Taxes - Page 7

85% of New Jersey is Fed Up With Phil Murphy Citing Taxes, Transportation and Education as Key Problems

NEW BRUNSWICK, N.J. — An overwhelming 85% of New Jersey residents are dissatisfied with how the state government is handling the cost of living and affordability, according to a Rutgers-Eagleton Poll released…

COLORADO MAN SENTENCED TO 18 MONTHS IN FEDERAL PRISON AND ORDERED TO PAY OVER $350,000 IN RESTITUTION FOR FAILING TO PAY EMPLOYMENT TAXES

United States Attorney Bob Murray announced today that CURTIS ALAN PERRY, of Windsor, Colorado, was sentenced on 12 counts of failure to account for and pay trust fund taxes. He appeared before…

May 31, 2022

Hungary slaps $2.19 billion in new windfall taxes on banks, companies

BUDAPEST – Hungary will collect a total of 800 billion forints ($2.19 billion) annually this year and next from new windfall taxes imposed on banks, energy firms, insurers and airlines among others,…

May 26, 2022

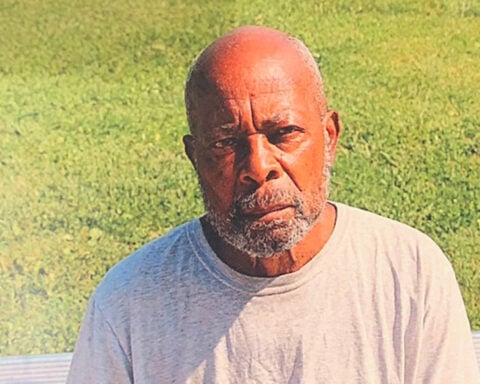

Owner of the Taxman Financial Services Sentenced to Three Years in Prison for Aiding in Filing False Taxes

NEW ORLEANS – U.S. Attorney Duane A. Evans announced that LEROI G. JACKSON, age 50, of New Orleans, was sentenced by U.S. District Judge Susie Morgan to three (3) years in prison…

May 24, 2022

Operators Of Monroe County Veterinary Clinic Sentenced To Prison For Failure To Remit Payroll Taxes

SCRANTON- The United States Attorney’s Office for the Middle District of Pennsylvania announced that Dr. Karin Breitlauch, age 58, of Saylorsburg, Pennsylvania, and Linda Breitlauch, age 64, of Stroudsburg Pennsylvania, were each…

May 23, 2022

North Royalton Man Sentenced to Prison After Failure to Pay Taxes Collected from Employees and Embezzling from an Employee Healthcare Plan

Acting U.S. Attorney Michelle M. Baeppler announced that John George Medas, 69, of North Royalton, Ohio, was sentenced today by U.S. District Judge Sara Lioi to 24 months in prison and ordered…

May 20, 2022

Taos business owner pleads guilty to failure to pay taxes withheld from employee paychecks

ALBUQUERQUE, N.M. – Diane Mariani, 66, of Taos, New Mexico, pleaded guilty on May 18 in federal court to willful failure to collect or pay over tax. Mariani will remain on conditions…

May 19, 2022

Hazleton Roofing Company Owner Sentenced To Six Months’ Imprisonment For Failing To Pay Payroll Taxes

SCRANTON- The United States Attorney’s Office for the Middle District of Pennsylvania announced that Charles R. Ehrenberg, age 34, owner of Ehrenberg Roofing and Construction, Inc., located in Hazleton, Pennsylvania, was sentenced…

May 18, 2022

Brazil’s Guedes says govt will reduce payroll taxes

BRASILIA – Brazil’s Economy Minister Paulo Guedes said on Monday the government will reduce payroll taxes, without giving details or deadlines for a move he has defended since taking office in 2019.…

May 16, 2022

Imperial, PA Daycare Operator Pleads Guilty to Failing to Account for and Pay Over Taxes

PITTSBURGH, PA – A resident of Imperial, Pennsylvania, pleaded guilty in federal court to a charge of failing to account for and pay over payroll taxes to the Internal Revenue Service, United…

May 9, 2022

Brazil’s Guedes defends leaner tax reform to reduce corporate taxes

BRASILIA – Brazil’s Economy Minister Paulo Guedes said on Monday the country could propose a leaner version of a tax reform to increase taxation on the super-rich and reduce corporate taxes. Speaking…

May 9, 2022

Harrisburg Man Charged With Failing To Pay Over $700,000 Employment Taxes

HARRISBURG – The United States Attorney’s Office for the Middle District of Pennsylvania announced today that Sam Duong, age 48, of Harrisburg, Pennsylvania, was charged in a criminal information with failing to…

