Jackson, NJ—A grant from Jackson’s Clean Communities program helped a local organization clear hundreds of trash bags of litter from the city’s roadways this weekend.

New Jersey Clean Communities is a statewide program that promotes volunteer cleanup of public lands.

This week, dozens of local groups hit the highways with trash bags and began cleaning the streets.

Each year, the township hosts these public cleanups and reimburses organizations and community groups $500 per mile of road cleaned. That funding comes from the NJ DEP’s New Jersey Clean Communities grant.

This year, approximately 30 groups, directed by Jackson DPW under Shawn Bolinksy hit the roads and cleaned up over 200 bags of trash. That doesn’t include the tires or wood pallets discarded along the roadside, which were also collected.

Jackson Council President Jennifer Kuhn worked alongside the Jackson Thunder Travel Little League to clean up Grawtown Road.

“This is a great way for the community to pitch in and help keep our roadways clean,” Councilwoman Kuhn said. I want to thank all of the organizations that came out to pitch in today.”

The Clean Communities Program was organized under Mayor Michael Reina’s administration. It was previously managed by Patricia Wood, who grew the program over the years before her passing in 2021.

- Lakewood girls school shuts down suddenly, leaving families in panic

LAKEWOOD, NJ – In a stunning and emotional turn of events, Bnos Penina, a girls school in Lakewood, announced that it will cease operations this week, leaving dozens of families without a school for their daughters.

Administrators notified parents in a letter dated February 17 that the school will not be able to continue classes beyond Wednesday, February 18, and urged parents not to send students beginning Thursday, February 19. The closure, they explained, comes after months of mounting financial strain and unfulfilled commitments from within the parent body that had been essential to keeping the institution afloat.

The administration said the school’s financial model relied heavily on both tuition and additional pledges from parents who had promised to share in the fiscal responsibility of maintaining operations. However, as the letter explained, many accounts fell behind. “Had tuition obligations been maintained as agreed, we would not be in this position today,” the school wrote, underscoring the severity of the budget shortfall.

Compounding the problem were higher operational expenses caused by this winter’s sub-freezing temperatures, which drove up heating and maintenance costs. The situation reached a breaking point when the school’s landlord informed the administration that the building could no longer be used after Wednesday, effectively leaving Bnos Penina without a facility or a way to continue classes.

Financial struggles reach breaking point

Despite months of intense discussions, community appeals, and attempts to secure alternative funding, school officials said they were unable to find a sustainable path forward. “After much effort, many conversations, and every possible attempt to find a sustainable path forward, we have reached the painful conclusion that we will not be able to continue,” the administration wrote.

The letter also noted that the decision came after consultation with Torah authorities, emphasizing that it was not made lightly and only followed “tremendous thought, tears, and sincere attempts to avoid this outcome.”

- The Lakewood school announced closure effective Thursday, Feb. 19

- Administrators cited unpaid tuition and unmet financial pledges

- The school’s landlord ended its lease, leaving no facility to operate

Community reaction and next steps

The closure leaves families scrambling for alternatives as parents search for new placements for their children mid-year. Bnos Penina leaders expressed hope that parents might still come together to make continuation possible, though for now, operations will cease indefinitely.

“It is our sincere hope that our wonderful and loyal parents will step forward in a meaningful and immediate way to make continuation possible,” the administration concluded.

End of an era for Bnos Penina

- New Jersey bill demands full disclosure of massive utility societal benefits surcharge funds

TRENTON, NJ – Legislation introduced in the New Jersey General Assembly would require the Governor’s annual budget message to include a detailed accounting of revenues and expenditures tied to the state’s societal benefits charge, a utility surcharge that funds energy assistance, clean energy programs and other initiatives. The measure seeks to provide greater transparency into how billions of dollars collected from electric and gas customers are allocated and spent.

