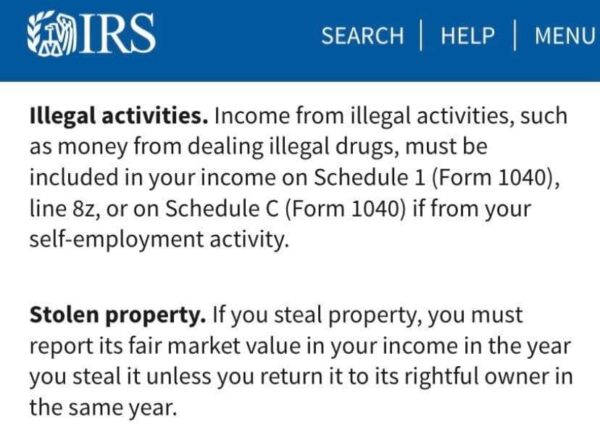

In the IRS tax publication, the agency says, “If you steal property, you must report its fair market value in your income in the year you steal it unless you return it to its rightful owner in the same year.”

For drug dealers or people who earn money from the sale of illegal goods, the IRS says you must include that money on schedule 1 of your 1040 form.

“Income from illegal activities, such as money from dealing illegal drugs must be included in your income on Schedule 1 (Form 1040), line 8z, or on Schedule C (Form 1040) if from your self-employment activity.

The same holds true for pimps engaged in for-profit human trafficking. Your percentage of the take from tricks you pull from your prostitutes should be clearly identified as income when filing your taxes in April.

Failure to report your stolen flat-screen televisions, high-end sneakers and jewelry from a 2021 smash and grab could also flag you as an IRS tax cheat, even if local authorities don’t prosecute you for your crimes.

If you happen to return the stolen property to your victim, you do not need to report those returned items on your taxes.

There is good news for thieves and looters. If you are operating your criminal enterprise from your home, there is a chance that you can deduct a portion of the costs of the home from your taxes as a business write-off. The IRS recommends you hire a professional accountant in order to legally maximize your deductions without drawing a red flag for a possible future audit.

For more complex tax issues, such as drug dealers who employ mules or smash and grab criminals who then sell the items on the black market, an accountant is advised and good bookkeeping is recommended to avoid tax penalties and other issues.

The IRS does not give specific guidance for organized mafia members for reporting activities such as loansharking, extortion, illegal gambling or whether or not financial bribes to public officials are a legitimate tax write-off. Consult an accountant for more complex criminal enterprise tax management.

There is good news however for victims of looters and thieves. The IRS allows you to deduct your losses on your taxes, but businesses in states like California fall into a grey area. For a theft to be written off as a loss on your taxes, the actual theft must be illegal under the law where you live. If the theft is not considered illegal by local and state law, you might be out of luck.

“A theft is the taking and removal of money or property with the intent to deprive the owner of it. The taking must be illegal under the law of the state where it occurred and must have been done with criminal intent. The amount of your theft loss is generally the adjusted basis of your property because the fair market value of your property immediately after the theft is considered to be zero,” the IRS said.