May 4, 2022

Shoreline Business Owner Admits Failure to Pay Taxes

Leonard C Boyle, United States Attorney for the District of Connecticut, and Joleen D. Simpson, Special Agent in Charge of IRS Criminal Investigation in New England, today announced that CHRISTOPHER JARDINE, 55,…

April 29, 2022

Thrice-Convicted Rhode Island Businessman Sentenced for Pocketing Employee Federal Withholding Taxes

PROVIDENCE – A Rhode Island businessman convicted of misusing more than a half-million dollars in employment taxes collected from his employees to finance his own personal expenditures, including rent payments on a…

April 28, 2022

Vice President of Kenwood Keys Sentenced for Failing to Pay Over Payroll Taxes

United States Attorney Richard G. Frohling announced that on April 27, 2022, Patrick Souter (age: 57) of Racine, WI was sentenced to one year and one day in prison on charges that…

April 27, 2022

Senator Chuck Schumer: The Only Way to Reduce Inflation is to Raise Taxes

Democrat Majority Leader Chuck Schumer claimed the “only way” to reduce Bidenflation is to raise taxes, during the Senate Democrat’s weekly press conference on Monday. “If you want to get rid of…

April 29, 2022

Former Monahans Businessman Ordered to Pay $1.3M for Failure to Pay Withholding Taxes

ALPINE – Yesterday a former Monahans businessman was ordered to pay $1.3 million in restitution for failure to pay withholding taxes. According to court documents, George Wayne Johnson, 74, of Lawrenceburg, TN,…

April 27, 2022

Dental clinic operator arrested for failing to pay $1.7 million in taxes

HOUSTON – A local man has been taken into custody on charges of tax evasion and failure to pay employment taxes, announced Jennifer B. Lowery. Jonathan Louis Lepow is expected to make…

April 26, 2022

State College Man Sentenced To 15 Months’ Imprisonment For Failure To Pay Over $1 Million In Employment Taxes

WILLIAMSPORT- The United States Attorney’s Office for the Middle District of Pennsylvania announced that Scott Lykens, age 44, of State College, Pennsylvania, was sentenced yesterday to 15 months’ imprisonment by Chief District…

April 22, 2022

Kentwood Man Pleads Guilty to Defrauding Employer and Filing False Taxes

NEW ORLEANS – U.S. Attorney Duane A. Evans announced that on April 19, 2022 MICHAEL J. GOLL, age 46, of Kentwood, pleaded guilty to wire fraud and filing false federal tax returns.…

April 21, 2022

Biden White House Report Says Energy Taxes Are ‘Needed’ For Green Transition

Biden White House Report Says Energy Taxes Are ‘Needed’ For Green Transition Thomas Catenacci on April 18, 2022 The White House said Americans should pay higher taxes to ensure a rapid green…

April 18, 2022

PROPERTY TAXES ON SINGLE-FAMILY HOMES RISE ACROSS U.S. IN 2021, TO $328 BILLION

Average Property Tax Also Up 2 percent, to $3,785, as Effective Rate Declines Slightly; Highest Effective Tax Rates in Illinois, New Jersey, Connecticut, Vermont, Pennsylvania IRVINE, Calif., April 14, 2022 — ATTOM,…

April 14, 2022

Peru waives taxes on essential food items to combat inflation

LIMA – Peru’s congress approved legislation on Tuesday that waives taxes for what it deems as essential foods, aiming to fight surging prices that have hit consumers hard in recent months. The…

April 12, 2022

Belgrade construction company co-owner admits failing to pay $2.8 million in employee, employer taxes

MISSOULA — The co-owner of H & H Earthworks, Inc., a Belgrade-based construction company that does commercial site-development work in four states, admitted to failing to pay the IRS approximately $2.8 million…

April 11, 2022

Business Owner Pleads Guilty to Failing to Pay $2 Million in Payroll, Employment Taxes

KANSAS CITY, Mo. – A Lafayette County, Missouri, business owner has pleaded guilty in federal court to failing to pay over nearly $2 million in payroll and employment taxes over a four-year…

April 8, 2022

CEO of Medical Device Company Charged with Evading Payment of $6 Million in Federal Payroll Taxes

MINNEAPOLIS – A Mounds View man has been charged with tax evasion for failing to pay several years’ worth of payroll taxes, announced U.S. Attorney Andrew M. Luger. According to court documents,…

April 5, 2022

Breaking News

State Says Unlikely a Mountain Lion is Roaming Around Ocean County College

September 27, 2025

Ocean County Landfill Operator Sees Six Accident Cases Tossed by Judge

September 26, 2025