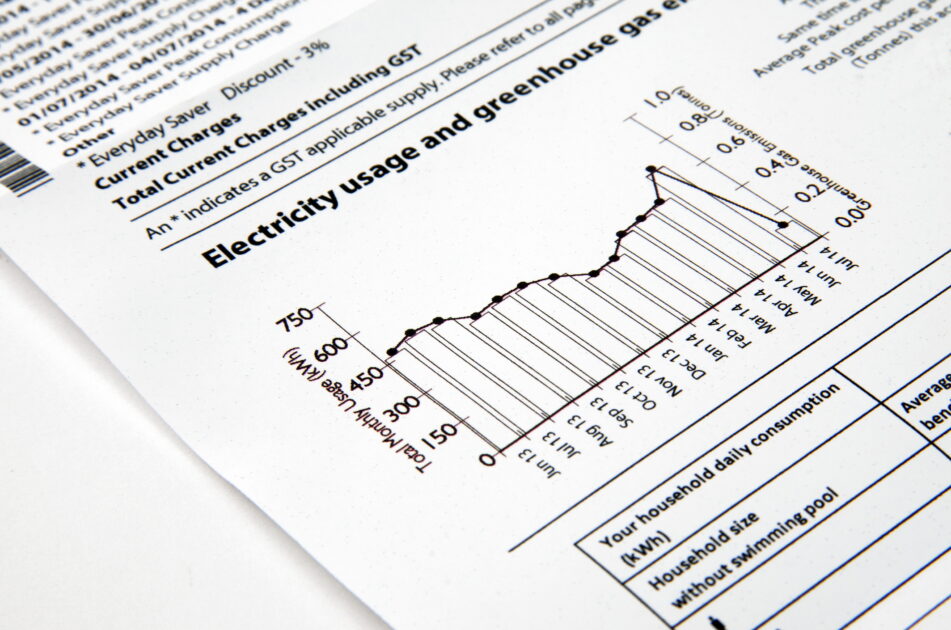

The societal benefits charge is embedded in monthly electricity and natural gas bills statewide and supports programs ranging from energy assistance for low-income households to renewable energy incentives and nuclear plant decommissioning. Assembly Bill A804 would require a standardized, multi-year financial report as part of the annual budget process, offering lawmakers and the public a clearer picture of how the funds are distributed and retained.

Assembly Bill A804 was pre-filed for introduction in the 2026–2027 legislative session.

The bill is sponsored by Assemblyman David Bailey Jr. (D-3), whose district includes Cumberland, Gloucester and Salem counties; Assemblyman Roy Freiman (D-16), representing Hunterdon, Mercer, Middlesex and Somerset counties; and Assemblyman Al Abdelaziz (D-35), representing Bergen and Passaic counties. It is co-sponsored by Assemblymen Scharfenberger and Karabinchak.

Electric bill If enacted, the bill would supplement Title 52 of the Revised Statutes and take effect immediately, applying beginning with the fiscal year commencing July 1, 2026. Under the proposal, the Governor’s annual budget message must include a detailed report covering revenues and expenditures derived from the societal benefits charge over the past five fiscal years and the current year.

What the report would include

The required report would detail the total revenues collected through the societal benefits charge, the amount retained by the state and allocated to demand-side management programs, renewable energy programs, distributed energy resources, and administrative functions. It would also include funds directed to the Universal Services Fund—covering the Lifeline Credit Program and Tenants’ Lifeline Assistance Program—and allocations to the Plug-in Electric Vehicle Incentive Fund, which supports the light-duty electric vehicle rebate program and related infrastructure initiatives.

The legislation directs the Board of Public Utilities (BPU) to assist and advise the Governor in preparing the report. The BPU currently determines surcharge levels, which are collected by utilities and remitted to the board, though utilities may retain approved components.

Key points:

- Assembly Bill A804 mandates detailed disclosure of societal benefits charge revenues and expenditures in the annual state budget

- The report must include five prior fiscal years and the current year

- Itemized data would cover energy efficiency, renewable energy, utility-retained funds, and electric vehicle programs

The societal benefits charge was established in 1999 under the Electric Discount and Energy Competition Act, which restructured New Jersey’s electric utility industry. Rates for each component vary by utility and must be approved by the BPU. The funds finance programs including the Universal Services Fund, clean energy initiatives, energy consumer education, nuclear decommissioning, and remediation of former gas plant sites.

Over the years, portions of the surcharge have been redirected to support emerging policy goals, such as incentives for plug-in electric vehicles under the Plug-in Electric Vehicle Incentive Fund created in 2019. While individual program budgets appear in scattered reports and budget documents, no single consolidated account currently exists within the Governor’s budget message—something this bill aims to change.

If enacted, A804 would embed transparency into the state’s fiscal reporting framework, offering lawmakers and the public a unified look at one of New Jersey’s most consequential funding mechanisms. For ratepayers, the measure would not alter existing charges but could inform future debates about how funds are distributed among energy assistance, clean energy, and electrification programs.

Next steps for the legislation

The bill, pre-filed for the 2026–2027 legislative session, now awaits committee review and potential amendment before advancing to a floor vote. Should it pass, the new reporting mandate would take effect for the fiscal year beginning July 1, 2026—potentially reshaping how billions in utility surcharge revenues are disclosed in the state budget.